This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 18, 2022

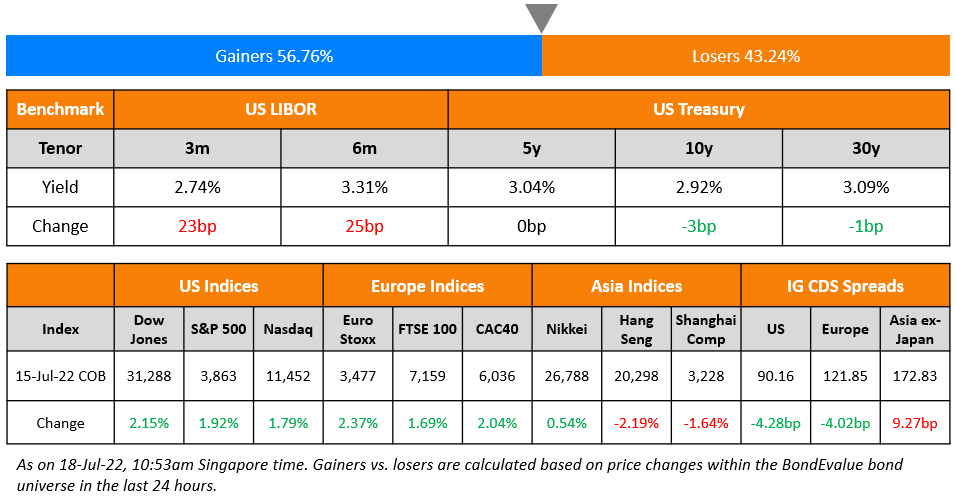

US equity markets bounced back strongly on Friday with the S&P and Nasdaq up 1.9% and 1.8% respectively with positive economic data. Sectoral gains were led by Financials and Healthcare, up 3.5% and 2.4% respectively. US 10Y Treasury yields were down 3bp to 2.92%. European markets also performed strongly with the DAX, CAC and FTSE up 2.8%, 2%, and 1.7% respectively. Brazil’s Bovespa was up 0.5%. In the Middle East, UAE’s ADX closed flat on Friday and Saudi TASI was 1.2% higher on Sunday. Following the US, Asian markets have also opened higher today – Shanghai, HSI, STI and Nikkei are up 1.5%, 2.5%, 0.5% and 0.6% respectively. US IG CDS spreads narrowed 4.3bp and US HY spreads were narrower by 26.7bp. EU Main CDS spreads were 4bp tighter and Crossover spreads were tighter by 19.9bp. Asia ex-Japan IG CDS spreads widened 9.3bp.

US retail sales rose 1% MoM and 8.4% YoY for June as compared to estimates that ranged widely from a -0.2% drop to a 2.2% rise.

Masterclass on Corporate Debt Restructuring | Today, 18 July at 5pm SG/HK

Final call to sign up for the upcoming masterclass, which will be conducted live via Zoom on Monday, 18 July 2022. The session will cover:

- In-court vs. Out-of-court restructurings

- Out-of-court debt restructuring techniques

- Understanding Chapter 11 bankruptcy

- Cross-border insolvencies with a focus on China

- Key considerations for a corporate debt restructuring

- Case studies of recent restructurings from Asia Pacific, including a deep-dive into the recent consent solicitation and schemes transacted by Chinese property developers including Guangzhou R&F Properties

New Bond Issues

New Bonds Pipeline

-

Lenovo hires for $ Green bond

- Busan Bank hires for $ Social bond

Rating Changes

-

Kuwait Outlook Revised To Stable From Negative On Favorable Terms Of Trade; ‘A+’ Ratings Affirmed

-

Howard Hughes Corp. Outlook Revised To Negative From Stable; ‘B+’ Rating Affirmed

-

Central China Real Estate Downgraded To ‘B-‘; Placed On CreditWatch Negative

Term of the Day

Dollar Doom Loop

A dollar doom loop refers to a negative spiral of events that is led by a strong US dollar and ends with global growth worries. With concerns about growth plateauing or even falling, JST Advisors’ Jon Turek notes that we may see a dollar ‘doom loop’ like never before amid high inflation and commodity prices.

Talking Heads

On US Risks Talking Itself Into a Recession, Moody’s Economist Says

Mark Zandi, chief economist at Moody’s Analytics

“I talk to CEOs, CFOs, investors, friends, family — to the person, they think we’re going into recession. I’ve never seen anything like it. I’ve seen a lot of business cycles now. And no one predicts recessions. But in this one, everyone is predicting a recession. So when sentiment is so fragile, it’s not going to take a whole lot to push us in. I think with a little bit of luck, and some reasonably good policy-making by the Fed, we’re going to be able to avoid a recession. But I don’t say that with a lot of confidence.”

On Fed’s Bostic Signaling He Doesn’t Favor a 100 Basis-Point July Fed Rate Hike

“Moving too dramatically will undermine a lot of the other things working well…We want it to be orderly and for people to have the right perceptions about the economy.”

On India Has a Chance to Escape Global Inflation Trap – RBI

“India’s economy is showing signs of resilience despite fears of recession and war globally …Stronger agricultural activity and a pick-up in manufacturing and services point to a high-growth trajectory over the medium-term…If recent moderation in commodity prices and an easing of supply chain pressures continue, “the worst of the recent surge in inflation will be left behind, enabling the Indian economy to escape the global inflation trap.”.

On Debt sell-off intensifying strains for more than a dozen emerging markets

Charlie Robertson, global chief economist at Renaissance Capital

“It’s pretty shocking to see this scale of a collapse in bond prices…the sell-off is one of the biggest I’ve seen in 25 years…Emerging markets do not like the Fed hiking rates and do not like it when the dollar’s strengthening…it’s just bad news for countries that need capital when that happens, and we haven’t seen rate hikes like this in nearly 30 years”.

On Governments Risking Undoing Central Bank Inflation Fight – IMF

Kristalina Georgieva, IMF Managing Director

“Governments need to focus cost-of-living support to those most vulnerable in order to avoid undoing central bankers’ work in fighting inflation…If help is not well-targeted, it might be that providing support to populations in an un-targeted manner creates more pressure for prices to go up, and then the monetary policy should target even further action…Monetary policy is tightening, but fiscal policy could unintentionally go the other way”

Top Gainers & Losers – 18-July-22*

Go back to Latest bond Market News

Related Posts: