This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 29, 2022

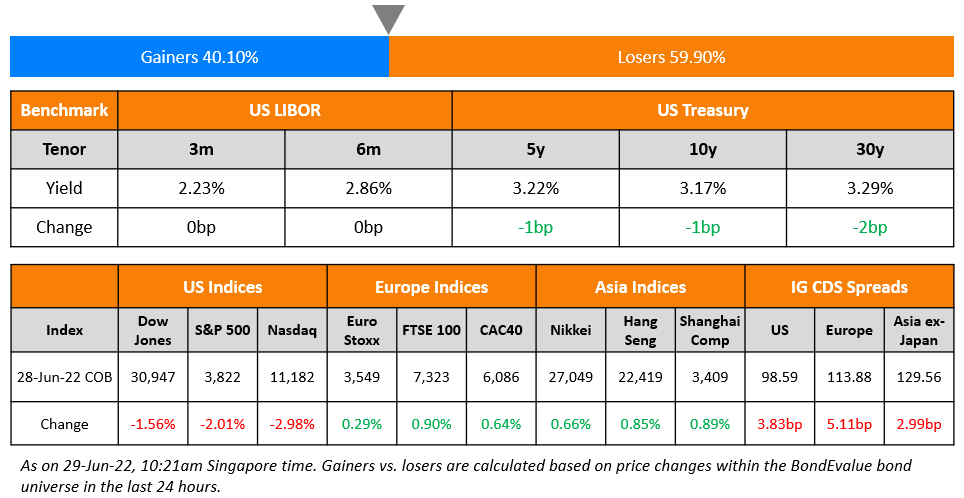

US equity markets ended sharply lower on Tuesday with the S&P and Nasdaq down 2% and 3% respectively. Sectoral losses were led by Consumer Discretionary down 4% followed by IT which fell 3%, while Energy was up 2.7%. US 10Y Treasury yields were 1bp lower at 3.17%. European markets were up with the DAX, CAC and FTSE were higher 0.4%, 0.6% and 0.9% respectively. Brazil’s Bovespa was down 0.2%. In the Middle East, UAE’s ADX and Saudi TASI gained 1.9% and 2.1%. Asian markets have opened broadly lower – STI was up 0.4%, while Shanghai, HSI and Nikkei were down 0.6%, 1.6% and 1% respectively. US IG CDS spreads widened 3.8bp and US HY spreads were wider by 31.2bp. EU Main CDS spreads were 5.1bp wider and Crossover spreads were wider by 23.9bp. Asia ex-Japan IG CDS spreads widened 3bp.

Learn About Sovereign Debt Restructuring | One Day to Go – Thursday, 30 June

Just one more day to go for the upcoming live masterclass on sovereign debt restructuring! The 90-minute session, to be conducted live via Zoom tomorrow, Thursday, 30 June, will be conducted by Asian high yield and liability management expert Florian Schmidt.

The session will be particularly insightful for bond investors who own EM sovereign debt as well as advisors whose clients hold these bonds. In particular, this Thursday’s session will offer guidance on what to expect if you own dollar bonds of Sri Lanka (already defaulted) and/or other sovereigns such as Pakistan (distressed). Click on the banner below to sign up.

New Bond Issues

- Qingdao City Construction Investment $ 3Y at 5.2% area

Nomura raised $1.9bn via a three-tranche deal. It raised

Nomura raised $1.9bn via a three-tranche deal. It raised

- $800mn via a 3Y bond at a yield of 5.099%, 15bp inside initial guidance of T+205bp area.

- $500mn via a 5Y bond at a yield of 5.386%, 15bp inside initial guidance of T+230bp area.

- $600mn via a 7Y bond at a yield of 5.605%, 15bp inside initial guidance of T+250bp area.

The bonds have expected ratings of Baa1 (Moody’s)/ BBB+ (S&P). Proceeds will be used for general corporate purposes.

Bank of East Asia (BEA) raised $250mn via an inaugural 6NC5 LAC bond (Term of the Day, explained below) at a yield of 5.179%, 20bp inside initial guidance of T+210bp area. The bonds have expected ratings of Baa2/BBB (Moody’s/S&P), and received orders over $1bn, 4x issue size. The bonds are callable on May 31, 2027 and if not called, the coupon will reset to the prevailing 1Y US Treasury yield plus the initial spread of 190bp. The loss absorption capacity will be recognized until year 5. There is no interest deferral and no non-viability principal loss absorption. The bonds are subordinated to all unsubordinated creditors but senior to Tier 2 and Tier 1 capital instruments and share capital. Proceeds will be used for general corporate purposes.

ABN AMRO Bank raised S$750mn via a 10.25NC5.25 bond at a yield of 5.502%, 24.8bp inside initial guidance of 5.75% area. The subordinated bonds have expected ratings of Baa2/BBB-/BBB+. The bonds are callable on July 5, 2027 with a reset date of October 5, 2027. If the bonds are not called by the reset date, the coupon will be reset to the prevailing 5Y SORA-OIS benchmark rate plus the reset spread of 270.6bp. The bonds have a special event redemption upon occurrence of certain tax events, capital event or MREL disqualification event, subject to regulatory approval. Statutory loss absorption is also applicable for the bond.

China Railway Group raised $500mn via a 5Y bond at a yield of 4.099%, 42bp inside initial guidance of T+125bp area. The bonds have expected ratings of A- (Fitch), and received orders over $4.3bn, 8.6x issue size. There is a change of control put at 101 and proceeds will be used for debt refinancing, including $500mn of bonds maturing in July, and for general corporate purposes. The new bonds offer a yield pick-up of 5.9bp over its existing 3.25% 2026s that yield 4.04%.

New Bonds Pipeline

- Dar Al-Arkan hires for $ 3Y Sukuk

- Korea Gas hires for $ 5Y/10Y bond

- Bank of East Asia hires for $ 6NC5 bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Moody’s places Sino-Ocean’s Baa3 ratings on review for downgrade

- Fitch Affirms AerCap Holdings N.V. at ‘BBB-‘; Outlook Revised to Positive

- Alfa S.A.B. de C.V. Outlook Revised To Positive From Stable On Improving Credit Metrics; ‘BBB-‘ Rating Affirmed

Term of the Day

LAC Bond

Loss Absorption Capacity (LAC) bond is a type of debt issued by a bank to be able to absorb losses during a crisis. While they are similar to AT1/CoCo Bonds in that, both of them are loss absorbing instruments, LAC bonds can be senior to Tier 2 and Tier 1 capital instruments and share capital. These bonds try to ensure that the bank has have sufficient bail-in debt to pass losses to investors and minimize the risk of a government bailout.

Bank of East Asia raised $250mn from an inaugural non-preferred LAC bond at a yield of 5.179%.

Talking Heads

On Seeing 50 or 75 Basis-Point Rate Hike Debated in July – Fed’s Williams

“I see us tapping on the brakes to slow to a more sustainable pace, rather than slamming on the brakes, going over the handlebars and having the proverbial recession. I wouldn’t be surprised, and it’s actually in my forecast, that growth will slip below 2%, but it won’t actually pivot down into negative territory for a long period of time… in terms of our next meeting, I think 50 to 75 is clearly going to be the debate.”

On Junk Bond Investors Stung by China Look to India, Southeast Asia

Dhiraj Bajaj, head of Asia fixed income at Lombard Odier in Singapore

“We believe that the shape of the Asia high-yield market will permanently change to be one with a lot less China… The implications of the systemic default wave out of China property are grave”

Amy Kam, a senior portfolio manager at Aviva Investors Global Services

“I expect growth from the Indian and Indonesian high-yield markets, notably Indian renewables, given the country’s ambition to triple capacity by 2030”

On ECB keeping countries on straight and narrow even if it buys their debt – Lagarde

“The new instrument will have to be effective, while being proportionate and containing sufficient safeguards to preserve the impetus of member states towards a sound fiscal policy… This means moving gradually if there is uncertainty about the outlook, but with the option to act decisively on any deterioration in medium-term inflation, especially if there are signs of a de-anchoring of inflation expectations”

On Wall Street’s Great Inflation Trade Peaking Across Assets

Seema Shah, chief global strategist at Principal Global Investors

US inflation is likely close to peaking… Consumers are shifting from goods to services, while overall demand is also slowing, so core goods price pressures are becoming more deflationary.”

Emmanuel Cau, head of European equity strategy at Barclays Plc

“After continually surprising to the upside over the last 12 months, and at least one previous ‘peak inflation’ event earlier in the year, could this one prove more realistic and durable?”

Top Gainers & Losers – 29-June-22*

Go back to Latest bond Market News

Related Posts: