This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 3, 2022

US equity markets rallied on Wednesday with the S&P and Nasdaq ending 0.9% and 0.5% higher. Sectoral gains were led by Communication Services up 3.1%, Real Estate and Utilities up 1.5-1.7%. US 10Y Treasury yields eased 2bp to 1.77%. European markets were broadly positive with the CAC and FTSE up 0.2% and 0.6% while DAX was flat. Brazil’s Bovespa closed 0.6% higher. In the Middle East, UAE’s ADX was up 0.2% while Saudi TASI closed 0.8% lower. Asian markets have opened mixed with STI up 2.1% while Nikkei was down 1.1%. Shanghai and HSI remain closed on account of the lunar new year holidays. US IG CDS spreads were 1.3bp wider and HY CDS spreads were 6.2bp wider. EU Main CDS spreads were 0.5bp tighter and Crossover CDS spreads were 0.3bp tighter. Asia ex-Japan CDS spreads were 0.4bp tighter.

Brazil hikes its benchmark Selic interest rate by 150bp to 10.75% in a move to counter inflation which stood at 10.20% in mid-January. Policy makers say that a slower hiking pace is now adequate. The rate crossed 10% for the first time in five years.

.png?width=1400&upscale=true&name=image%20(60).png)

New Bond Issues

.png)

Bank of America (BofA) raised $9bn via a five-tranche deal. Details are given in the table below:

-png.png)

This is the second largest bank deal in 2022 after peer Goldman Sachs’ jumbo $12bn six-trancher in mid-January.

IBM raised ~$4bn via a dual-currency multi-trancher:

- $650mn via a 5Y bond at a yield of 2.203%, 25bp inside initial guidance of T+85bp area

- $500mn via a 10Y bond at a yield of 2.722%, 19bp inside initial guidance of T+115bp area

- $650mn via a 30Y bond at a yield of 3.431%, 23bp inside initial guidance of T+155bp area

- €1bn via a 8Y bond at a yield of 0.979%, 23bp inside initial guidance of MS+80bp area.

- €1bn via a 12Y bond at a yield of 1.326%, 23bp inside initial guidance of MS+100bp area.

The bonds have expected ratings of A3/A-.

Goldman Sachs raised €2.25bn via a two-tranche deal. It raised:

- €1bn via a 3NC2 bond at a yield of 0.41%, 20bp inside initial guidance of 3mE+75bp area. Coupon is set at 3m Euribor +100bp until the optional redemption date of February 7, 2024. If not redeemed, coupon resets at 3m Euribor +55bp

- €1.25bn via a 7Y bond at a yield of 1.298%, 20bp inside initial guidance of MS+115bp area

The bonds have expected ratings of A2/BBB+/A.

New Bonds Pipeline

- Kia Corp hires for $ green bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- BRF S.A. Upgraded To ‘BB’ From ‘BB-‘ On Deleveraging From Follow-On, Outlook Stable

- Future Retail Downgraded To ‘SD’ On Principal Repayment Default; Notes Rating Affirmed At CCC-

- Moody’s downgrades Saipem’s CFR to B1 and places ratings on review for further downgrade

- Moody’s withdraws China Grand Auto’s rating for business reasons

- Moody’s withdraws Datang’s rating for business reasons

Term of the Day

Change of Control

Change of control is a covenant included in prospectuses that provide for an event wherein the ownership of the issuer changes. Typically, change of control events trigger structural changes in the bond’s terms like a coupon step-up or in the form of a ‘change of control put’ where bondholders have the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of the change of control event.

Talking Heads

On Saudi Wealth Fund May Tap Debt Markets ‘Gradually – Fitch

Expects PIF to gradually tap international capital markets, while continuing to receive stable flows of capital funding from its government during the growth stage of its operations.

On Traders Pulling Forward ECB Liftoff Bets to July on Inflation

Christoph Rieger, head of fixed-rate strategy at Commerzbank AG

“The inflation numbers should give her sleepless nights! A 5% inflation rate at the end of the year is quite unlikely but nevertheless a tail risk that the market has to price where the ECB will probably have to hike by more than 25bps before year-end.”

Roberto Cobo Garcia, head of G-10 currency strategy at BBVA

“The euro has jumped above $1.13 and could remain bid into the decision… Given that investors are starting to price in a tighter monetary policy context in the European Economic and Monetary Union, the euro downside potential should be limited.”

On DoubleLine Buying the Lowest Quality Blue-Chip Company Debt

Monica Erickson, head of investment-grade corporates

Companies learned a lesson in 2020 that being investment grade is a significant advantage… There was really no advantage, especially from an equity standpoint, for them to maintain that super-high rating… It made sense for them to allocate capital toward the equity class… We’re just more careful when we look at credits that are higher-rated, we have to have a level of comfort that they are interested in remaining at the higher credit rating

On Pakistan Seeking to End 50 Years of IMF Debt With ESG Bond, Trade

Pakistan Finance Minister Shaukat Tarin

“I think this program should be enough. If we start generating 5%-6% balanced growth, which means sustainable growth, then I don’t think we need another IMF program… We are trying to now take those steps, which are going to put this economy on an inclusive and sustainable growth path… Once it gathers momentum and is sustainable, then I think we will probably see 20-30 years of growth.”

On Aeromexico may still hit bumps after bankruptcy exit

Marco Antonio Montanez, an analyst with Vector brokerage

“It will be able to recover its market share bit by bit, even if it’s clear that recovery will be slow… Aeromexico must explore ways to lower its costs and compete, but I don’t see it becoming a low-cost airline.”

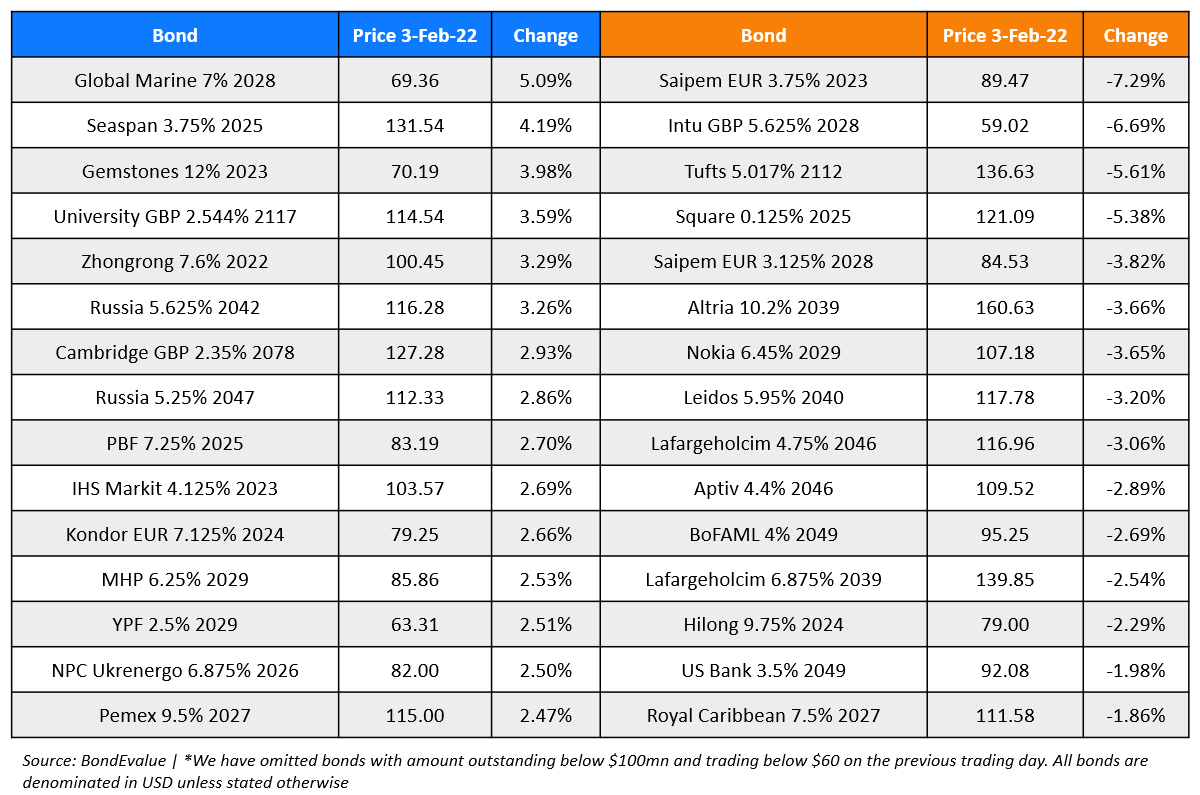

Top Gainers & Losers – 03-Feb-22*

Go back to Latest bond Market News

Related Posts: