This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 23, 2022

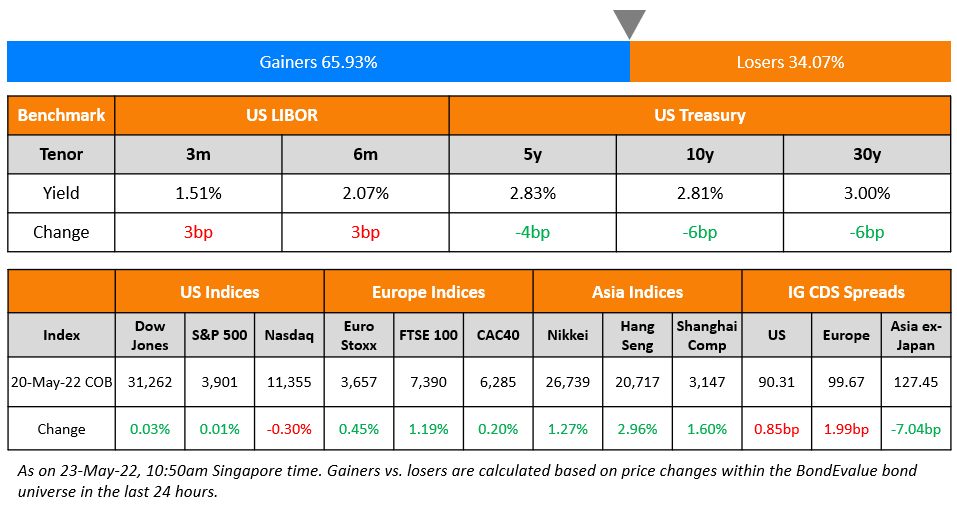

US equity markets saw a minor change on Friday with the S&P near flat while Nasdaq was down 0.3% Sectoral gains were led by Healthcare and Real Estate, up over 1% each while losses were led by Consumer Discretionary and Industrials, down over 1% each. US 10Y Treasury yields eased another 6bp to 2.81%, a total of 17bp in the last three days. European markets ended higher on Friday with the DAX, CAC and FTSE up 0.7%, 0.2% and 1.2% respectively. Brazil’s Bovespa closed 1.4% higher. In the Middle East, UAE’s ADX was up 0.9% on Friday and Saudi TASI fell 0.8% on Sunday. Asian markets are off to a negative start – Shanghai, HSI and STI were down 0.5%, 1.8%, 0.4% while Nikkei was up 0.5% respectively. US IG CDS spreads widened 0.8bp and HY spreads widened 6.7bp. EU Main CDS spreads were 2bp wider and Crossover spreads were 10.2bp wider. Asia ex-Japan CDS spreads were 7bp tighter.

Advanced Two-Day Course on Bonds (In-Person) | 7-8 June | Singapore

Keen to develop a deeper understanding of bonds? Sign up for our upcoming IBF-recognized course on bonds, scheduled for 7-8 June in-person at 79 Robinson Road, Singapore. This course is ideal for finance professionals in Singapore, with 80/90% IBF funding available to eligible company-sponsored candidates. Click on the banner below for details about the course modules, instructor profiles, fees and funding.

New Bond Issues

- OUE Commercial Trust S$ tap of 4.2% 2027

NatWest Markets raised €1.25bn via a two-tranche deal. It raised €750mn via a 3.25Y bond at a yield of 2.091%, 15bp inside initial guidance of MS+105bp area. It also raised €500mn via a 3.25Y FRN at a yield of 0.592% vs. initial guidance of 3m Euribor area. The 3.25Y fixed-rate bonds received orders over €900mn, 1.2x issue size. The 3.25Y FRN received orders over €600mn, 1.2x issue size. The bonds have expected ratings of A2/A-/A+.

New Bonds Pipeline

- Indonesia $ Sukuk

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

Rating Changes

- Moody’s downgrades Ukraine’s ratings to Caa3 and changes outlook to negative, concluding review for downgrade

- Fitch Ratings Downgrades DTEK Oil & Gas Production B.V. to ‘CC’

- Moody’s downgrades Sierra Enterprises LLC to B3; outlook remains negative

- Slovakia Outlook Revised To Negative From Stable On Rising Economic And Fiscal Risks; ‘A+/A-1’ Ratings Affirmed

-

Trade BondbloX via Singapore-based member CapBridge and Receive Cash Credits.

Term of the Day:

Euribor

Euribor is an average unsecured inter-bank rate complied from a panel of 20 large European banks that lend money on an overnight basis to one another in Euros. Maturities on loans used to calculate Euribor often range from one week to one year. Euribor is generally considered as a reference rate for pricing bonds denominated in Euros. The equivalent of Euribor in the US is the USD Libor rate.

Talking Heads

On Signals That July Is Likely Liftoff Date for ECB Rates

Christine Lagarde, ECB President

“We are going to follow the path of stopping net asset purchases. Then, sometime after that — which could be a few weeks — hike interest rates… We need to make sure that this is going gradually enough so that we don’t put the break on this car that is moving. We have to lift the accelerator for sure to slow inflation but we cannot be breaking any speed.”

On On US Corporate Credit Spreads Hover Around ‘Danger Zone’

Winifred Cisar, global head of credit strategy at CreditSights

“We’re in kind of the approach to the danger zone, 150 basis points of spread. If you break to 200, that’s when the Fed has to take a little bit of a pause and say, ‘Are capital markets still functioning?

Bloomberg strategist Michael Gambale

US high-grade bond syndicate desks “will look to next week for some stability in the financial markets. Companies that stood down on expected deals will likely look again over the next few days

On IMF urging Asia to be mindful of spillover risks from tightening

Deputy Managing Director Kenji Okamura, International Monetary Fund

There is a risk that drifting inflation expectations could require an even more forceful tightening”

On Goldman Raising China Property HY Default Forecast to 31.6%

China’s high-yield property default rate may reach 31.6% this year, with the worsening stress in the market pointing to rising cases of default, updating their previous forecast of 19%

Top Gainers & Losers – 23-May-22*

Other Stories

Wells Fargo Advisors fined $7mn by U.S. SEC for anti-money laundering lapses, article with gallery

Go back to Latest bond Market News

Related Posts:-jpg.jpeg)