This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 31, 2022

US equity markets saw a sharp rally on Friday with the S&P and Nasdaq ending 2.4% and 3.1% higher. Sectoral gains were led by IT and Real Estate, up 4.3% and 3.4% each. US 10Y Treasury yields eased 2bp at 1.79%. European markets recovered with the DAX, CAC and FTSE down 1.3%, 0.8% and 1.2%. Brazil’s Bovespa closed 0.6% higher. In the Middle East, UAE’s ADX was up 0.4% and Saudi TASI closed 0.7% higher on Sunday. Asian markets have opened broadly higher with HSI, STI and Nikkei up 1.3%, 0.5% and 1.5% while Shanghai was down 1%. US IG CDS spreads were 1.3bp wider and HY CDS spreads were 5.1bp tighter, EU Main CDS spreads were 1.7bp wider and Crossover CDS spreads were 5.7bp wider. Asia ex-Japan CDS spreads were 1.6bp wider.

China’s manufacturing PMI came at 50.1 for January, just a tad inside expansion territory, beating expectations for a sub-50 print. The number was lower than December’s 50.3 print. Non-manufacturing PMI also declined to 51.1 in January vs. 52.7 in December.

.png)

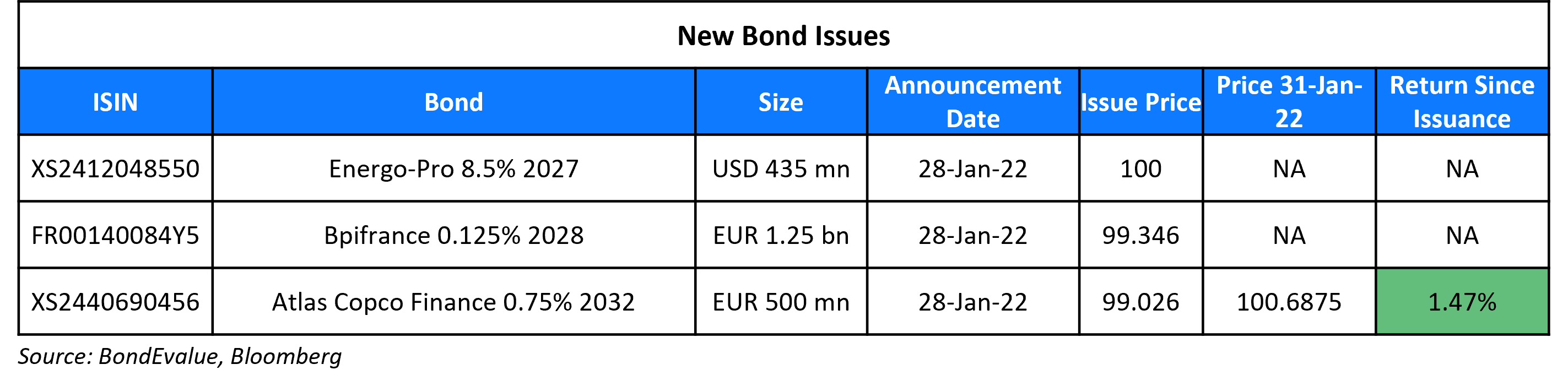

New Bond Issues

New Bonds Pipeline

- Kia Corp hires for $ green bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

Term of the Day

Risk Parity

Risk parity refers to an asset allocation strategy wherein the allocation or weight to each asset class is defined based on the risk each of them contribute to the overall portfolio, rather than the return. Let’s take the example of a 60:40 portfolio, where 60% of the allocation to equities contributes 90% of the risk of the portfolio given that they are historically around 3x more volatile compared to fixed income securities. Given the concentration into equities, the portfolio return is dictated by the performance of equities. Risk parity avoids this concentration risk, by constructing more balanced and diverse risk-based portfolios. Under this strategy, a 60:40 portfolio would entail an allocation to equities such that it contributes 60% to the overall portfolio risk and thereby the weightage would typically be lower than 60% given the higher risk inherent to equities. It build out of Modern Portfolio Theory (MPT) that promotes portfolio construction that maximize expected returns given a level of risk. However as compared to MPT, risk parity allows for short selling and leverage.

Talking Heads

On Fed rate hike being half-point if needed, Atlanta Fed President Raphael Bostic

“Every option is on the table for every meeting,” Bostic told FT. “If the data say that things have evolved in a way that a 50 basis point move is required or [would] be appropriate, then I’m going to lean into that… If moving in successive meetings makes sense, I’ll be comfortable with that.”

On Global Junk-Bond Markets Wobbling, Spelling Risk for M&A Financing

David Knutson, head of U.S. fixed income product management at Schroders

“We are now facing the reality of a much more hawkish Fed that will withdraw liquidity faster than expected. Terms and pricing will become more favorable to investors to bring the market back into balance”

On US corporate bond spreads widening as investors de-risk on hawkish Fed

Ryan O’Malley, a fixed income portfolio manager at Sage Advisory

“People are expecting a bunch of rate hikes, they’re expecting the (Fed) balance sheet runoff to be faster and sooner than people had expected even a couple months ago. Money has been pushed out to the far ends of the risk spectrum, because you couldn’t get anything out of the front end in Treasuries or investment grade … Now that the tide is kind of going back out, people don’t want to own the riskier stuff anymore”

Jack McIntyre, a portfolio manager at Brandywine Global

“I don’t think spreads should widen in the corporate sector … corporates are in strong financial positions, they have benefited from two years of easy money”.

On Turkey’s Erdogan Voing to Continue Lowering Interest Rates

“We will lower interest rates as we have done already… We are aware of the fact that the inflation is a serious burden on citizens… I repeat here, as you already know my fight against interest rates; we will lower interest rates as we have done already. Inflation will decline as well.”

On Fed’s Tightening Plan Upends Outlook for Treasury’s Bond Sales

Subadra Rajappa, head of U.S. rates strategy at Societe Generale

“Treasury will likely do cuts this time similar to those it did at its November refunding. But all bets are off after May, because the Fed is going to discuss balance-sheet runoff over the next couple meetings. And Treasury needs will have to rise commensurately.”

Jonathan Cohn, head of rates trading strategy at Credit Suisse Group

“At this point, the pace of supply is still set to outstrip financing needs, so further cuts to nominal coupons across the curve are warranted”

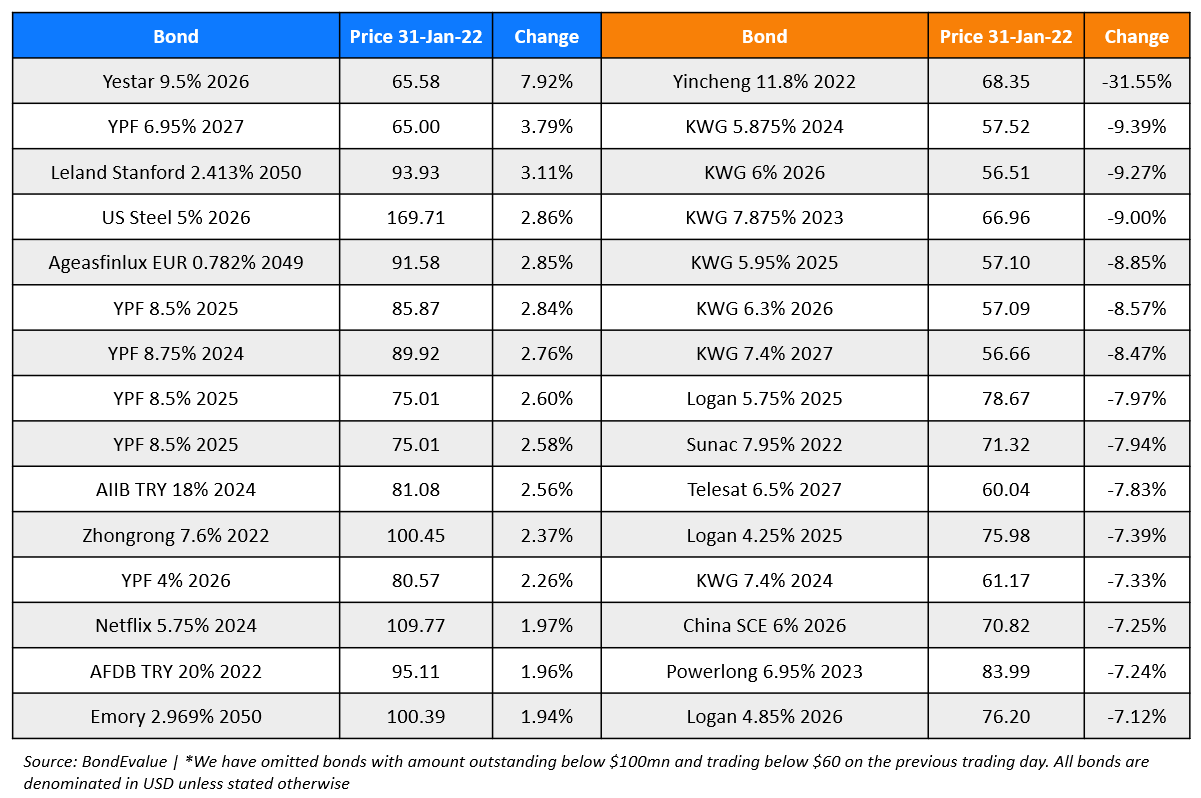

Top Gainers & Losers – 31-Jan-22*

Other Stories

Go back to Latest bond Market News

Related Posts: