This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 18, 2022

S&P and Nasdaq dropped sharply again on Thursday as Russia-Ukraine risk-off sentiment hit markets – the indices were down 2.1% and 2.9% respectively. Most sectors were in the red, led by IT, Communication Services and Consumer Discretionary, down over 2.5% each. The US 10Y Treasury yield was down 4bp at 1.99%. European markets were lower with the DAX, CAC and FTSE down 0.7%, 0.3% and 0.9% each. Brazil’s Bovespa closed 1.4% higher. In the Middle East, UAE’s ADX was up 0.1% and Saudi TASI closed 0.2% lower. Asian markets have opened broadly higher with Shanghai, HSI and STI up 0.4%, 0.3% and 0.4% respectively, while Nikkei was down 0.2%. US IG CDS spreads were 2.5bp wider and HY CDS spreads were 10.5bp wider. EU Main CDS spreads were 1.5bp wider and Crossover CDS spreads were 7.7bp wider. Asia ex-Japan CDS spreads were 1.2bp wider.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

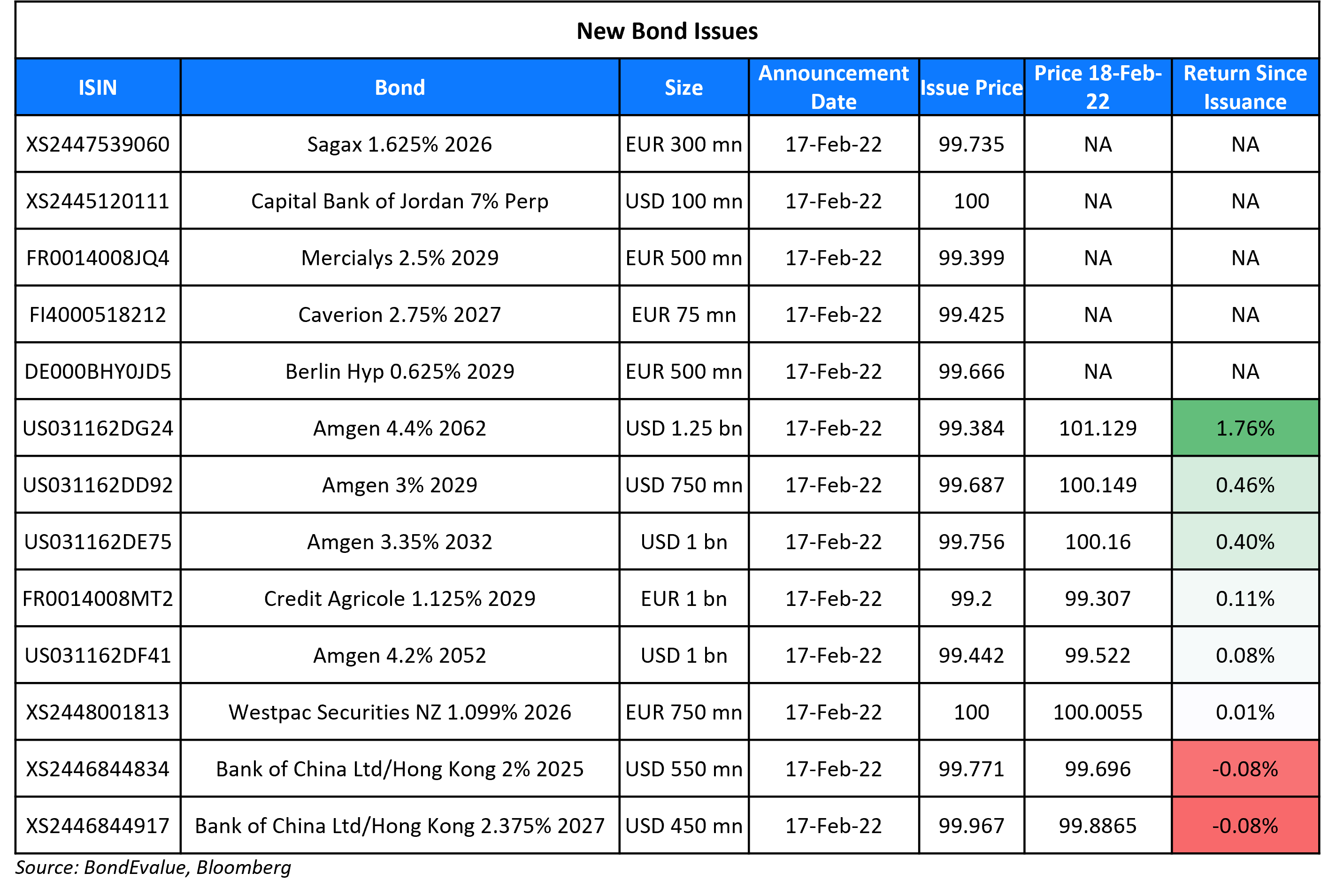

New Bond Issues

BOC HK branch raised $1bn via a two-tranche deal. It raised $550mn via a 3Y bond at a yield of 2.079%, 40bp inside initial guidance of T+75bp. It also raised $450mn via a 5Y bond at a yield of 2.382%, 40bp inside initial guidance of T+90bp. The bonds are rated A1/A/A (Moody’s/S&P/ Fitch) and received orders over $1.75bn, 1.75x issue size, Proceeds will be used for general corporate purposes. The 3Y was priced ~7bp within its comparable 2.375% bonds due January 2025 that yield 2.15%.

Credit Agricole raised €1bn ($1.1bn) via a 7Y bond at a yield of 1.245%, ~22bp inside initial guidance of MS+75/80bp. The bonds have expected ratings of Aa3/A+/AA- and received orders over €1.75mn ($2bn), 1.75x issue size.

Westpac raised €750mn ($853mn) via a 4Y bond at a yield of 1.099%, 10bp inside initial guidance of MS+70bp area. The bonds have expected ratings of A1 / AA- (Moody’s / S&P) and received orders over €1.15bn ($1.3bn), 1.5x issue size.

New Bonds Pipeline

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Kalyan Jewellers India hires for $ 5Y bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

Rating Changes

- Nabors Industries Ltd. Upgraded To ‘B-‘ On Improved Financial Flexibility; Outlook Stable

- Moody’s downgrades Times China’s ratings to B1/B2; outlook negative

- Logan Group Downgraded To ‘BB-‘ On Previously Unreported Guaranteed Debt And Reduced Liquidity Buffer; Outlook Negative

- Moody’s downgrades Xerox’s CFR to Ba2; outlook stable

- Bombardier Inc. Outlook Revised To Positive From Stable On Improving Earnings Profile; ‘CCC+’ ICR Affirmed

Term of the Day

Structural Subordination Risk

Structural subordination risk refers to the risk that most of the claims of the holding company are at its operating subsidiaries where these claims have a priority over the claims at the holding company in the event of a bankruptcy. Essentially, a lender to a parent is structurally subordinated to other lenders who have lent money to the subsidiary. Hence, lenders to the parent company will not have access to the subsidiary’s assets until the subsidiary’s creditors have been paid back first.

Talking Heads

“Rotate into credit now… As the rate volatility plays through the market segment, we think high yield could become more attractive very quickly.”

On Bullard Saying Fed May Need to Raise Rates Above 2% to Curb Prices

“If you wanted to put downward pressure on inflation, you’d actually have to get to neutral — go beyond neutral… And I think that’s a major concern of mine — we’re not really in a position to do that right now, but we have to get in a position to do that… We have to manage the risk that it does not dissipate”

On ECB chief economist shifting inflation stance to signal policy ‘normalisation’

ECB’s Philip Lane, Chief Economist

“Inflation is expected to settle around 2%. In terms of asset purchases it is a different path than if it was going to spend a period below 2%… There are several factors indicating that the excessively low-inflation environment that prevailed from 2014 to 2019 – might not re-emerge even after the pandemic cycle is over.”

Carsten Brzeski, head of macro research at ING

“Impressive to see how fast a consensus at the ECB could be built on normalisation. Only unsolved questions are: when to hike the deposit rate and what to do when once the deposit rate is back at zero.”

On El Salvador’s Bukele telling bitcoin-wary U.S. senators to stay out of internal affairs

“Ok boomers… You have 0 jurisdiction on a sovereign and independent nation… We are not your colony, your back yard or your front yard. Stay out of our internal affairs. Don’t try to control something you can’t control.”

On Fed hikes will limit Mexico’s monetary policy – Central Bank official

“We cannot have a monetary policy that is independent or countercyclical to the Federal Reserve… If the Federal Reserve begins to raise in March, well, I think that practically sets a ceiling for us… We don’t really have any (economic) growth engine” for 2022.

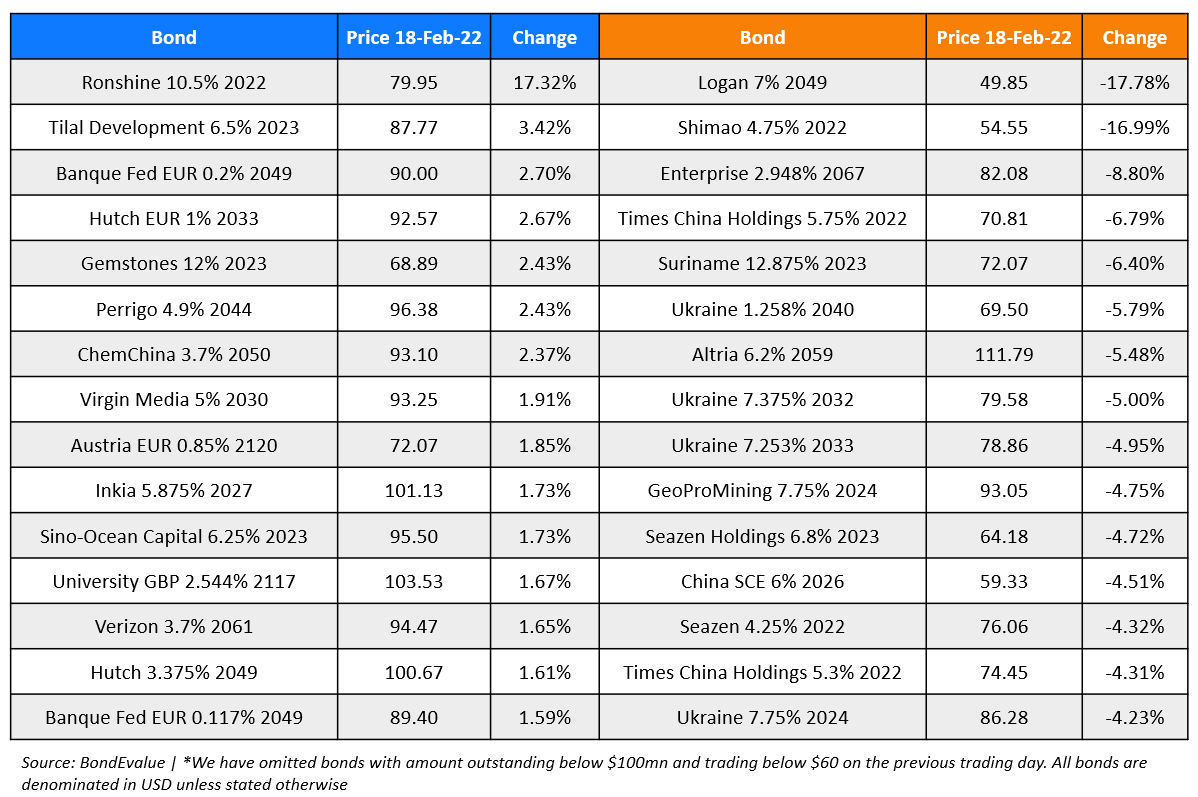

Top Gainers & Losers – 18-Feb-22*

Go back to Latest bond Market News

Related Posts: