This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

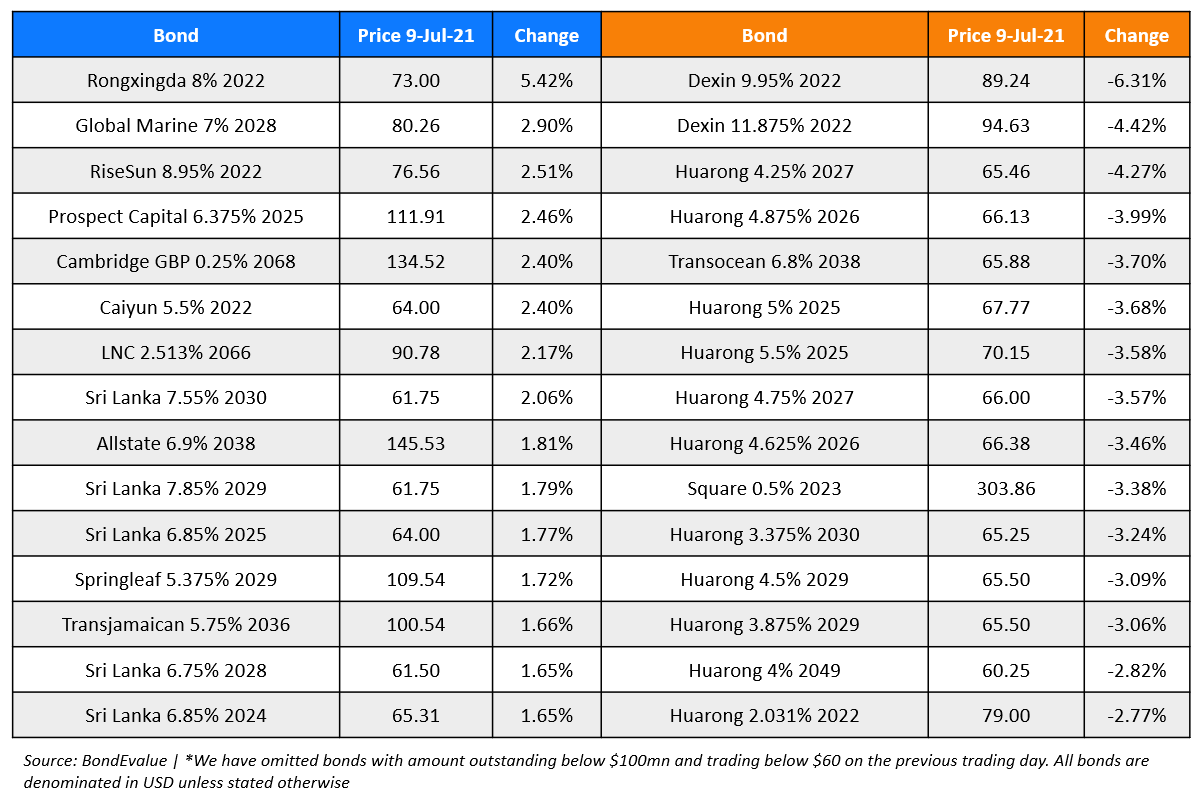

Macro; Rating Changes; New Issues; Talking Heads, Top Gainers & Losers

July 9, 2021

US Markets tumbled more than 1% from their record levels on a possible risk off sentiment before staging a small comeback. Weekly jobless claims rose marginally by 2k to 373k vs. the 350k estimate for the prior week. S&P was down 0.9% and Nasdaq was down 0.7%. Sectors across witnessed a sea of red with Financials, Industrials and Materials, down 2%, 1.4% and 1.3%, were the worst hit and were closely followed by Communications and IT down ~1%. US 10Y Treasury yields dipped to 1.25 before recovering to end flat at 1.32%. In Europe, ECB approved a new monetary policy strategy in which it set a symmetric 2% inflation target over the medium term (details below). European indices dropped across – CAC closed lower by 2% and DAX and FTSE were down 1.7%. US IG and HY CDS spreads widened 1.1bp and 7bp respectively. EU main and crossover CDS widened 1.3bp and 6.9bp respectively. Saudi TASI and Abu Dhabi’s ADX were down 1.2% and 0.1% respectively. Brazil’s CPI MoM was reported at 0.53% against a forecasted 0.59% and vs 0.83% last month. Bovespa was down 1.3%. Asian markets were mixed – Nikkei was sharply down 2.5% as Japan declared its fourth state of emergency and banned spectators from most Olympics events. Shanghai was down 1% and HSI is up 0.6%Singapore’s STI was pleasantly up 0.2%. Asia ex-Japan CDS spreads were 2.1bp wider.

New Bond Issues

-

Weifang Binhai Investment 363-day $ notes at 5.7% area

Beijing Capital Development Holding raised $517mn via a 5Y bond at a yield of 3.445%, 30bp inside initial guidance of T+300bp area. The bonds have expected ratings of BBB and received orders over $1.9bn, 3.7x issue size. Proceeds will be used for debt repayment.

Eastern Air Overseas raised S$500mn via a 5Y SBLC-backed note bond at a yield of 2%, 40bp inside initial guidance of 2.4% area. The bonds have expected ratings of A1 and received orders over $1.2bn, 2.4x issue size. The bonds are backed by a letter of credit from ICBC Shanghai Municipal Branch, rated A1/A. There is a change of control (CoC) put at 101 if the SASAC ceases to directly or indirectly control Eastern Air Overseas, or if the issuer consolidates or merges, sells or transfers all or a substantial portion of its assets to a non-SASAC entity.

Mitsubishi raised $500mn via a 5Y bond at a yield of 1.237%, 25bp inside initial guidance of T+75bp area. The bonds have expected ratings of A2/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Minor International hires for $ PerpNC5 with Bangkok Bank guarantee

- KT Corp hires for $ bond with expected 5.5Y tenor

Rating Changes

- Moody’s upgrades Tianqi Lithium to Caa1; outlook remains negative

- Fitch Downgrades Tunisia to ‘B-‘; Outlook Negative

- Jaguar Land Rover Automotive Outlook Revised To Stable On Strong Cost Control; ‘B’ Ratings Affirmed

- Outlooks On Three Australian Retail REITs Revised To Stable From Negative; Ratings On Eight Affirmed

- Fitch Affirms and Withdraws Ratings on Empresa Electrica Angamos SpA

Term of the Day

Change of Control Put

Change of control put is a covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Eastern Air Overseas’ S$500mn bonds priced today have a change of control put at 101.

Talking Heads

Peter Chatwell, head of multi-asset strategy at Mizuho International

“For bond investors, the outcome is quite simply bullish for now to reflect the more dovish central bank reaction function,” said Chatwell. “This is the underlying reason for the ECB’s new framework — running inflation hot is necessary.”

Andreas Lipkow, strategist at Comdirect Bank AG

“Risks are increasing and, given the good performance in the first half of the year, more and more investors are getting nervous.” “The negative news flow is becoming too much.”

Padhraic Garvey, ING Groep NV strategists and team

“It seems that this position unwind is occurring at the worst of times: when macro expectations are being pared back, and when market liquidity is drying out ahead of the summer.” The “price action suggests more reflation trades are being shed.”

Guy Miller, chief market strategist at Zurich Insurance Group

“Markets have gone from thinking that growth is strong and inflation could be strong to saying growth has peaked and inflation is transient.”

Frederik Ducrozet, Pictet Wealth Management strategist

“You have to change your view given the facts that you are faced with – economic growth is not solid, inflation is not about to surge.”

Mike Sewell, a portfolio manager at T.Rowe Price

“There is still some potential for that trade to re-engage but that is more a 3rd or 4th quarter potential. Right now the reflation trade is not dead but it’s certainly hibernating,” Sewell said.

Charles Diebel, head of fixed income at Mediolanum International Funds

“The muscle memory of markets is that governments will lock down again if they see cases rise, which means slower growth and that we are caught in a loop.”

On China’s central bank watching for monopolistic behaviour in fintech firms

Fan Yifei, deputy governor of People’s Bank of China

“Ant Group is not the only company that engages in monopolistic behaviour, while in fact there are other payment companies in China with similar misconduct issues.” “The central bank continues to support the payment industry to grow faster and better, but at the same time we would also crack down on any misconduct or malpractice in the sector.”

Gordon Tsui, chairman of Hong Kong Securities Association

“The central bank’s widening crack down on malpractices of online payment companies may slow down their development in the near term, but it will help China to develop its fintech market in a healthy and orderly manner.” “It will create a fair market and enhance customer protection.”

In a note by Citigroup Inc. strategists led by Gaurav Garg

“This is an important dovish shift and is likely to drive unwind of residual policy normalization fear and expectations, and render some support to broad risk assets.”

Fiona Lim, senior currency strategist at Malayan Banking Berhad

“Policy divergence of the Fed and the PBoC could narrow yield differentials and chip away the carry advantage of the renminbi.” “However, the potential support of such a monetary policy action for the real economy and domestic assets may mitigate the impact on the renminbi.”

Top Gainers & Losers – 09-Jul-21*

Go back to Latest bond Market News

Related Posts: