This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

UOL, ABC Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 24, 2021

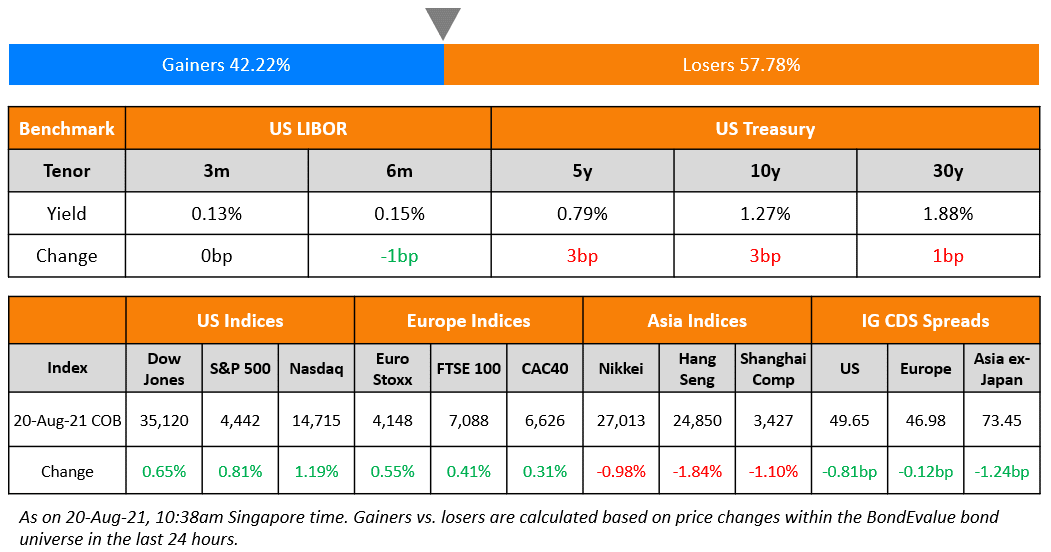

US markets extended Friday’s gains to an all time high coming off a losing week – S&P and Nasdaq gained 0.9% and 1.6%. Energy, up 3.8% led the gains and was followed by Consumer Discretionary and IT up 1.4% and 1.3% respectively. Utilities, down 1.3% dragged the markets lower. Mirroring the US, European bourses also inched up – the CAC was up 0.9% while FTSE and DAX were up 0.3% each. UAE’s ADX gained 0.1% while Saudi’s TASI lost 0.1%. Brazil’s Bovespa reversed its gains to end 0.5% lower. Asian markets took cues from the US and European markets and opened in the green – HSI and Nikkei were up more than 1% while Singapore’s STI and Shanghai are up 0.3% and 0.6%. US 10Y Treasury yields were flat at 1.26%. US IG tightened by 1.1bp while the HY CDS spreads tightened 7.6bp. EU Main and Crossover CDS spreads tightened 1bp and 4.3bp respectively. Asia ex-Japan CDS spreads were 0.3bp tighter.

US manufacturing PMI for August came in at 61.2 vs. expectations of 62.5 and vs. 63.4 in the previous month. The Markit composite came in at 55.4, 2.9 points lower than expectations and 4.5 points lower MoM. Eurozone Markit composite PMI posted 59.5 vs. expectations of 59.7 and lower than last month’s 62.8. German Composite PMI posted 60.6 vs. forecast of 62.2 and slightly lower than last month’s 62.4. The same metric for UK came in at 55.3 vs. last month’s 59.2. Singapore’s CPI for August was 2.5% inline with the expectations and higher by 0.1% MoM.

Navigating The Bond Markets by Leveraging the BEV App | Aug 25

New to the BondEvalue App? We will be conducting a complimentary session on Navigating The Bond Markets by Leveraging the BEV App on August 25, 2021. This session is aimed at helping bond investors in tracking their investments using the BondEvalue App. Click on the banner below to register.

New Bond Issues

- UOL Group markets S$ 7yr IPG 2.5% area

- ABC International Holdings $ 3/5Y @ T+115/135bp area

.png)

AIMS APAC REIT raised S$250mn via a perpNC5 at a yield of 5.375%, 12.5bp inside the initial guidance of 5.5% area. The bonds are unrated and received orders over S$450mn, 1.8x issue size. Proceeds will be used for general corporate needs, including working capital, capital expenditure and investments, as well as for full or partial debt refinancing. The bond will be issued by HSBC Institutional Trust Services Singapore in its capacity as the REIT’s trustee and will be drawn from a S$750m ($551.4mn) multi-currency debt issuance programme. The coupon is deferrable and non-cumulative. If not called, the coupon will reset at the end of year five and every five years thereafter to the prevailing Singapore dollar SORA OIS plus the initial credit spread. Private banks will receive a 25-cent concession. The new bonds are priced 63.5bp wider to its existing 5.65% SGD perps that are callable in August 2025 that are currently yielding 4.74%.As per IFR, this is one of the highest coupons paid on SGD perps issued this year, matching Olam’s 5.375% perpNC5.5 issued in January and behind ESR Cayman’s $200mn 5.65% perpNC5 issued in February.New Bonds Pipeline

- SGX hires for $ 5yr Reg S bond

- CMB Luxembourg branch hires for $ 2yr SOFR sustainability bonds & 5yr green bonds

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

- Occidental Petroleum Corp. Upgraded To ‘BB’ On Lower Leverage And Commitment To Further Debt Reduction; Outlook Stable

- Western Midstream Operating L.P. Upgraded To ‘BB+’ From ‘BB’ On Upgrade Of Occidental Petroleum Corp., Outlook Stable

- Core & Main L.P. Rating Raised To ‘B+’ On Completed IPO And Debt Repayment; Outlook Stable; Term Loan Rated ‘B+’

- Moody’s upgrades Vedanta’s senior unsecured notes to B3 from Caa1, and affirms B2 corporate family rating; outlook stable

- U.K.-Based William Hill Ltd. Downgraded To ‘B’ On Takeover By Caesars Entertainment; Outlook Stable

- Moody’s downgrades China South City’s CFR to B3, revises outlook to negative

- Moody’s downgrades Huarong AMC to Baa2; ratings remain on review for downgrade

- Moody’s affirms Emirates NBD’s long-term deposit ratings, changes outlook to stable

- Fitch Revises China Huarong’s Rating Watch to Positive, From Watch Negative

- Sally Beauty Holdings Inc. Outlook Revised To Positive On Potential Debt Reduction And Improved Operating Prospects

- Forum Energy Technologies Inc. Outlook Revised To Stable From Negative; Ratings Affirmed

- BHP Group ‘A’ Rating Placed On CreditWatch Negative On Announced Agreement To Pursue Petroleum Merger With Woodside

- Fitch Affirms CK Infrastructure at ‘A-‘; Raises Standalone Credit Profile to ‘a-‘

- Moody’s assigns Baa3 rating to EnBW AG hybrid notes; stable outlook

Term of the Day:

Special Drawing Rights (SDR)

Special Drawing Rights (SDR) issued by the IMF to its member countries’ central banks are a reserve asset that can be exchanged for hard currencies with another central bank. The value of an SDR is set daily based on a basket of five major international currencies: the USD (42%), the EUR (31%), the CNY (11%), the JPY (8%) and the GBP (8%). An allocation of SDRs requires approval by IMF members holding 85% of the total votes and US is the biggest holding 16.5% of the votes.

$650bn of SDR came into effect on Monday, which is the largest allocation of SDR in history.

Talking Heads

“But today we have come to a very critical level,” Wijewardene said. “With IMF or without IMF we cannot continue with this loose monetary policy anymore and we cannot maintain this low interest rate regime anymore.” “As a result the central bank has done what it should do in a situation like this. It has reversed its policy stance.” “Instead of claiming that it is going by this alternative policy, it is now going by its normal monetary policy where it has increased the policy interest rate and increase the statutory reserve ratio.” “This is actually the beginning of a long journey in order to maintain the macro-economy in Sri Lanka.” “Without going to the IMF there is no other solution.” MMT advocates claim “the printing of money has no relation to inflation or exchange rate depreciation,” Wijewardene explained. “And based on that the central bank had been printing new money on a massive scale and had been permitting commercial banks to lend to the government huge amounts of money.” he said.

“We’re not expecting a big policy reveal at this meeting.” “I don’t think Powell wants to front run the [September policy] meeting, given the myriad of voices that are out there. I don’t think this is the time when Powell really wants to make a splash.”

“[PUFG] has sped through a restructuring, underscoring the Chinese government’s desire for efficient, market-based default resolutions . . . the deal’s speediness and the high recovery rate will increase market acceptance of court-led workouts.”

“The liquidity risk in investment grade debt is high, especially for older bonds.” “Trading has more recently focused on more liquid issues, and the share of trading in previous bond issues remains below 2019 levels.”

Complying “will make your work and your potential liability much larger,” Flensborg said. “They need to provide some kind of carrot to go the extra distance.” “If you don’t deliver, what’s going to happen?” “If you have to be 100% aligned to be an EU green bond, it will reduce the universe quite a bit,” Flensborg said. “You need to show alignment in the portfolio and you need to be 100% aligned in the bond, and that 100% alignment is a risk factor because that is pretty tough.”

“The strategic objective of the programme is to unlock the value of investments in brownfield public sector assets by tapping institutional and long-term patient capital which can thereafter be leveraged for further public investments.”

Top Gainers & Losers – 24-Aug-21*

.png)

Go back to Latest bond Market News

Related Posts: