This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

NWD, Huaneng Launch $ Bonds; HKAA’s $1.5bn Perps 10x Covered; CS Upgraded to Baa1; Vedanta’s $ Bonds Inch Up

December 2, 2020

S&P and Nasdaq closed 1.1% and 1.3% higher with DAX and CAC also higher by 0.7% and 1.1%. On the data front, China’s Caixin/Markit Manufacturing PMI surprised at 54.9 from October’s 53.6 while both the US and Germany’s ISM and PMI Manufacturing showed resilience at 57.5 and 57.8 respectively. Eurozone headline and core CPI dipped -0.3% MoM last month. Sentiment was also lifted with the unveiling of a $908bn US bipartisan congressional relief bill to support US small businesses, the unemployed and airlines. The announcement led the US 10Y and 30Y Treasury yields to rise 7bp and 9bp. In the UK, the government said that its telecoms operators will be banned from installing new 5G equipment made by Huawei after September 2021. US IG CDS spreads tightened 0.15bp and HY spreads widened 1.2bp. EU main CDS spreads were 2.6bp tighter while crossover CDS spreads tightened 14bp. Asia ex-Japan CDS spreads were tighter by 1.3bp and Asian equities have opened slightly higher with the Shanghai Composite up 0.2%, KOSPI up 1.4%, IDX up 0.7% while Straits Times and Hang Seng were down 0.5% and 0.3% respectively.

Bond Traders’ Masterclass – Three Hours to Go

Sign up for the upcoming sessions on Understanding New Bond Issues & Credit Rating at 4PM Singapore/HK time today and Using Excel to Understand Bonds tomorrow, December 3. These are more advanced sessions focused on the primary markets, credit ratings and using Excel for bond calculations. These modules are specially curated for private bond investors and wealth managers. Thursday’s session has limited seats as it is a hands-on interactive session conducted by ex-Credit Suisse trader George Thomas so do sign up before seats sell out. Click on the image below to register.

Register today to avail a 12.5% discount on the Masterclass package

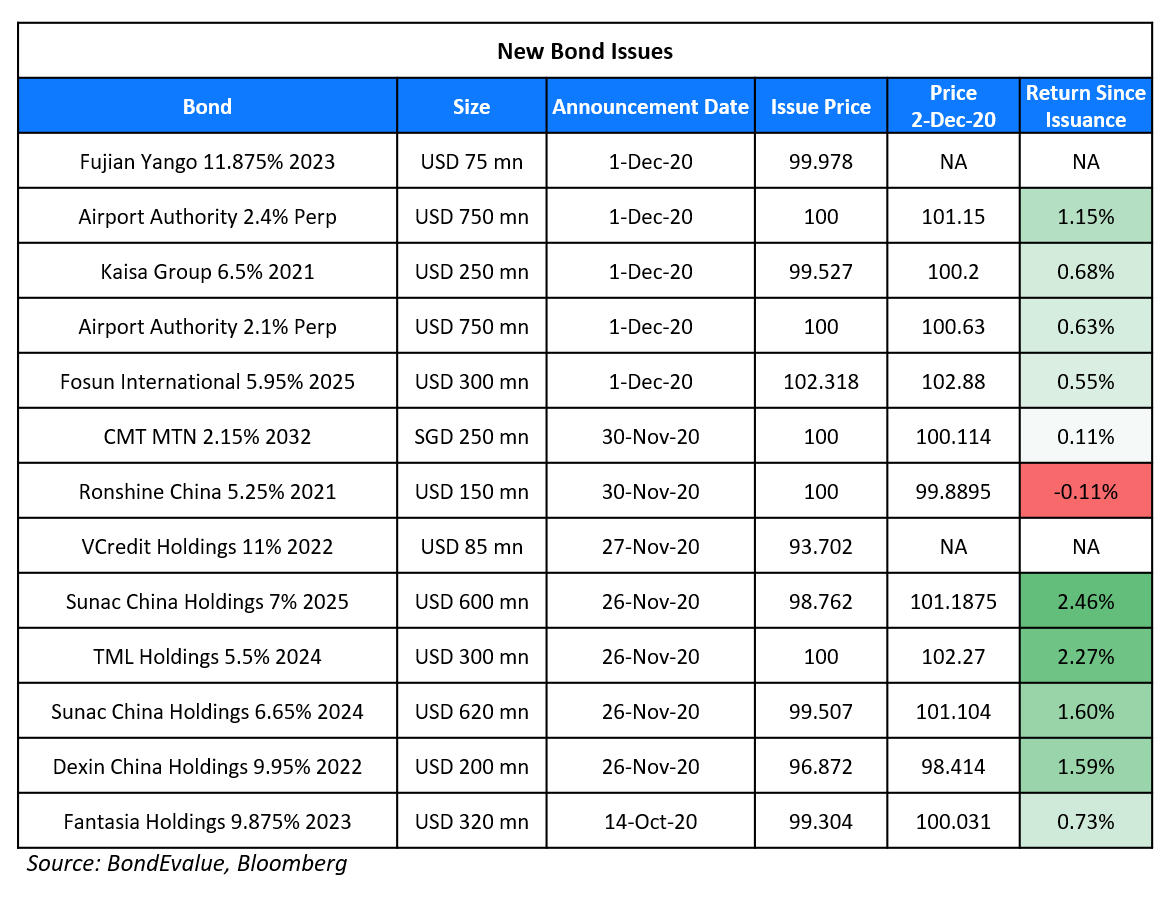

New Bond Issues

- Philippines $ 10.5Y/25Y at T+100bp/3% area

- New World Development $ PerpNC3 at 5.25% area

- China Huaneng $ PerpNC3/PerpNC5 at 3.3%/3.55% area

- Sichuan Languang Development $ 2.25Y at 10.875% area

Fosun International raised $300mn via a tap of their 5.95% 2025s at a yield of 5.4%, 50bp inside initial guidance of 5.9% area. The bonds have a BB rating and received orders of over $2.2bn, ~7.3x issue size. Fund managers and asset managers bought 87%, banks 10% and private banks 3%. Asia took 76% and the rest went to EMEA. Proceeds will be used to refinance some of the Chinese conglomerate’s existing offshore debt, including funding a concurrent cash tender offer for its $254mn 6.875% bonds due 2021 and its $1.297bn 5.25% bonds due 2022. The company is offering $1,008.75 and $1,014.25 plus accrued and unpaid interest for each US$1,000 in principal amount for the 2021s and the 2022s.

Kaisa Group raised $250mn via a 364-day sustainable bond at a yield of 7%, 50bp inside initial guidance of 7.5% area. The bonds have an expected B+ rating by Fitch and received orders over $2.65bn, 10.6x issue size. Proceeds will be used for debt refinancing. The issue comes alongside a concurrent tender offer for two of its outstanding bonds. They have launched a tender offer for $224.613mn of their 6.75% 2021s and $379mn 11.75% 2021s. The purchase prices are $1,006 and $1,018 respectively plus accrued and unpaid interest, for each $1,000 in principal.

Commonwealth Bank of Australia too has launched tender offers on seven of its dollar/euro bonds on Tuesday. For details of the tender offer, click here

Fantasia Holdings raised $120mn via a tap of their 9.875% 2023s at a yield of 9.95%, 50bp inside initial guidance of 10.45% area. The bonds have an expected B+ rating by Fitch and received orders of over $1.25bn, 10.42x issue size. The issuer is rated B2/B/B+ and proceeds will be used for offshore debt refinancing.

Rating Changes

- Moody’s upgrades Credit Suisse’s ratings with a stable outlook, affirms UBS

- Fitch Downgrades SriLankan Airlines’ Government-Guaranteed Bonds to ‘CCC’

- Fitch Downgrades Suriname’s Long-Term Foreign Currency Rating to ‘RD’

- Fitch Downgrades Neuquen to ‘RD’

- Fitch Places IHS Markit’s L-T Ratings on Positive Watching Following S&P Global Merger Announcement

- Fitch Affirms Guatemala at ‘BB-‘ and Removes Negative Watch; Outlook Stable

- Fitch Revises National Grid’s Outlook to Negative; Affirms IDR at ‘BBB’

- Fitch Affirms Soechi Lines at ‘B’; Places Bond on RWN on Tender Offer

- Fitch Affirms NORD/LB Luxembourg S.A. Covered Bond Bank’s LdGPs at ‘AAA’/Stable; Withdraws Rating

- Fitch Affirms Aegon Bank at ‘A-‘; Withdraws Ratings

- Fitch Affirms Aegon’s Covered Bonds at ‘AAA’; Withdraws Rating

Moody’s Upgrades Credit Suisse to Baa1 from Baa2

Moody’s has upgraded the rating of Swiss bank Credit Suisse to Baa1 from Baa2 and has changed the outlook to stable from positive on the back of a strengthening credit profile. The rating agency considered the bank’s profitability as stable due to a lower cost base and lower funding costs. It also viewed the revenue growth, stable earnings and lower risk profile positively. The restructuring of the bank between 2015 and 2018 has also lowered its reliance on less predictable revenue items, and has improved the returns and operating leverage. The bank has maintained “superior liquidity” and “solid funding profile” the rating agency said. The rating action includes the following:

- Bank’s senior unsecured debt ratings upgraded to Baa1 from Baa2

- Long-term senior unsecured debt and deposit ratings of its subsidiary, Credit Suisse AG (CS), upgraded to Aa3 from A1

- Baseline Credit Assessment (BCA) upgraded to baa1 from baa2 and Adjusted BCA to upgraded to baa1 from baa2

- Long-term Counterparty Risk (CR) Assessment upgraded to Aa3(cr) from A1(cr)

In related news, Moody’s affirmed the rating of another Swiss bank, UBS at Aa2 reflecting its strong capital position and active risk management by the bank. The bonds of the Credit Suisse were stable. Its 6.25% and 7.5% perps were up ~0.1 at 110.1 and 111.8 respectively.

For the full story, click here

HK Airport Authority Raises $1.5 Billion via Two Tranche Perps 10x Covered

HK Airport Authority (HKAA) raised $1.5bn via perpetual non-call 5.5Y (PerpNC5.5) bonds and perpetual non-call 7.5Y (PerpNC7.5) bonds. It raised $750mn via the PerpNC5.5 to yield 2.1%, 65bp inside initial guidance of 2.75% area and $750mn via the PerpNC7.5 to yield 2.4%, 70bp inside initial guidance of 3.10% area. The bonds are rated AA by S&P and met with strong investor demand with orders of over $15.5bn, ~10.3x issue size. Proceeds will be used to fund capital expenditure, including the construction of a third runway, and for general corporate purposes.

The coupons will reset and have a 300bp step-up if the perps are not called on the first call/reset date of June 8, 2026 and June 8, 2028 for the PerpNC5.5 and PerpNC7.5 respectively. The issuer has an optional redemption (in whole and not in part) at par on any business day on or after three months before the first reset date. The bonds have an optional distribution deferral on a cumulative and compounding basis, subject to a dividend stopper and 3-month look-back distribution pusher (Term of the day, explained below).

The dividend stopper is applicable on dividends, distributions, redemptions, reductions, cancellations, buy-back, acquisitions or any other discretionary payments related to Junior and Parity Securities; they also have a dividend pusher with no deferrals allowed if dividend, distributions or other payment were paid or declared on parity or junior securities and such had been redeemed within a 3-month look-back period.

The solid response to HKAA’s perp issuance has led other non-financial corporates to launch perpetual issues with new deals from Hong Kong-based real estate developer New World Development and Chinese state-owned electricity company China Huaneng. HKAA’s existing USD 3.45% 2029s were down 0.48 to 112.32, yielding 1.83%.

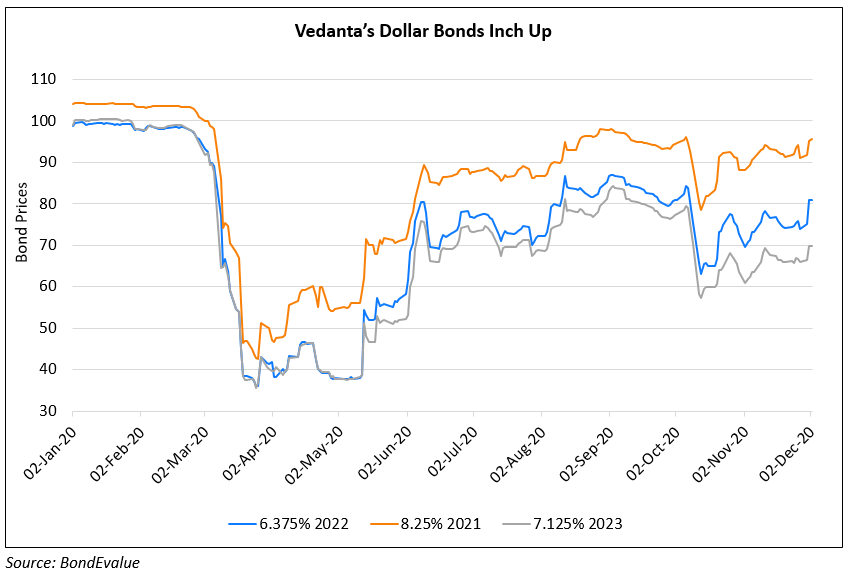

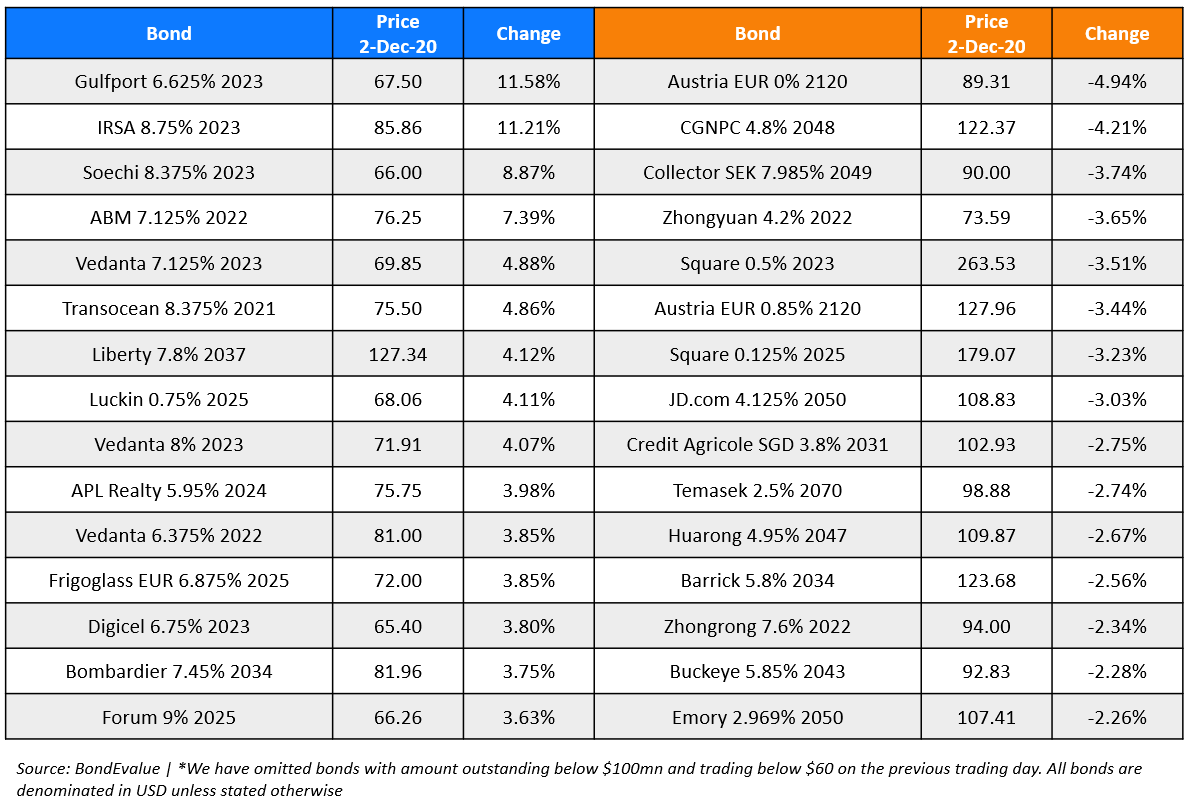

Vedanta, DP World Eye Stake in SCI, Vedanta’s Dollar Bonds Rally

Vedanta and Dubai’s DP World have shown interest in acquiring a stake in state-owned Shipping Corporation of India (SCI) by organizing investor roadshows, The Economic Times said citing sources. The roadshows attracted up to 9 potential investors, including shipping companies from Norway and South Korea they said. The government plans to sell its entire 63.75% shareholding in SCI to a strategic buyer after the Cabinet Committee on Economic Affairs first approved the strategic divestment in November last year. SCI is India’s largest shipping company that owns and operates around a third of the Indian tonnage, and has operating interests in practically all areas of the shipping business. They have a fleet of 70 ships, including crude oil tankers and crude carriers, petroleum product carriers, LPG carriers, bulk carriers, container ships and off-shore support vessels. DP World’s 4.7% 2049s were higher by 1.2% to 111.31 while most of Vedanta’s dollar bonds rallied by 4-9% on Tuesday.

For the full story, click here

Tuspark Dollar Bonds Rally After Tsinghua Sells 14.84% Stake

Tuspark’s 7.95% bonds due 2021 and 6.95% 2022s, guaranteed by Tus-Holdings, jumped almost 50% after Tsinghua Holdings completed the sale of a 14.84% stake in the company, as per Bloomberg. The notes rallied 23.4 and 19 points to 67.8 and 58.7 cents on the dollar, their largest jump ever. Post the stake sale to Hefei Construction Investment, Tsinghua Holdings is no longer the controlling shareholder of Tus-Holdings. Tsinghua Holdings will continue to own 30.08% stake after the sale. As per its website, Tus-Holdings is the university-owned enterprise of Tsinghua University that manages assets worth over $30bn and has a controlling shareholding in over 800 enterprises.

Transocean Announces Amendments to Its Restructuring to Resolve Default Allegations

Switzerland-based Transocean announced on Tuesday that it has resolved certain default allegations by bondholders with regards to its restructuring carried out in September. The world’s largest offshore drilling contractor had swapped ~$826mn worth of debt for alternate bonds worth $687mn as part of the restructuring. Two of its bondholders, Whitebox Advisors LLC and Pacific {Investment} Administration Co. alleged that their holdings have been leapfrogged, which amounted to a default, as reported by WSJ. The allegation gave the company 90 days to resolve the issue, which ended on Tuesday. Transocean, via press release said that it has “executed amendments to certain of their financing documents and implemented certain internal reorganization transactions” and added, “As a result, any claim of an alleged breach under any of the Company’s existing financing documents in respect of a transfer of the assets of the Transocean Holdings Entities resulting from the Prior Transactions has been rendered moot and cured (to the extent it ever existed, which the Company continues to unequivocally reject.)”

Transocean’s 8.375% bonds due 2021 recovered from mid-September lows of 46.5 to 75.5 cents on the dollar while its 6.875% bonds due 2027 traded higher from early November lows of 74.5 to 86.5 cents on the dollar. Its other bonds due 2031, 2038 and 2041 are trading at distressed levels of 27-28 cents on the dollar.

For the full story, click here

Term of the Day

Lookback Distribution Pusher

A lookback distribution pusher is similar to a dividend pusher where the issuer has to automatically make a distribution to the bondholder (in the form of coupon/principal) if they have made any distributions like dividends during a lookback period, which is typically 3, 6 or 12 months before the bond’s payment. These features are particularly observed in perpetual bonds and are designed to protect bondholders. For example, the Hong Kong Airport Authority perpetual bonds priced today carry a 3-month look-back distribution pusher, which requires the company to pay its bondholders if it has made other distributions in the prior three months.

Talking Heads

On the proposed $908bn spending package by bipartisan US senator group

Jerome Powell, Federal Reserve Chairman

“We can both acknowledge the progress and also point out just how far we have left to go,” Mr Powell said, adding that the “lion’s share of the credit really should go to fiscal policy”. “We’ll use our tools until the danger is well and truly passed, and it may require help from other parts of government as well, including Congress,” he added. “We can see the end, we just need to make sure we get there.”

Mark Warner, Virginia senator

“It would be stupidity on steroids if Congress left for Christmas without doing an interim package as a bridge,” Mr Warner said.

Sherrod Brown, Ohio senator

“Other than using your final months in office to work for the people whom you have sworn to serve, you appear to be trying to sabotage our economy on the way out the door,” said Brown.

Vikram Rai, head of municipal strategy at Citigroup

“The market will not weaken just because of the announcement. But say, just one high-profile municipal deal which witnesses weak demand will be enough to have a ripple effect and can fan investor fears — this in turn could cause volatility spikes,” said Rai.

“From an operational perspective, we could reinstate the expiring facilities quickly if needed,” said Logan. “Risks from the pandemic haven’t fully receded so I think our ongoing purchases are helping to insure against any re-emergence” of stress seen earlier this year, she said.

“Even if more persistent downward pressure on rates emerges, we are confident that the Federal Reserve has tools to ensure effective control over the federal funds rate and other short-term interest rates across the broad range of potential outcomes,” Logan said.

Elon Musk urging Tesla employees to focus on profits in an email obtained by Electek

“When looking at our actual profitability, it is very low at around 1% for the past year. Investors are giving us a lot of credit for future profits, but if, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a soufflé under a sledgehammer!”

“More defaults could happen next year due to the ongoing policy tightening and the growth deceleration later,” he said.

“Frequent issuers would prefer to fully utilize their offshore bond quota by the end of this year so that they can start applying for new quotas,” Zhang said.

On China rating agencies standing by ratings for SOEs despite default spree

Andrew Collier, managing director of Orient Capital Research

“China’s rating agencies are even worse than [those] in the US,” said Collier. “They’re not only beholden to the customer but also [to] the government.”

Bruce Pang, head of macro and strategy research at investment bank China Renaissance

“The lack of downgraded ratings is only one of the privileges enjoyed by SOEs,” said Pang.

Jenny Zeng, co-head of Asia-Pacific fixed income at AllianceBernstein

“It’s going to have an impact,” said Zeng. She added that while onshore ratings were not “completely useless . . . from a credit perspective, I would rather just do my own work”.

“Central bank actions will inflate asset values, which will encourage people to take more risk both in equities and also high-yield bonds,” said Lloyd-Jones. “We are confident that calendar year 2021 will be a better year than calendar year 2020.

On bond investors counting on Canada to chart fiscal path back to normal

Vinayak Seshasayee, head of Canada portfolio management at PIMCO

“We don’t expect that the bond market will sharply raise borrowing costs for the government because I think there is belief that in the long-term those deficits will be reined in,” Seshasayee said.

Darcy Briggs, a portfolio manager at Franklin Templeton Canada

“I think the bond market would probably be a little more tentative if the central banks, like the Bank of Canada, the Fed, or the ECB were not in the market buying newly issued securities from the government to finance the deficits,” said Briggs.

“We feel the political risk premium and, to some degree, associated policy uncertainty embedded in current credit spreads overstate the risks to Ghana’s ability and willingness to service its debt,” said Babb.

Top Gainers & Losers – 2-Dec-20*

Go back to Latest bond Market News

Related Posts: