This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Markets Pricing in 3 More Fed Hikes This Year; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

February 20, 2023

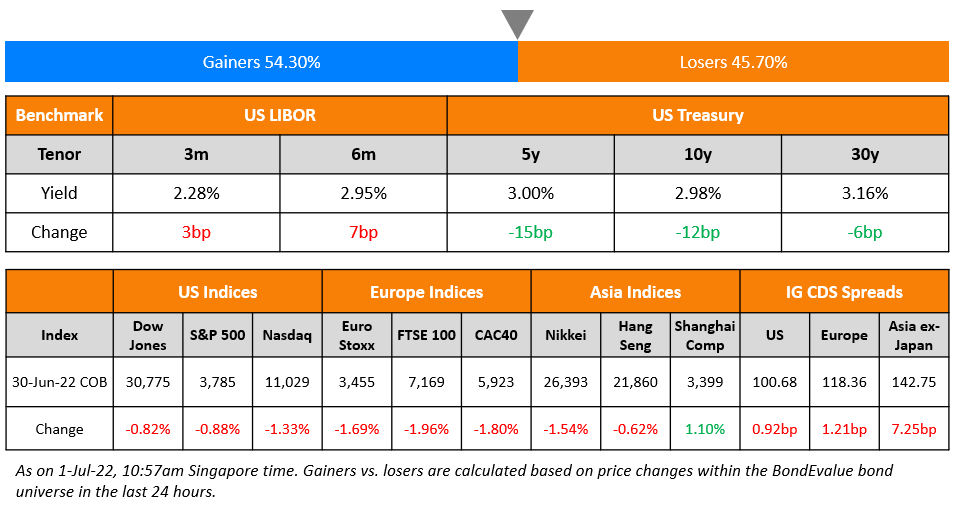

US Treasury yields inched lower by 4-6bp. The US 10Y Treasury yield touched its highest levels of the year at 3.92% early on Friday before retracting lower. The peak Fed funds rate was up 1bp to 5.30% for the July 2023 meeting. With a 25bp hike in March being priced in, markets are now also pricing in a possibility of a 50bp hike next month. CME probabilities show that markets are pricing in a 25bp in March, May and June. This is a change from two 25bp hikes that were priced last week in March and May. Goldman Sachs and BofA have now come out with calls for three more 25bp rate hikes this year (scroll below to the Talking Heads). The chance of a 25bp hike in June has risen to 55% from 38% last week. US IG CDS spreads tightened 0.4bp while HY spreads were 3.7bp tighter. Equity indices fell with the S&P and Nasdaq down by 0.3% and 0.6% respectively.

European equity markets ended lower too. The European main CDS spread widened by 2.2bp while crossover CDS spreads widened 12.6bp. Asian equity markets have opened with a positive bias today. Asia ex-Japan CDS spreads were 4.6bp wider.

New Bond Issues

-

Credit Agricole S$ 10NC5 Tier 2 at 5.2% area

New Bonds Pipeline

-

REC hires for $ Long 5Y Green bond

Rating Changes

- Kraft Heinz Co. Upgraded To ‘BBB’ On Organic Growth; Outlook Stable

- Moody’s downgrades China SCE’s ratings to B3/Caa1; outlook remains negative

Term of the Day

Payment-In-Kind Bonds

Payment-In-Kind or PIK bonds refer to bonds that pay interest in the form of securities (kind) instead of cash. Typically, PIK bonds pay interest in the form of additional issuance of the underlying bond. Thus, the amount outstanding for PIK bonds increases through the lifetime of the bond and are paid out at maturity. This structure allows issuers to preserve cash thereby reducing its financial burden.

Talking Heads

On Goldman, BofA expecting three more U.S. rate hikes this year

Goldman Sachs

“In light of the stronger growth and firmer inflation news, we are adding a 25bp (basis points) rate hike in June to our Fed forecast, for a peak funds rate of 5.25%-5.5%”

BofA

“Resurgent inflation and solid employment gains mean the risks to this (only two interest rate hikes) outlook are too one-sided for our liking”

On T-Bills Offering Stock-Like 5% to Take Fed, Debt-Limit Risk

Ben Emons, Senior PM at NewEdge Wealth

“Cash has become king. At such higher rates these cash-like instruments become a much better risk-management tool in your portfolio than other things. If you put 50% of your portfolio now in bills and the rest in equities then your portfolio is better balanced”

Deborah Cunningham, CIO Liquidity & Senior PM at Federated Hermes

“People are realizing that with what the Fed has said about going higher but staying there for longer is probably going to dictate market returns in 2023”

China’s weaker LGFVs facing default risks as property crisis hurts revenues – analysts

Ben Yau, senior director at China Lianxin Credit Rating

“Individual LGFVs’ credit risks, especially in private equity, non-standard debt instruments, and commercial bills have increased to some extent, enhancing the tailwind risk for [other] LGFVs and regions”

Martin Petch of Moody’s

“An unexpected LGFV bond default as a result of a gap in regional local government (RLGs) support … could lead to contagion in the onshore bond market, with implications for RLGs, financial institutions”

Top Gainers & Losers – 20-February-23*

Go back to Latest bond Market News

Related Posts: