This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 2, 2022

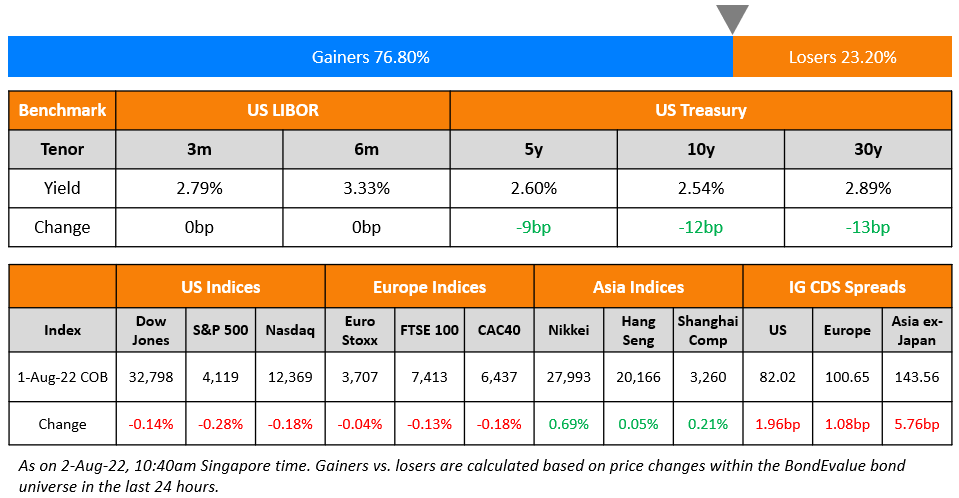

US equity markets snapped its upward trend, starting the week lower on Monday with the S&P and Nasdaq down 0.3% and 0.2% respectively. Sectoral losses were led by Energy, down 2.2% and Financials down 0.9%. US 10Y Treasury yields eased a further 12bp to 2.54%, taking the 2s10s spread to negative 31bp. European markets ended mixed – DAX was flat, while CAC and FTSE were down 0.2% and 0.1% respectively. Brazil’s Bovespa was down by 0.9%. In the Middle East, UAE’s ADX and Saudi TASI rose 1.2% each. Taking cue from the US, Asian markets have opened lower – STI, Shanghai, HSI and Nikkei were down 0.2%, 2.9%, 3% and 1.6% respectively. US IG CDS spreads widened 2bp and US HY spreads were wider by 6.7bp. EU Main CDS spreads were 1.1bp wider and Crossover spreads were widened by 1.3bp. Asia ex-Japan IG CDS spreads widened 5.8bp.

Consumer prices in South Korea rose 6.3% YoY in July in line with estimates; June’s print was 6% in comparison. Transportation costs, food & beverage prices and hotels & restaurants prices rose significantly. This month, Bank of Korea is expected to hike rates by 25bp. Meanwhile, inflation in Pakistan rose to 24.93% in July, its highest in 14 years and over expectations of 23.5%, vs. June’s reading of 21.3%. Food inflation surged to 28.77% and transport prices shot up by 64.7% in July.

IBF-STS Course on Digital Assets | 11 Aug 2022 (In-person in Singapore) | 70/90% Funding

New Bond Issues

- Suzhou City Construction $ 3Y at 6.2% area

Barclays raised $2bn via a PerpNC7 AT1 bond at a yield of 8%, 37.5bp inside the initial guidance of 8.375% area. The bonds have expected ratings of Ba2/B+/BBB-. Proceeds will be used for general corporate purposes and to strengthen further the capital base of the issuer,its subsidiaries and/or the group. The bonds will be callable at par from March 15, 2029 until Sept 15, 2029. Thereafter, if the bonds are not called back, it will reset on Sept 15 2029 at the 5Y UST plus the reset margin of 543.1bp. Additionally, the AT1 has a mechanical trigger which activates if the CET1 ratio is less than 7%. The new bonds are priced 31bp wider to its existing 8.875% perps callable in 2027 that yield 7.69%.

KT Corp raised $500mn via a 3Y bond at a yield of 4.059%, 30bp inside the initial guidance of T+155bp area. The bonds have expected ratings of A–/A (S&P, Fitch), and received orders over $2.6bn, 5.2x issue size. Proceeds will be used for general corporate purposes, including to repay debt. The new bonds are priced 23.9bp wider to its existing 1% 2025s that yield 3.82%.

Mianyang Investment raised $300mn via a 3Y bond at a yield of 6.7%, unchanged from the initial guidance. The bonds have expected ratings of BB (Fitch). Proceeds will be used to repay offshore debt.

UBS raised $5bn via a three-tranche deal. It raised:

- $1.75bn via a 3NC2 bond at a yield of 4.49%, 25bp inside the initial guidance of T+185bp area. The new bonds are priced 17bp wider to its existing 4.488% 2026s that currently yield 4.32%

- $1.75bn via a 5NC4 bond at a yield of 4.703%, 25bp inside the initial guidance of T+230bp area. The new bonds are priced 23.3bp wider to its existing 1.364% 2027s that currently yield 4.47%

- $1.5bn via a 11NC10 bond at a yield of 4.988%, 30bp inside the initial guidance of T+270bp area.

The senior unsecured bonds have expected ratings of A-/A+ (S&P/Fitch).

Apple raised $5.5bn via a four-tranche deal as seen in the table below:

- The new 7Y bonds are priced at a new issue premium of 11bp vs. its existing 2.2% 2029s that yield 3.16%

- The new 10Y bonds are priced at a new issue premium of 13.4bp vs. its existing 1.65% 2031s that yield 3.23%

- The new 30Y bonds are priced at a new issue premium of 15.8bp vs. its existing 2.65% 2051s that yield 3.83%

- The new 40Y bonds are priced at a new issue premium of 18.8bp vs. its existing 2.85% 2061s that yield 3.93%.

The senior unsecured bonds have expected ratings of Aaa/AA+. Proceeds will be used for general corporate purposes, including repurchases of common stock and payment of dividends.

New Bonds Pipeline

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- Johnson Electric hires for $ Senior bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

- Busan Bank hires for $ Social bond

Rating Changes

- Moody’s downgrades Sino Ocean’s senior unsecured rating to Ba1, assigns Ba1 CFR and withdraws Baa3 issuer rating; outlook negative

- Moody’s downgrades Credit Suisse Group AG’s senior unsecured debt ratings to Baa2; outlook negative

- S&P: Credit Suisse Outlook Revised To Negative On Leadership Changes, Strategic Review, Market Headwinds; Ratings Affirmed

- Fitch Revises Arabian Centre Company’s Outlook to Stable; Affirms IDRs

Term of the Day

Neutral Rate of Interest

The neutral rate aka natural rate is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Last Wednesday, Fed Chair Jerome Powell had suggested that with the latest interest rate hike, the Fed Funds Rate which is currently at 2.25-2.50%, was at a neutral level “where it’s neither stoking nor restraining consumer prices.” Ex-Treasury Secretary Lawrence Summers begged to differ and claimed that Powell’s assessment was indefensible in a high inflation economy like this.

Talking Heads

On the Dangers of Inflation in Bond Market

Rob Nicholl, head of the Australian Office of Financial Management

“The size of the market has grown quite substantially…Without market-making capacity keeping up, when you get periods of volatility, you are almost mathematically going to get periods where liquidity disappears more quickly.”

James Wilson, a senior portfolio manager in Melbourne at Jamieson Coote Bonds

“While sovereign bond markets are still functioning very well, price makers’ appetite to hold any risk positions is much lower than normal…That’s been the case especially for spread products — leaving markets jumpy and prone to the very wide daily ranges we have seen lately.”

On Italian 10-Year Bond Yields Falling Below 3% as Fears Before Election Fade

Antoine Bouvet, senior rates strategist at ING Groep NV

“It reflects hopes that the election campaign and the new government will not challenge Draghi’s fiscal and reform record, it is of course early days and I would personally be cautious before reaching any conclusion on that front.”

On China’s Economy Deteriorating Further in July

Leland Miller, chief executive officer of CBBI

“Beware the July rebound narrative. Markets are convinced that easing lockdowns mean the worst is over, but July data show that firms are still largely refusing to invest, borrow and especially now, hire. This is likely because companies simply do not believe that their Covid Zero nightmare is over.”

On Evergrande Debt Setback Impact on China Developers

Daniel Fan, a Bloomberg Intelligence analyst.

“There are no signs that China will provide stronger policy support in terms of refinancing. The policy of prioritizing home delivery would help market sentiment only if the measures result in a rebound in contracted sales. But at this moment the sales are still choppy.”

Shu Hui Woon, credit analyst at Lucror Analytics.

“Generally, the delay in announcing a detailed plan is disappointing, though unfortunately investors have few options other than to wait. There could be more winding-up petitions if Evergrande drags the process further.”

Top Gainers & Losers – 2-August-22*

Other Stories

Go back to Latest bond Market News

Related Posts:%20no%20logo-1.png)