This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

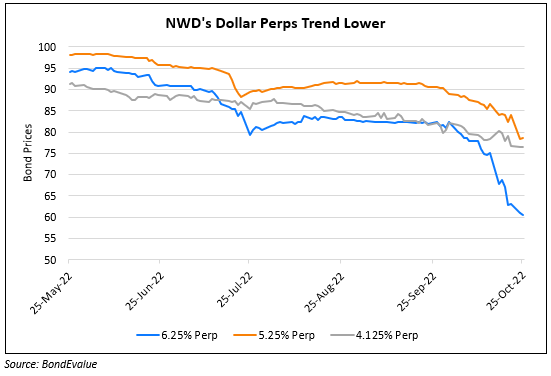

NWD’s Dollar Perps Fall by Over 5 Points

October 25, 2022

Dollar perps of Hong Kong property developer New World Development (NWD) fell by 5-7 points on Monday. While there was no specific news about the company, there are concerns that Hong Kong’s mass-residential prices could drop 10-15% before the end-2023 and that mortgage rates could be much higher than housing rental yields for a prolonged period. This may lead to a multiyear downtrend under a scenario of more-aggressive rate hikes later this year and in 2023, as per Bloomberg Intelligence. Hong Kong’s home affordability is at a risk of a 24Y low, they note. BI further adds that the Yuan’s depreciation of late (from RMBHKD 1.22 in the beginning of the year to RMBHKD 1.07 currently), may impact companies like NWD, Wharf Holdings and Hang Lung more than the others as they derive sizable profits from mainland China.

NWD’s 4.125% Perp callable in October 2028 fell by over 7 points to 65 cents on the dollar before recovering today. If not called by that date, the coupon resets to the US 5Y yield plus a spread of 585.5bp. NWD’s 5.25% Perp callable in March 2026 fell 6 points to 78.5 cents on the dollar. If not called by that date, the coupon resets to the US 5Y yield plus a spread of 788.9bp. NWD’s 6.25% fixed-for-life Perp callable in March 2024 has been on a consistent decline over the last one month, falling from 82 to 60 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Sun Hung Kai Becomes HK’s Largest Home Seller Overtaking NWD

January 6, 2022

NWD Announces Results of Tender Offer

June 21, 2022

Cathay Sells $650mn 5.5Y Bond at 4.875%

May 11, 2021