This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 8, 2022

It was a sea of red again on Monday with US equity markets ended lower again on Monday with the S&P and Nasdaq closing 3% and 3.6% lower each. Sectoral losses were led by Materials, Financials, IT, Consumer Discretionary and Communication Services, down 3.5%-5.0%. European markets ended lower again – the DAX, CAC and FTSE were down 2%, 1.3% and 0.4% respectively. US 10Y Treasury yields picked up by 4bp to 1.78%. Brazil’s Bovespa ended 2.5% lower. In the Middle East, UAE’s ADX was down 0.3% and Saudi TASI was almost unchanged. Asian markets have opened lower – Shanghai, HSI, STI and Nikkei were down 2%, 0.5%, 0.8% and 1.2% respectively. US IG CDS spreads widened 3.4bp and HY spreads were 19.2bp wider. EU Main CDS spreads were 4.6bp wider and Crossover CDS spreads were 21bp wider. Asia ex-Japan CDS spreads were 9.7bp wider.

The Bank of England (BoE) has begun its process of not reinvesting proceeds of maturing gilts, thus beginning the reduction of its £875bn ($1.2tn) in gilt holdings for the first time. The BoE’s balance sheet saw an unwinding of £28bn ($37bn) in gilts, marking the reversal of its QE program beginning Monday.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

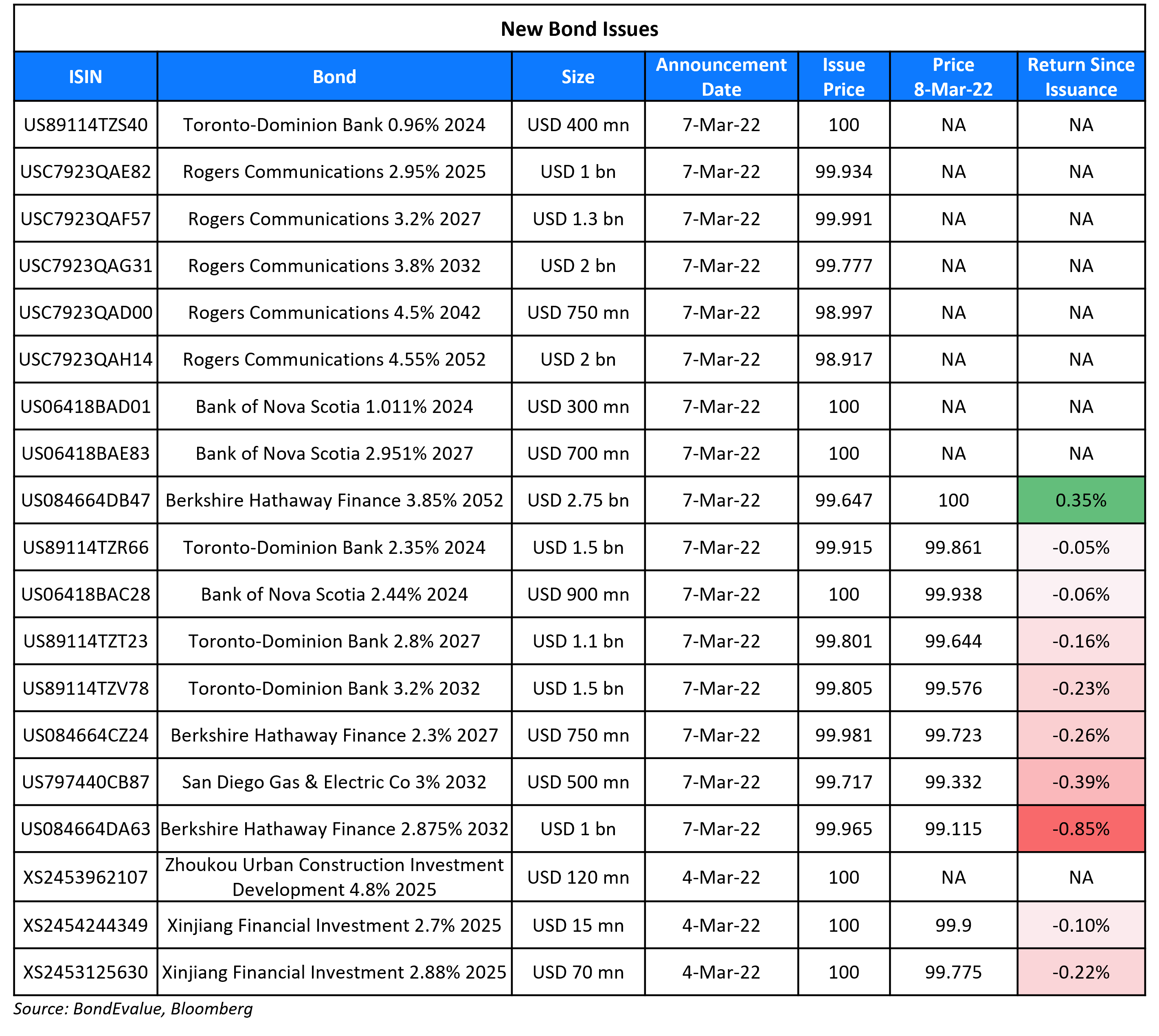

New Bond Issues

- Asian Development Bank (ADB) $ 2/7Y at MS+20/36bp area

- Henan Railway Construction & Investment $ 5Y green at T+150bp area

- HDB SGD 5Y green at 1.845% final

- $750mn via a 5Y bond at a yield of 2.304%, 15bp inside initial guidance of T+75bp area

- $1bn via a 10Y bond at a yield of 2.879%, 15bp inside initial guidance of T+125bp area

- $2.75bn via a 30Y bond at a yield of 3.87%, 15bp inside initial guidance of T+180bp area

The SEC registered bonds (Term of the Day, explained below) are rated Aa2/AA.

Bank of Nova Scotia raised $1.9bn via a three-trancher. It raised:

- $900mn via a 2Y bond at a yield of 2.44%, 10bp inside initial guidance of T+75bp area

- $300mn via a 2Y FRN at a yield of SOFR+96bp vs. inside initial guidance of SOFR equivalent

- $700mn via a 5Y bond at a yield of 2.951%, 10bp inside initial guidance of T+180bp area

The SEC registered bonds are rated A2/A-. Proceeds will be used for general corporate purposes. The bank dropped its 5Y tranche during guidance.

TD Bank raised $4.5bn via a four-tranche deal. Details are given in the table below:

-png.png)

New Bonds Pipeline

- Shaoxing City Keqiao District State-owned Assets Investment hires for $ bond

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Fitch Downgrades Logan Group to ‘B+’; on Rating Watch Negative

- Moody’s downgrades Logan to B2; rating remains on review for downgrade

- Fitch Downgrades Redco to ‘CCC-‘ on Limited Liquidity

- Ukrainian Electricity Producer DTEK Renewables Downgraded To ‘CCC’ And Placed On CreditWatch Negative

- Russian Corporates Downgraded To ‘CCC-‘ After Similar Action On Sovereign; Ratings Placed On CreditWatch Negative

- Russian Banks Downgraded To ‘CCC-/C’; Ratings Put On CreditWatch Negative

- Moody’s changes Oasis Petroleum’s rating outlook to positive upon merger announcement with Whiting Petroleum

Term of the Day

SEC Registered Bonds

As the name suggests, these are bonds registered with the US Securities and Exchange Commission (SEC). These are not to be confused with 144A bonds, which are privately placed, not SEC registered and have lesser documentation and are traded among Qualified Institutional Buyers (QIBs). Given 144As are restricted securities, they have resale and transfer restrictions that are not applicable for SEC-registered securities. Besides these, they also have a few other differences like being eligible for inclusion in bond indices like Barclays Aggregate Bond Index, no investment restrictions and no private placement restrictions on communications.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Morgan Stanley Saying Russia’s Set for Venezuela-Style Default

Simon Waever, global head of emerging-market sovereign credit strategy

“We see a default as the most likely scenario… In case of default, it is unlikely to be like a normal one, with Venezuela instead perhaps the most relevant comparison… The potential for significant further selling will put additional downside pressure on prices… We see very little incentive for any investor to step into Russian sovereign bonds at this point.”

On Argentina government warning Congress not to block IMF deal

Economy Minister Martin Guzman

“It would generate a situation of deep exchange rate stress with inflationary and negative consequences on economic activity, employment and poverty”

Opposition legislator

“We have a point of agreement, not to push the country into default. We also agree on endorsing the refinancing of the debt with the IMF but we don’t endorse the economic program.”

On ESG At Crossroads After Investing in Putin’s Russia

Clements-Hunt, founder of advisory firm Blended Capital Group

“ESG investors have failed. ESG is being used ineffectively… the obsession with easy money-making is overriding everything”

Philippe Zaouati, chief executive of Mirova

“Ukraine is one of the most important ESG issues we’ve ever had. It’s a vital issue for energy and human rights, and questions whether we still want to live in a democracy or not”

Hortense Bioy, Morningstar’s global head of sustainability research

“There are still people who inappropriately conflate sustainability and ethics. Sustainable and ESG funds aren’t the same as ethical funds.”

Felix Boudreault, managing partner at research firm Sustainable Market Strategies

“As an investor, you have to consider not just the company, but the environment in which they operate. And we are saying the same for China. It’s uninvestable from any ESG perspective. By a strike of a pen, a bureaucrat in Beijing can really kind of wipe out an entire sector like they did with education technologies recently”.

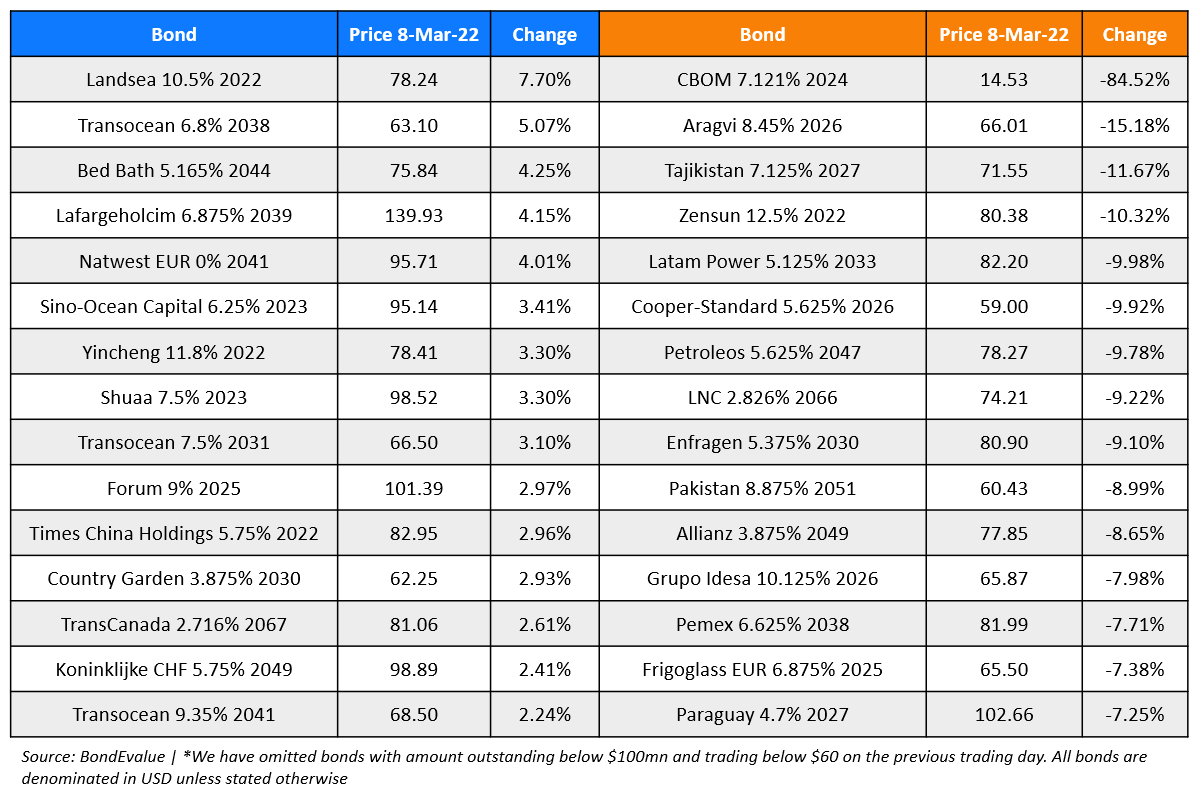

Top Gainers & Losers – 08-Mar-22*

Other Stories

Go back to Latest bond Market News

Related Posts: