This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 18, 2022

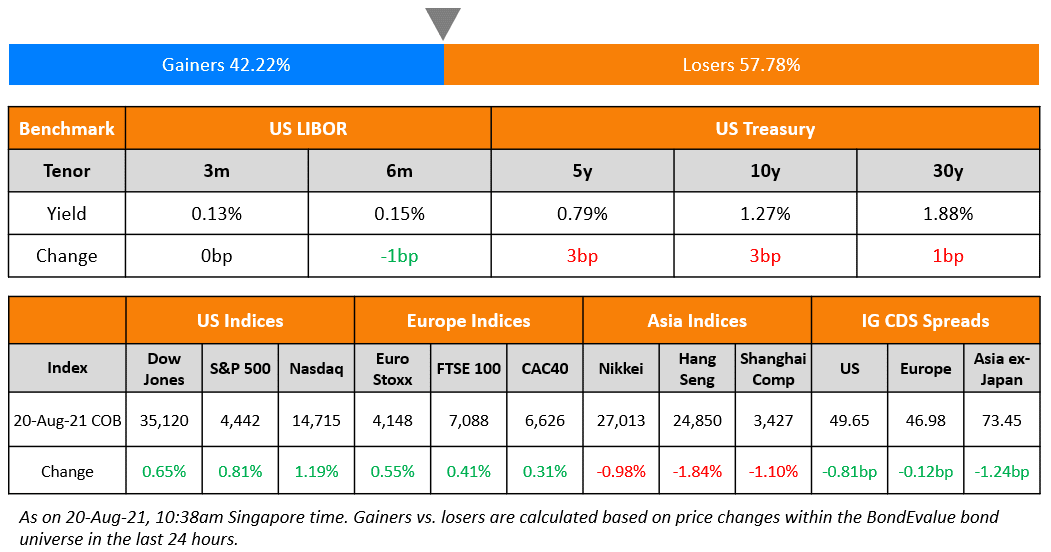

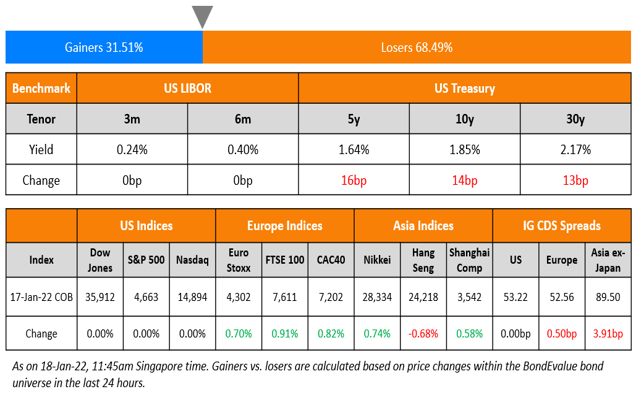

US equity markets were closed on Monday on account of Martin Luther King Jr. Day. US 10Y Treasury yields rose 14bp to 1.85% over increased expectations of a Fed rate hike in March. European markets closed higher on Monday with the DAX, CAC and FTSE up 0.3%, 0.8% and 0.9% respectively. Brazil’s Bovespa closed 0.5% lower. In the Middle East, UAE’s ADX was 0.15% lower while Saudi TASI was up 0.46%. Asian markets have opened broadly higher – Shanghai, STI and Nikkei are up 0.9%, 0.2% and 0.4% while HSI is down 0.1%. US IG and HY CDS spreads were unchanged, EU Main CDS spreads were 0.5bp wider and Crossover CDS spreads were 1.7bp wider. Asia ex-Japan CDS spreads widened 3.9bp.

China’s economy grew at a slower pace of 4% in Q4, down from 4.9% in Q3 but faster compared to expectations of 3.6%. This was the slowest quarter since Q2 2020 on the back of a meltdown in its property sector, supply chain issues and the pandemic. For the full year 2021, the world’s second largest economy grew 8.1%, the fastest pace in about a decade.

New Bond Issues

- Housing and Development Board S$800mn 7Y bond at 1.971%

- Hyundai Capital Services $ 3.25Y bond at T+110bp area; $ 5Y green bond at T+125bp area

- Guangdong Provincial Communications Group $ 5Y bond at T+120bp area

- Huzhou City Investment Development $ 3Y bond at 3.3% area

- Caofeidian State Holding Investment Group $ 2.9Y bond at 2.2% area

- Jiaozuo Investment $ 364-day bond at 5.5% area

.png?width=1400&upscale=true&name=New%20Bond%20Issues%2018%20Jan%20(1).png)

Sweihan PV Power Company (SPPC) raised $700.8mn via an amortizing green bond with a weighted average life of 15 years at a yield of 3.625%, 25bp inside the initial guidance of 3.875% area. The bonds have expected ratings of Baa1/BBB+ (Moody’s /S&P), and received orders over $1.6bn, 2.3x issue size. The final size came in slightly below the issuer’s target of $728mn. Proceeds will be used to finance expenditures related to the Noor Abu Dhabi solar plant, in line with eligibility criteria as outlined in Sweihan PV’s Green Bond Framework. Sweihan is 60% owned by TAQA, which is 96.8% owned by the Abu Dhabi government. The remaining stake in Sweihan is split equally between Japan’s Marubeni Corp and China’s JinkoSolar.

Chengdu Jingkai Guotou Investment Group raised $200mn via a tap of its 5.3% 2024s at a yield of 5.4%, 40bp inside the initial guidance of 5.8% area. The bonds are rated Ba2 (Moody’s). Proceeds will be used for offshore debt refinancing. The issuer, formerly known as Chengdu Economic and Technological Development Zone State-owned Assets Investment, is a state-owned housing and infrastructure development entity in the Chengdu Economic and Technological Development Zone in China’s Sichuan province.

Jinan Zhangqiu Holding raised $105mn via a 364-day bond at a yield of 3.8%, 50bp inside the initial guidance of 4.3% area. The bonds are unrated. Proceeds will be used for offshore debt refinancing. The bonds are issued by Golden Dragon Mountain Trading (BVI) and guaranteed by Jinan Zhangqiu Holding, which is wholly owned by the Zhangqiu Finance Bureau of Zhangqiu district in Jinan city, Shandong province in China.

Zhejiang Qiantang River Investment Development raised $80mn via a 3Y bond at a yield of 2.1%, in line with initial guidance of 2.1% area. The bonds are unrated. Proceeds will be used for project construction and working capital. The bonds are issued by wholly owned subsidiary ZhongChuang (HK) Technology and guaranteed by Zhejiang Qiantang River Investment Development. The bonds are supported by a letter of credit from the Bank of Hangzhou Jiaxing branch.

Maxi-Cash Financial raised S$60mn via a 3Y bond at a yield of 6.05% as part of an exchange offer for its outstanding S$50mn 6.35% 2022s. The deal was upsized by S$36.75mn from the initial S$23.25mn. The bonds are unrated. Proceeds will be used for general corporate needs, including debt refinancing or repayment, acquisitions and working capital purposes.

New Bonds Pipeline

- Quzhou Communications Investment Group hires for $ green bond

- Health and Happiness hires for $ 400 mn bond

- Kalyan Jewellers India hires for $ 5Y bond

- Henan Railway Construction & Investment hires for $ green bond

- Shinhan Card hires for $ 5Y social bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

- JY Grandmark hires for $ bond

- ADB marketing hires for $ 5Y bond

- China Oilfield Services Limited hires for $ bond

Rating Changes

- Fitch Downgrades Sri Lanka’s Long-Term Foreign-Currency IDR to ‘CC’

- Agile Group Downgraded To ‘B+’ On Sizable Maturities And Tightening Funding Access; Outlook Negative

- Times China Downgraded To ‘B+’ On Tough Business Conditions, Reduced Liquidity Buffer; Outlook Negative

- R&F (HK) Upgraded To ‘CC’ On Completing Distressed Tender; Guangzhou R&F Affirmed At ‘CC’; Outlooks Negative

- Fitch Downgrades Yuzhou to ‘C’ on Distressed Debt Exchange

- Fitch Downgrades EDF to ‘BBB+’; Places Rating on Negative Watch

- Electricité de France Placed On CreditWatch Negative On Nuclear Outages And Adverse Political Decisions

- Moody’s reviews EDF’s A3 ratings for downgrade

- Moody’s withdraws Hopson’s rating for business reasons

- Moody’s upgrades Navios Holdings’ ratings to B3 and affirms Navios South American Logistics’ B3; outlooks are stable

Term of the Day:

CET1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On strategists’ view on markets as Treasury yields spike

Adam Reynolds, chief executive officer for Asia-Pacific at Saxo Capital Markets

“The anticipation of higher yields is already impacting the broader market which has seen a weak start to the new year for equities.” “Typically we see inflows in January, which drive outperformance. This year that has not occurred. The more important consideration for me is the prospect of an early start to reducing the size of the Fed balance sheet. Any significant and early withdrawal of liquidity will have a negative impact on asset prices.” “We are seeing a weak start for the week in both equities and fixed income,” Reynolds added. “My expectation is that this will continue throughout the week and even may start to accelerate.”

Tai Hui, chief Asia market strategist at J.P. Morgan Asset Management

“We prefer equities over fixed income. Not only equities’ valuation is less demanding than fixed income, the duration risk relating to fixed income could be a challenge on generating positive return in 2022.”

In a note by Goldman Sachs Group Inc. strategists led by David Kostin

“The outlooks for the Fed, interest rates, and economic growth suggest equity investors should balance their exposures to growth and value.” “Our rates strategists expect yields will continue to rise, a dynamic that should support value over growth.”

In a note by Vishnu Varathan, head of economics and strategy at Mizuho Bank

“The dissonance associated with the juxtaposition of higher Treasury yields and a softer U.S. dollar stemming from the underlying hawkish Fed divergence (vis-a-vis the European Central Bank and Bank of Japan) reveals the many tensions that dwell beneath.” “Insofar that a hawkish Fed is augmenting inflation expectations lower, real UST yields have been climbing; catching up with, and potentially overtaking the rise in nominal yields.” “And if sustained, this lift in real rates should inspire USD traction, if not rebound. If indeed the real (rates) U.S. dollar stands up, one-way bearish bets on the dollar will fumble.”

Sue Trinh, head of global macro strategy Asia at Manulife Investment Management HK Ltd

“Broadly speaking, rising real yields are negative for risk assets.” “We find that higher real rates are likely more painful for risk assets than higher nominal rates.” “Crucially, the correlation between real yields and risk assets has become stronger and more negative in the past five years.”

Arthur Lau, head of Asia ex-Japan fixed income at PineBridge Investments in Hong Kong

“While in theory they should be able to repay debt maturing in July this year from the FX reserve, this will certainly affect the repayment of debts later on.” “Talk of obtaining a meaningful bilateral financing arrangement do not seem sufficient right now.”

Matthew Vogel, portfolio manager and head of sovereign research at FIM Partners

“We have not held Sri Lankan debt for close to a year, troubled by the current-account developments — much weaker tourism and remittances than expected, weak economic growth and lack of commitment to an IMF program, which we would see as essential.”

Top Gainers & Losers – 18-Jan-22*

Other Stories

Cinda, under Beijing pressure, scraps $944 mln investment in Ant unit -sources

Go back to Latest bond Market News

Related Posts:.png)