This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 12, 2022

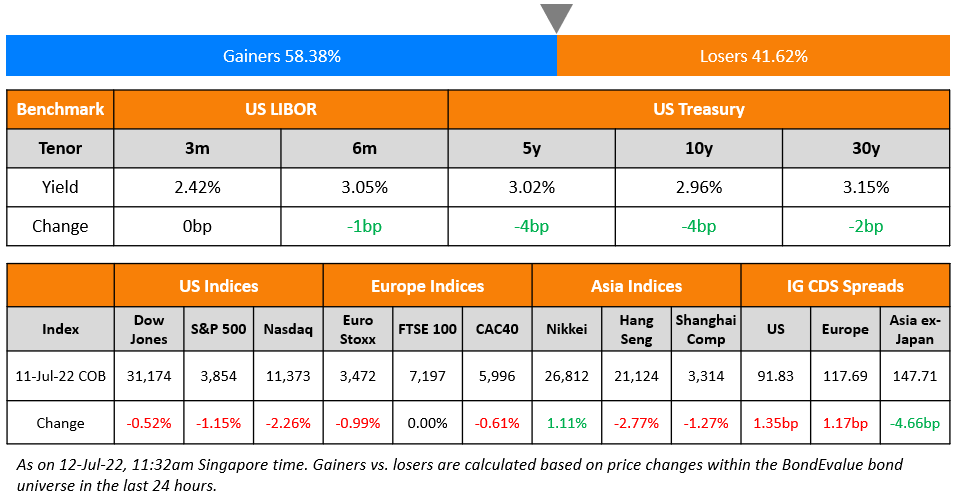

US equity markets started the week lower on Monday with the S&P and Nasdaq down 1.2% and 2.3% respectively. Sectoral losses were led by Communication Services and Consumer Discretionary fell 2.8% each. US 10Y Treasury yields were 4bp lower at 2.96%. European markets were broadly lower with the DAX and CAC down 1.4% and 0.6% respectively while FTSE was flat. Brazil’s Bovespa trended lower 2.1%. In the Middle East, UAE’s ADX and Saudi TASI were closed due to festive holidays. Asian markets opened mixed – Shanghai, HSI and Nikkei were down 0.9%, 1.4% and 1.7% respectively while STI was up 0.1%. US IG CDS spreads widened 1.4bp and US HY spreads were wider by 14.8bp. EU Main CDS spreads were 1.2bp wider and Crossover spreads were wider by 8.8bp. Asia ex-Japan IG CDS spreads narrowed by 4.7bp.

US NFP for June rose by 372k, higher than the surveyed 265k, whilst being slightly lower than May’s 390k print. The unemployment rate was unchanged at 3.6% unchanged from the prior month and in-line with forecasts. Average hourly earnings went up 0.3% MoM and up 5.1% YoY.

Not sure what to expect in a corporate debt restructuring? Sign up for the upcoming masterclass, which will be conducted virtually via Zoom on 18 July 2022. The session will cover, among other things, a deep dive on the recent consent solicitation and schemes transacted by Chinese property developers including Guangzhou R&F Properties. Click on the banner above to sign up!

New Bond Issues

Korea Housing Finance Corp raised €500mn via a 4Y covered social bond at a yield of 1.963%, unchanged from the initial guidance of MS+40bp. The bonds have expected ratings of Aaa/AAA (Moody’s/S&P), and received orders over €560mn, 1.1x issue size. The new bonds are priced 16.3bp wider to another Korean issue, Kookmin Bank’s 0.048% 2026s (rated AAA) that currently yield 1.8%.

New Bonds Pipeline

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Fitch Downgrades Turkiye to ‘B’, Outlook Negative

- Moody’s downgrades PEMEX’s ratings to B1; outlook changed to stable

- Moody’s downgrades Mexico’s ratings to Baa2, changes outlook to stable from negative

- Moody’s downgrades Ronshine’s ratings to Ca/C; outlook remains negative

- Fitch Downgrades Times China to ‘CCC+’ on Rising Refinancing Risks

- Guacolda Energia Downgraded To ‘B-‘ From ‘B’ On Wider-Than-Expected Cash Deficit, Outlook Still Negative

- Moody’s affirms ratings of Allianz SE and changes outlook to positive

Term of the Day

Real Interest Rate

Real interest rate refers to the interest rate after accounting for inflation. It is approximately calculated by deducting the annual inflation rate from the nominal interest rate per annum. In an inflationary environment, the purchasing power of every dollar invested reduces by the annual inflation rate. This is why investors consider real interest to be an important metric since it indicates a more “real” indication of returns.

Talking Heads

On Confidence that Economy Can Handle Another Jumbo Rate Hike

Federal Reserve Bank of Atlanta President Raphael Bostic

“Right now I’m pretty comfortable. I’m confident that the economy will be able to withstand this next move. I would support a 75 basis-point” increase.

Kansas City Fed President Esther George

“This is already a historically swift pace of rate increases for households and businesses to adapt to, and more abrupt changes in interest rates could create strains, either in the economy or financial markets”

On Bill Gross Favoring T-Bills Over Stocks, Bonds as Recession Looms Large

“Be patient. 12-month Treasuries at 2.7% are better than your money market fund and almost all other alternatives… Stocks must contend with future earnings disappointments and are not as cheap as they appear. Don’t buy them just yet.”

On Raising Rates Too Fast Risks ‘Oversteering’ – Kansas Fed’s Esther George

“Communicating the path for interest rates is likely far more consequential than the speed with which we get there. Moving interest rates too fast raises the prospect of oversteering… Along these lines, I find it remarkable that just four months after beginning to raise rates, there is growing discussion of recession risk, and some forecasts are predicting interest rate cuts as soon as next year.

On BlackRock Warning Against Dip Buying as High-Volatility Era Dawns

Strategists Wei Li, Vivek Paul and Scott Thiel

“We are braving a new world of heightened macro volatility and higher risk premia for both bonds and equities… The Federal Reserve, for one, is likely to choke off the restart of economic activity and only change course when damage emerges… We could go back to the volatility seen in the 1970s. This regime is not necessarily one for ‘buying the dip.’ Policy will not quickly step in to stem sharp asset price declines.”

Top Gainers & Losers – 12-July-22*

Go back to Latest bond Market News

Related Posts: