This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 9, 2022

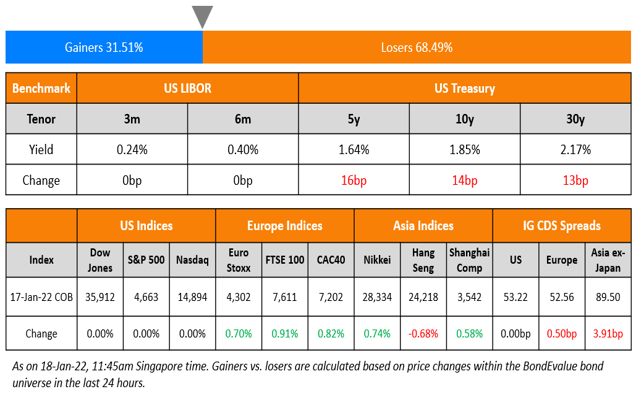

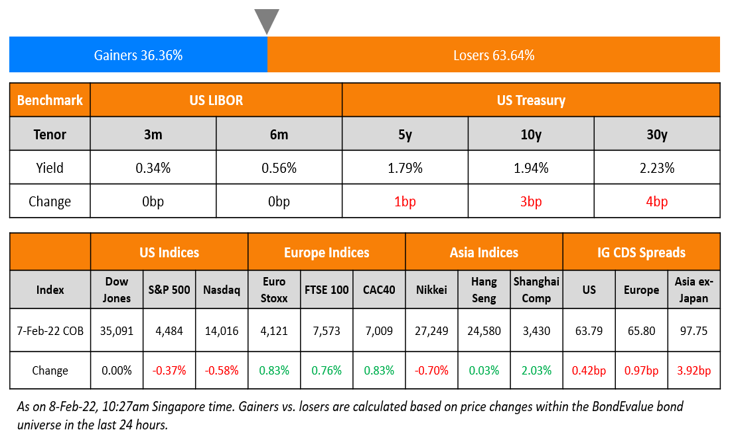

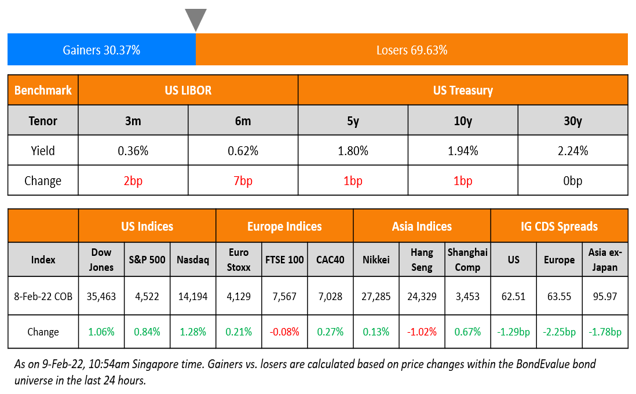

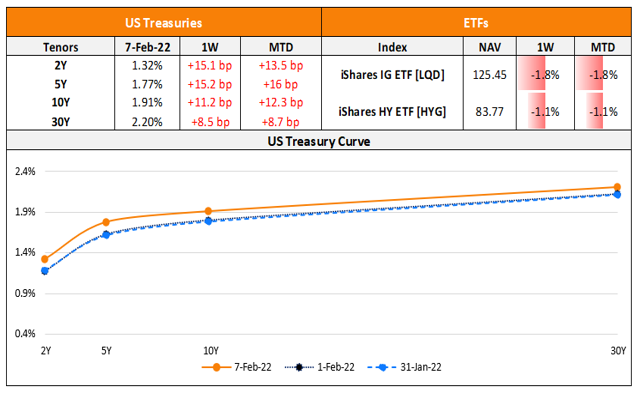

US equity markets rose with the S&P and Nasdaq ending 0.8% and 1.3% higher. Sectoral gains were led by Materials and Consumer Discretionary, up 1.5%. US 10Y Treasury yields rose 1bp to 1.94%. European markets were broadly higher with the DAX and CAC up 0.2-0.3% while FTSE was down 0.1%. Brazil’s Bovespa closed 0.2% lower. In the Middle East, UAE’s ADX was up 0.5% and Saudi TASI closed 0.2% lower. Asian markets have opened in the green led by HSI up 1.97%, Nikkei up 1.15%, Shanghai up 0.4% and STI up 0.14%. US IG CDS spreads were 1.3bp tighter and HY CDS spreads were 1.9bp tighter. EU Main CDS spreads were 2.3bp tighter and Crossover CDS spreads were 11.9bp tighter. Asia ex-Japan CDS spreads were 1.8bp tighter.

New Bond Issues

- ANZ New Zealand $ 3Y/3Y FRN @ T+80bp/SOFR equiv area

.png)

Mexico raised €800mn via a 8Y bond at a yield of 2.491%, 5bp inside the initial guidance of MS+190bp. The bonds have expected ratings of Baa1/BBB/BBB-. Proceeds will be used to redeem Mexico’s outstanding EUR 1.625% 2024 notes in full and for general purposes of the Government of Mexico.

Dubai Islamic Bank raised $750mn via a 5Y sukuk bond at a yield of 2.74%, 25bp inside the initial guidance of T+120bp area. The bonds have expected ratings of A3/ A (Moody’s / Fitch), and received orders over $1.6bn, 2.1x issue size.

Kia Corp raised $700mn via a two-tranche deal. It raised:

- $400mn via a 3Y green bond at a yield of 2.466%, 30bp inside the initial guidance of T+120bp area.

- $300mn via a 5Y green bond at a yield of 2.857%, 25bp inside the initial guidance of T+130bp area. The new bonds offer a new issue premium of 6.7bp over its existing 2.5% 2027s that yield 2.79%.

The bonds have expected ratings of Baa1/BBB+ (Moody’s/S&P). Proceeds will be used to finance or refinance, in whole or in part, new and/or existing eligible green project categories (as further described in Kia’s Green Finance Framework dated March 2021).

Mexican utility Comision Federal de Electricidad (CFE) raised $1.75bn via a two-tranche sustainability issuance. It raised $1.25bn via a long 7Y bond at a yield of 4.688%, 25bp inside initial guidance of T+300bp area. It also raised $500mn via a 30Y bond at a yield of 6.264% or T+400bp, inside guidance of T+ low 400s. The bonds have expected ratings of Baa1/BBB. An amount equal to the net proceeds is expected to finance/refinance in whole or in part new or existing Eligible Green Projects or Eligible Social Projects pursuant to the Sustainable Financing Framework.

The European Union raised €2.2bn via a bond at a yield of 0.31%, 2bp below the initial guidance of MS-21bp. The bonds have expected ratings of Aaa/AA/AAA, and received orders over €19bn, 8.6x issue size. Proceeds will be used for the European Financial Stabilisation Mechanism (EFSM) programme.

New Bonds Pipeline

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Downgrades Logan to ‘BB-‘; Outlook Negative

- Moody’s withdraws DaFa’s ratings due to insufficient information

- Fitch Withdraws Shinsun’s Ratings

Term of the Day:

Cost of Risk

Cost of Risk refers to the losses that arise out of ‘expected losses’ and the ‘cost of losses over and above the average loss’. Expected losses are those that arise on average due to defaults and depend on the credit risk of the borrower. The cost of losses over and above the average loss are measured by either Basel related regulatory capital or risk based capital.

Talking Heads

On Sri Lanka on the brink of sovereign bond default, warn investors

Richard House, head of emerging market debt at Allianz Global Investors

“They are demonstrating an amazing willingness to pay. But why they would want to, I’m a bit flabbergasted. They are bankrupt, pretty much.”

Polina Kurdyavko, head of emerging market debt at BlueBay Asset Management

“At these levels, a restructuring over the next 12 months should be the base-case scenario. I find it difficult to see them muddling through this year.”

On the News Being About the Quiet Selloff in Corporate Credit Now

Ben Emons, global macro strategist with Medley Global Advisors

The stock-market selloff has “spilled over to corporate bonds… It is changing the perception — and narrative — that corporate debt has been ‘stable’ in the wake of volatile equities.”

JPMorgan Chase & Co. analysts led by Alex Roever

“Credit markets are in an especially interesting situation today as valuation has cheapened materially in both spread and yield terms, but the potential for higher yields and more mark-to-market losses remains high”

Peter Tchir, head of macro strategy at Academy Securities

“Even though the loans are secured, you would expect to see more selling pressure, much more in line with high yield. You can see the same thing if you look at CCC credits, which would normally underperform in times of credit stress, but haven’t been doing poorly.”

China’s property developers are seen having a hard time accessing U.S. bond markets

Annalisa Di Chiara, a senior vice president at Moody’s

“We are seeing the trend of China property turmoil continuing to dampen enthusiasm for some high-yield issuance… If we were to carve out the refinancing needs for those issuers that have already defaulted, that probably carves out about $15 billion out of that $35 billion… We need to have some of these companies be able to access the U.S. dollar bond market, restore some of their liquidity and again see some stabilization in that property sector”

Top Gainers & Losers – 09-Feb-22*

Other Stories

Australia’s CBA unveils buyback as profit jumps on lending growth

Go back to Latest bond Market News

Related Posts:

The Week That Was (31 Jan – 6 Feb, 2022)

February 7, 2022

.png)