This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Ping An, Kasikornbank, Mapletree Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

August 3, 2021

US markets ended the day mixed with the S&P down 0.2% and Nasdaq up 0.1%. Materials and Industrials, down 1.2% and 0.7% dragged the index while Utlities, Consumer Discretionary and Healthcare, were up 0.8%, 0.3% and 0.2% providing support. HSBC’s Q2 profit topped forecasts (details below). General Motors and Alibaba will be reporting earnings later this week. The CAC, FTSE and DAX were up 1%, 0.7% and 0.2%. Saudi TASI and UAE’s ADX were up 0.8% and 0.2% respectively. Brazil’s Bovespa gained 0.6%. Asia Pacific stocks opened in the red – HSI, Nikkei, Singapore’s STI and Shanghai were down 0.8%, 0.6%, 0.4% and 0.1%. US 10Y yields dipped to 4bp to 1.19%.

US ISM Manufacturing printed at 59.5, just shy of 60, breaking five months of readings above 60. Demand remained robust with the New Orders Index at 64.9. Eurozone flash Manufacturing PMI remained resilient and came in at 62.8 for July against 63.4 in June and estimates of 62.6. China’s Caixin Manufacturing PMI fell to a 16-month low to 50.3 from 51.3 in June. US IG CDS were flat and HY spreads widened 2.1bp. EU Main spreads were flat and Crossover spreads widened 0.4bp and 1.2bp respectively. Asia ex-Japan CDS spreads were flat.

%20(1).jpg)

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

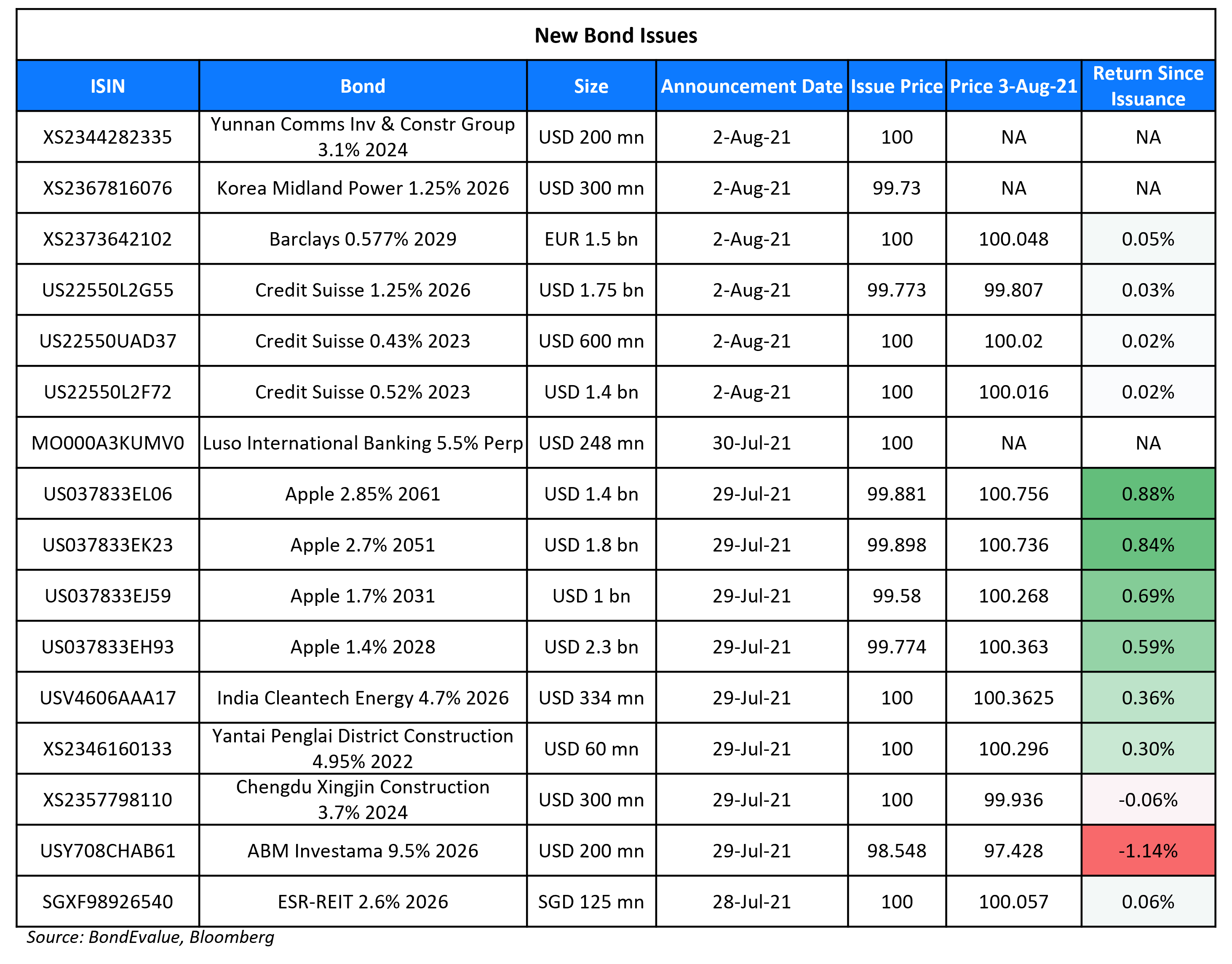

New Bond Issues

-

China Ping An Insurance Overseas (Holdings) $ 10Y at T+210bp area

-

Kasikornbank $ PerpNC5.5 AT1 at 4.25% area

-

Mapletree Investments S$ PerpNC3 fixed-for-life at 4% area

-

Bank of China (HK Branch) $ 3Y FRN at SOFR+80bp area, GBP 2Y FRN at SONIA+75bp area

Barclays raised €1.5bn ($1.8bn) via an 8Y non-call 7Y (8NC7) bond at a yield of 0.577%, ~22.5bp inside initial guidance of Mid-Swaps+105/110bp area. The bonds have expected ratings of Baa2/BBB/A, and received orders over €3.3bn. The coupons are fixed at 0.577% until the first call date of August 9, 2028 and if not called, resets to the 1Y EUR MS+85bp. Proceeds will be used for general corporate purposes, and may be used to strengthen further the capital base of the Issuer and its subsidiaries and/or the Group.

Credit Suisse raised $3.75bn via a three-part offering. It raised:

- $1.4bn via a 2Y bond at a yield of 0.52%, 12.5bp inside initial guidance of T+45/60bp area

- $600mn via a 2Y floating rate note (FRN) at a yield of 0.43%, 38bp over SOFR vs. initial guidance of SOFR Equivalent

- $1.75bn via a 5Y bond at a yield of 1.297%, 15bp inside initial guidance of T+80bp area

The SEC registered bonds have expected ratings of A1/A+. Proceeds will be used for general corporate purposes. The 5Y bond was priced ~16bp inside its 4.55% bonds due April 2026 (rated A-), that yield 1.46%.

Yunnan Communications Investment and Construction Group raised $200mn via a 3Y bond at a yield of 3.1%, 50bp inside initial guidance of 3.6% area. The bonds are unrated. Wholly-owned subsidiary YCIC International (HK) is the issuer and guaranteed by Yunnan Communications Investment and Construction Group. Proceeds will be used for general corporate purposes.

Korea Midland Power raised $300mn via a 5Y bond at a yield of 1.306%, 35bp inside initial guidance of T+100bp area. The bonds have expected ratings of Aa2/AA, and received orders over $2.7bn, 9x issue size. Asia took 89% of the bonds and the rest went to EMEA. Asset/fund managers bought 60%, banks 28%, central banks, sovereigns, supranationals and agencies and pension funds 11% and private banks 1%. Proceeds will be used for general corporate purposes, but not for activities related to the construction of new coal-fired generation units.

New Bonds Pipeline

- HDFC Bank hires for $ AT1

-

Ningbo Yincheng Group hires for $ bonds; calls today

-

Nanjing Jiangbei New Area Industrial Investment Group hires for $ bonds; calls today

Rating Changes

- Fitch Upgrades Cenovus Energy to ‘BBB-‘; Outlook Revised to Stable

- Southwestern Energy Co.’s Proposed Senior Unsecured Notes Due 2029 Rated ‘BB-‘ (Recovery: ‘3’) By S&P; On CreditWatch Positive

- CPI Property Group Rating Affirmed At ‘BBB’ By S&P And Removed From CreditWatch; Outlook Negative

-

Moody’s extends its review for downgrade on Huarong Financial Leasing

- Moody’s downgrades Evergrande’s and its subsidiaries’ ratings; changes outlook to negative

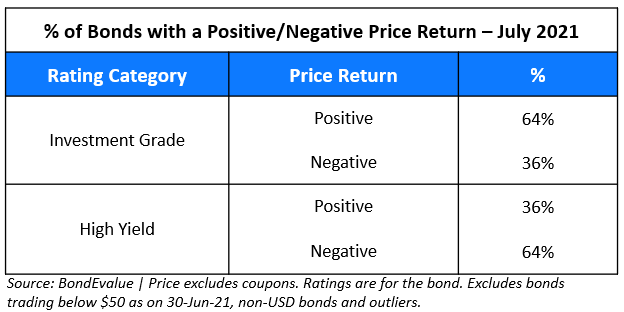

July 2021: 52% of Dollar Bonds Traded Higher with IG Outperforming

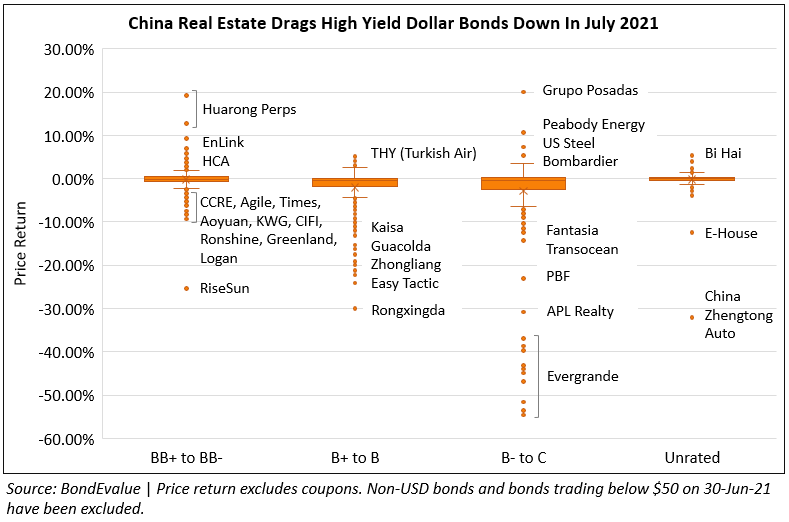

The month of July saw a continuation of June’s move with 52% of dollar bonds in our universe delivering a positive price return ex-coupon during the month compared to 54% in the prior month. But, unlike June where both Investment Grade (IG) and High Yield (HY) bonds traded in tandem (53% and 55% of IG & HY moved higher in June), July saw IG outperform with 64% of dollar bonds in the green. HY in comparison had a rather gloomy month with 64% of dollar bonds in the red.

The drag in the HY space was dominated by China real estate developers, led by China Evergrande’s dollar bonds that dropped over 50% and peers like Rongxinda, RiseSun, R&F Properties, Fantasia, Yuzhou also dropping sharply in the month.

For the box & whisker chart of investment grade bonds, issuance volumes, largest deals, top gainers and losers for July, click the button below:

For the box & whisker chart of investment grade bonds, issuance volumes, largest deals, top gainers and losers for July, click the button below:

Term of the Day

Risk Weighted Assets

Risk Weighted Assets (RWA) is a calculation used in banking that helps determine the minimum amount of capital (capital adequacy ratio) that a bank should keep as reserves against unexpected losses arising out of its assets turning sour or insolvency/bankruptcy. Riskier assets like unsecured loans, high yield securities etc. that carry a higher risk of default are given a higher risk weightage and safer assets like Treasuries are given a lower weightage since high risk assets require higher capital adequacy ratios (CAR).The minimum capital requirements as a percentage of RWAs are set by regulatory agencies with banks required to keep a minimum of 10.5% of RWA as Tier 1 and Tier 2 capital under Basel III.

Talking Heads

On the possibility of a taper call in September – Christopher Waller, Federal Reserve Governor

“I think you could be ready to do an announcement by September,” Waller said. “That depends on what the next two jobs reports do. If they come in as strong as the last one, then I think you have made the progress you need. If they don’t, then I think you are probably going to have to push things back a couple of months.”

Ian Lyngen, an analyst at BMO Capital Markets

“Peak growth and inflation might be behind us.”

Mitul Kotecha, strategist at TD Securities

“The components of the [official PMI] revealed a broad-based softening, with output and new orders weakening and trade components in contraction.”

Leslie Falconio of UBS

“We don’t believe that this is where we will end the year and we do anticipate that interest rates will rise.” “Heading into December 2021 we’ll see a compression of this labour market slack that have we witnessed over the past several months as kids go back to school and employment subsidies subside.”

“We don’t believe that this is where we will end the year and we do anticipate that interest rates will rise.” “Heading into December 2021 we’ll see a compression of this labour market slack that have we witnessed over the past several months as kids go back to school and employment subsidies subside.”

In a note by Citigroup’s economists led by Liu Li-Gang

“The policy efforts to support the economy will likely step up.” “In particular, we see more targeted measures underway to help small and medium-sized enterprises, as indicated by the mid-year Politburo meeting.”

According to Macquarie analysts

“It’s time for policy fine-tuning, but too early for outright easing.”

In a note by Guotai Junan analysts led by Dong Qi

“The biggest difference of cross-cyclical adjustment from a counter-cyclical one is that both the tightening and easing of policies will be more moderate in magnitude.”

Gorky Urquieta, money manager at Neuberger Berman

“Ecuador is becoming a bit of an island in the region.”

Dan Shaykevich, co-head of emerging-market and sovereign bonds at Vanguard Group Inc

“Ecuador has had its share of economic instability over the years.” “But this is also a country where you have a robust democracy and a change of leadership that’s very much trying to conduct policy that will be sustainable in the long term.”

Gustavo Medeiros, deputy head of research at Ashmore

“We still find it attractive but it’s not cheap anymore.” “It’s hard to be short or underweight in a bond with such high yields in a country that’s doing the right thing.”

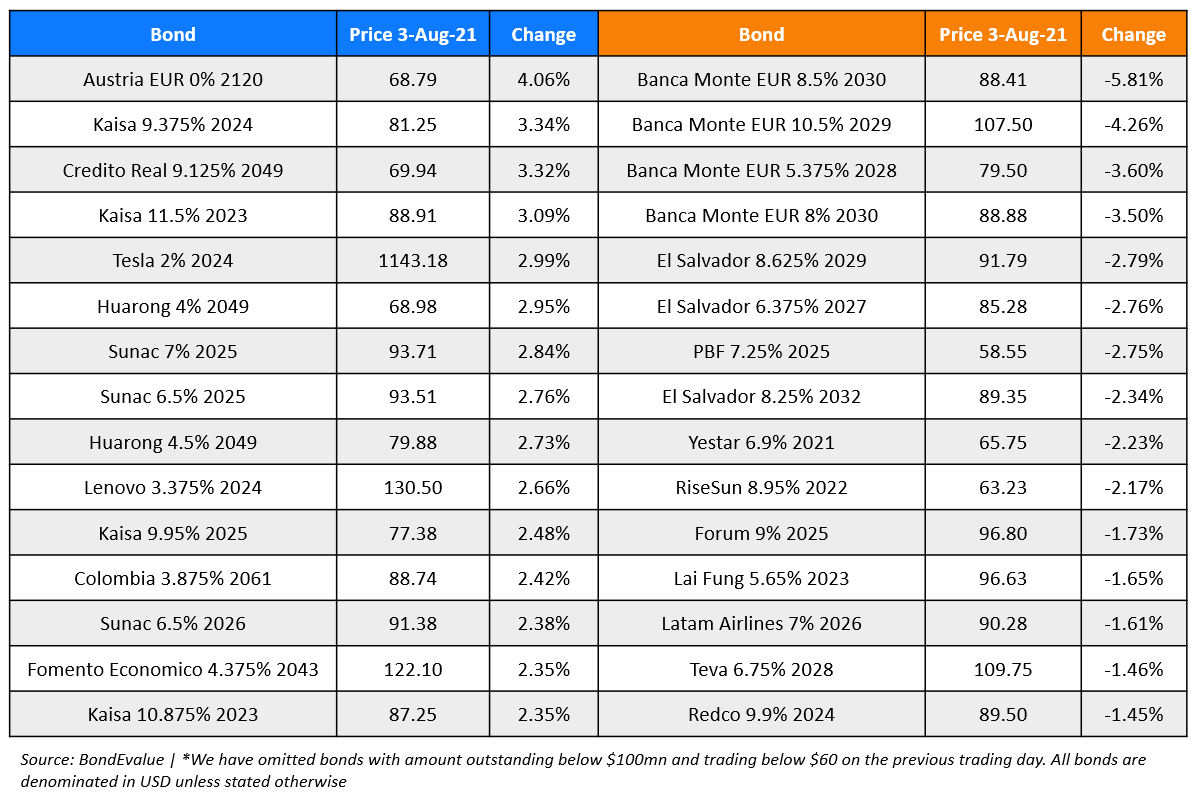

Top Gainers & Losers – 03-Aug-21*

Go back to Latest bond Market News

Related Posts: