This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 24, 2022

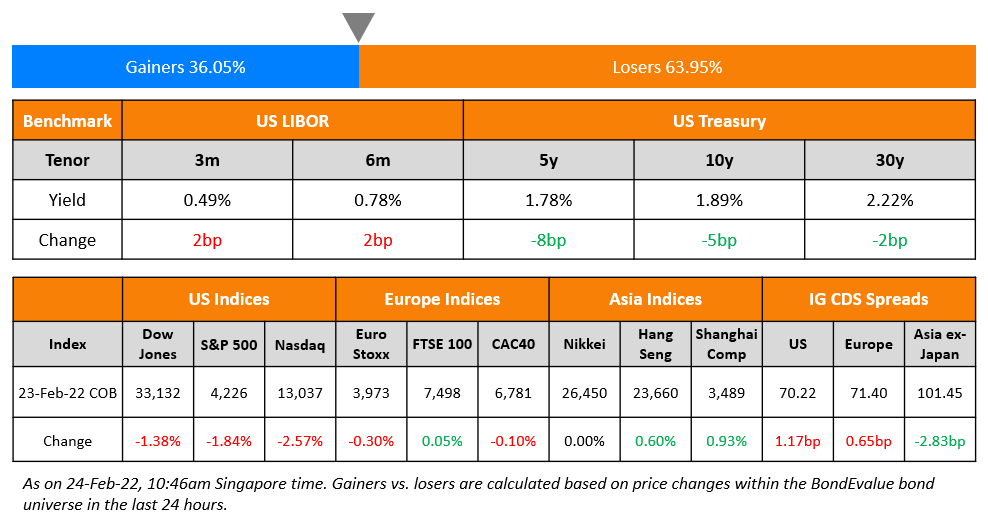

US equity markets dropped again on Wednesday with the S&P and Nasdaq down 1.8% and 2.6% with sectoral losses led by Consumer Discretionary and IT down over 2.5-3.5%. The US 10Y Treasury yields are down 10bp this morning to 1.89% on the back of Russia’s “military operation” in Ukraine (scroll below for details) this morning. European markets were relatively steady yesterday – DAX was down 0.4%, CAC was down 0.1% and FTSE was up 0.1%. Brazil’s Bovespa closed 0.8% lower. In the Middle East, UAE’s ADX was flat and Saudi TASI was down 0.3%. Asian markets have dropped sharply – Shanghai, HSI, STI and Nikkei are down 0.9%, 2.8% 2.7% and 2.3% respectively. US IG CDS spreads widened 1.2bp and HY spreads were 5.7bp wider. EU Main CDS spreads were 0.7bp tighter and Crossover CDS spreads were 1.6bp wider. Asia ex-Japan CDS spreads were 2.8bp tighter.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

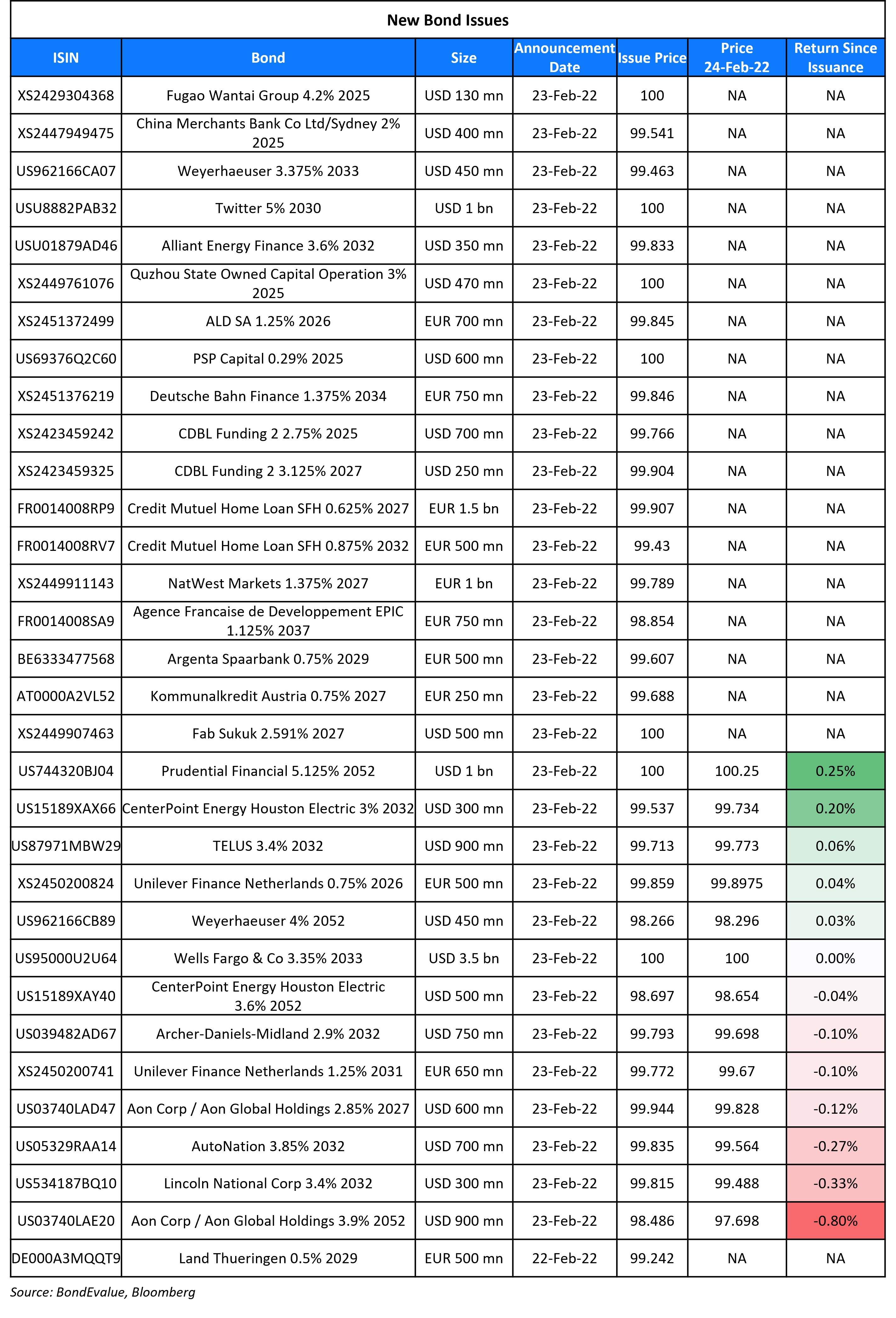

New Bond Issues

- Huatai Securities $ 3/5Y at T+120/140bp area

- Lishui Economic and Technological Development Zone $ 3Y at 2.8% area

- CNGR Advanced Material $ 5Y credit-enhanced green at 4.55% final

Prudential Financial raised $1bn via a 30NC10 bond at a yield of 5.125%, 25bp inside initial guidance of 5.375% area. The bonds are rated Baa1/BBB+. The coupons are fixed until March 1, 2032 and if not redeemed, would reset then and every 5Y thereafter at the 5Y CMT rate plus a spread of 316.2bp. The bonds have an optional redemption in four cases: (i) at par during the three-month period prior to the call date and every interest reset date thereafter; (ii) in whole, not in part within 90 days after the occurrence of a tax event or a regulatory capital event at par; (iii) in whole, not in part within 90 days after the occurrence of a rating agency event at 102% of par; (iv) make-whole call prior to December 1, 2031.

First Abu Dhabi Bank raised $500mn via a 5Y sukuk at a yield of 1.891%, 15bp inside initial guidance of T+85bp area. The bonds are rated Aa3/AA- (Moody’s/Fitch). FAB Sukuk is the issuer and First Abu Dhabi Bank is the obligor.

CDB Leasing raised $950mn via a two-trancher. It raised $700mn via a 3Y green bond at a yield of 2.832%, 35bp inside initial guidance of T+140bp area. It also raised $250mn via a 5Y bond at a yield of 3.146%, 35bp inside initial guidance of T+160bp area. The bonds were rated A2/A+ (Moody’s/Fitch), and received orders over $2.5bn, 2.6x issue size. The bonds are issued by CDBL Funding 2 and guaranteed by CDB Leasing (International) Co. China Development Bank Financial Leasing, which will provide a keepwell and asset purchase deed. Proceeds will be used for working capital and general corporate purposes.

Twitter raised $1bn via an 8Y will-not-grow (WNG) bond at a yield of 5%, inside initial guidance of 4.875/5% area. The bonds are rated Ba2/BB+. Proceeds will be used for general corporate purposes including capex, investments, repayment of debt, repurchases of common stock, working capital and potential acquisitions and strategic transactions.

CMB Sydney raised $400mn via a 3Y green bond at a yield of 1.779%, 42bp inside initial guidance of T+80bp area. The bonds were rated A3, and received orders over $1.25bn, x issue size. Proceeds will be used to finance and/or refinance green projects with a renewable energy theme.

Quzhou State-owned Capital Operation raised $470mn via a 3Y sustainable bond at a yield of 3%, 35bp inside initial guidance of 3.35% area. The bonds are rated BBB-. The issuer is the largest state-owned infrastructure construction and state-owned assets operation vehicle in Quzhou city. Proceeds will be used for financing and/or refinancing new or existing eligible projects.

Huai’an Investment Holdings Group raised $300mn via a 3Y sustainable bond at a yield of 3.3%, 40bp inside initial guidance of 3.7% area. The bonds are unrated. Proceeds will be used for offshore debt repayment. The issuer is the core infrastructure construction and investment entity in Huai’an, wholly owned by the Huai’an SASAC.

Fugao Wantai Group raised $130mn via a 3Y bond at a yield of 4.2%, 30bp inside initial guidance of 4.5% area. The bonds are unrated. Proceeds will be used for construction projects and to replenish working capital. The Chinese company operates in urban construction and real estate, among other businesses.

New Bonds Pipeline

- Hubei United Development Investment Group hires for $ green bond

- Yunnan Provincial Investment Holdings hires for $ bond

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Fitch Upgrades China Huarong to ‘BBB+’; Off RWP; Outlook Stable

- Moody’s upgrades Macy’s CFR to Ba1

- E-House Downgraded To ‘CCC’ On Heightened Repayment Pressure Amid Depleting Liquidity; Outlook Negative

- Moody’s downgrades Shimao to Caa1; outlook negative

- Moody’s downgrades Jingrui’s ratings to Caa2/Caa3; outlook remains negative

Term of the Day

Asset Backed Securities (ABS)

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Russia’s Dollar Bonds Can’t Escape Blow of EU, U.S. Sanctions

Nick Eisinger, co-head of emerging-markets active fixed income at Vanguard Asset Management

“The big one that has so far not happened would be to ban trading or holding or both of legacy bonds. We are underweight Russia in the funds in any case. We reduced before this got really bad”.

Guido Chamorro, co-head of EM hard-currency debt at Pictet Asset Management

While the sanctions mean Russia will be unable to borrow abroad for a while, the country is well positioned to get by without foreign funding. If “there is no more escalation, then we might not see much additional selling as prices have already adjusted. But if there is additional escalation that results in additional stronger sanctions, then all bets are off”.

Cathy Hepworth, head of emerging markets debt at PGIM Fixed Income

“It makes it much harder for Russia to issue external debt, but they really don’t need it”

On Ex-PBOC Advisers Say China Has Room to Cut Rates as Fed Tightens

Huang Yiping, a former member of the PBOC’s monetary policy

The central bank’s easing window could be “much longer than three to six months”

Yu Yongding, former PBOC’s monetary policy committee

I don’t think there’s a window for China’s monetary policy,” said Yu. “China can set the monetary policy and the pace of it entirely on its own.”

Bloomberg Economics’s Chang Shu and David Qu

“Over the this cycle, we project the PBOC to cut rates by 30 basis points and the RRR by 200 bps in total… That leaves another 20 bps of cuts in the one-year MLF rate and 100 bps of reductions in the RRR to go, probably spread out in the second and third quarter”.

On Junk-Bond Market Reawakens After Nearly Two-Week Deal Drought

Winifred Cisar, global head of strategy at CreditSights

“We’ve already hit the all-time low point in yields in both investment grade and high yield. We don’t think the move in yields has become a threat to either investment grade or high yield quite yet. Companies can still borrow at very low levels.”

On ESG-Debt Accounting Concerns Voiced by Watchdog Urging Rapid Fix

European Securities and Markets Authority

The development has the potential to “negatively affect the decision-making of financial market participants and thus the efficient functioning of capital markets”

International Accounting Standards Board

The board says that review includes a closer look at “market changes since the accounting standard was issued” back in 2018….and how responsive the accounting standard has been to those market changes… In that context, many stakeholders have provided information about the development of loans with interest rates that vary depending on whether the borrower meets pre-determined ESG targets.”

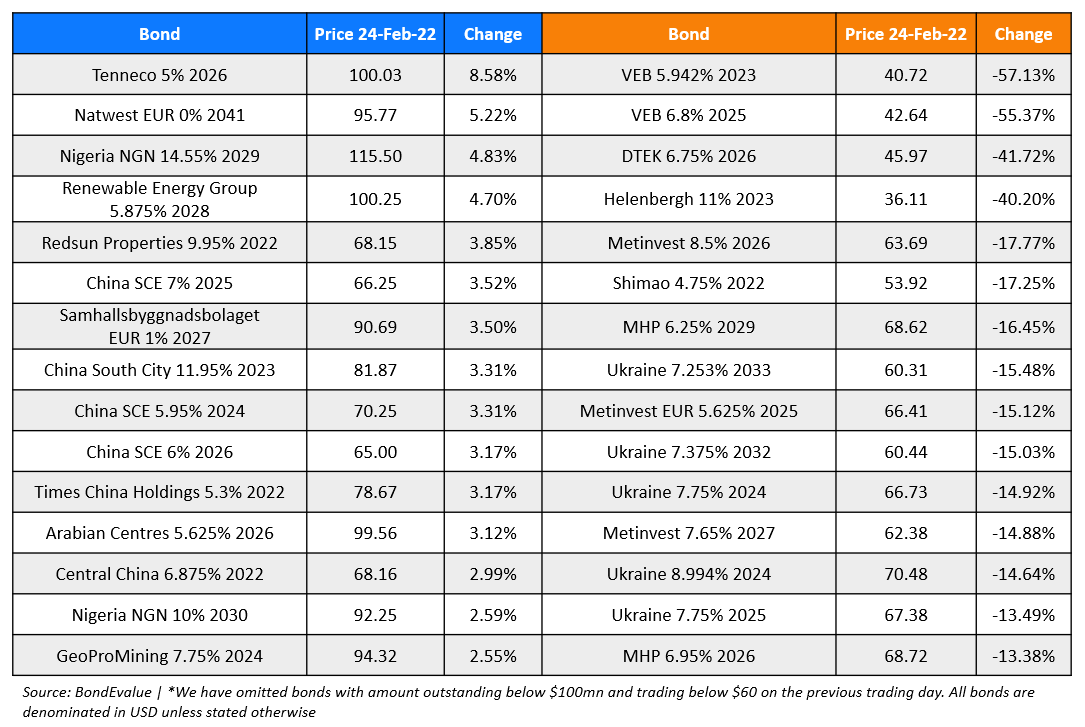

Top Gainers & Losers – 24-Feb-22*

Go back to Latest bond Market News

Related Posts: