This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

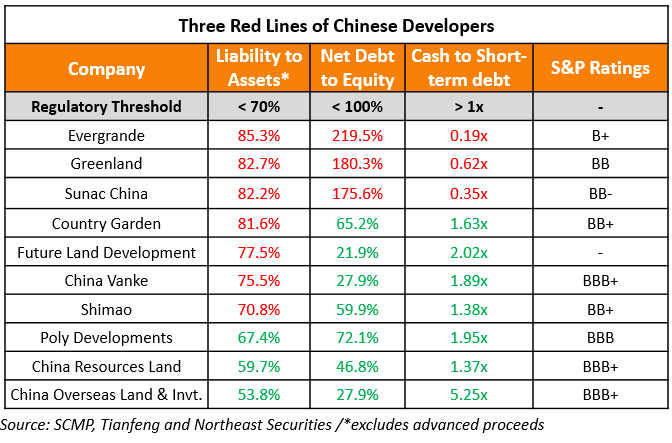

Only 6.3% of Rated Chinese Developers Comply With 3 Red Lines Limits – S&P

January 19, 2021

According to rating agency S&P’s analysis, only 6.3% of Chinese property developers currently comply with the three-red lines drawn by authorities. This would imply that the developers cannot borrow more money from banks or financial institutions if existing debts have not been paid, or, if its overall leverage has not improved. Chinese property developers have CNY 1.2tn ($185bn) in debt repayable by end-2021, 36% more than in 2020, according to Beike Real Estate Research Institute.

S&P’s analysis shows that while 14% of BBB rated developers have short term debt to cash of more than 1x, the number increases to 43% in the BB segment and 100% in the CCC segment. In terms of net gearing (net debt to equity), 0% of BBB developers have a ratio over 100% while the number increases to 36% for BB and 100% for CCC. Similarly, for liability to assets, 43% of BBB developers have a ratio over 70% while the number increases to 93%, 96% and 100% for BB, B and CCC names. Bonds sold by at least 85 Chinese developers totaling ~$65bn face pressures on repayment, according to company and ratings firm statements compiled by Bloomberg. “The policy is not as bad as investors perceive. It could even be positive from an investment perspective in the long run, as the sector will be less volatile going forward,” said Raymond Cheng of CGS-CIMB.

For the full story, click here

Go back to Latest bond Market News

Related Posts: