This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Reliance, AAHK, Kexim Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 5, 2022

US equity markets ended broadly lower, with the S&P and Nasdaq down 0.1% and 1.3% respectively. Energy led the gainers, up 3.5% while Healthcare and IT fell 1.4% and 1.1%. US 10Y Treasury yields continued to rise, by 2bp to 1.64%. Almost $1.2bn was pulled out of the TLT ETF (iShares 20+ Year Treasury Bond ETF) on Monday, the third-biggest daily outflow since its launch in 2002. European markets were higher with the DAX, CAC and FTSE up 0.8%, 1.4% and 1.6% respectively. Brazil’s Bovespa was down 0.4%. In the Middle East, UAE’s ADX was down 0.7% while Saudi TASI was up 0.3%. Asian markets have opened lower today – Shanghai, HSI and STI were down 0.2-0.4% while Nikkei was flat. US IG CDS spreads were flat and HY CDS spreads widened 1.3bp. EU Main CDS spreads were 0.2bp tighter and Crossover CDS spreads were 1.9bp tighter. Asia ex-Japan CDS spreads tightened 1.8bp.

US ISM Manufacturing PMI came at 58.7 vs. forecasts of 60 with the prices paid component (an inflation metric) coming softer at 68.2 vs. 79.5 forecasted. China’s Caixin Manufacturing PMI for December came at 50.9, vs forecasts of 50.1, a better print than November’s 49.9 contraction.

New Bond Issues

- Reliance Industries $ 10/30/40Y at T+150/190/205bp area

- Airport Authority HK $ 10/30/40Y at T+110/145/170bp area

- Kexim $ 3/5Y, 10Y green at T+50/60/85bp area

- SMFG $ 5Y floating at SOFR; $ 5/20Y at T+100/120bp area; $ 7Y green at T+110bp area

.png)

Mexico raised $4.1bn via a two-tranche deal. It raised $2.2bn via a 12Y bond at a yield of 3.556%, 30bp inside initial guidance of T+220bp area, and $1.9bn via a 30Y bond at a yield of 4.424%, 30bp inside initial guidance of T+265bp area. The bonds have expected ratings of Baa1/BBB/BBB-. Proceeds will be used to (i) retire outstanding indebtedness of Mexico pursuant to a concurrent tender offer (ii) redeem the $545mn amount outstanding of its 4% bond due October 2023 and (iii) general budgetary purposes. The new 12Y bonds are priced 25.6bp wider to its existing 7.5% bond due April 2033 that yield 3.3%.

Deutsche Bank raised $3bn via a two-tranche deal. It raised $1.75bn via a 6NC5 bond at a yield of 2.552%, 25bp inside initial guidance of T+145bp area, and $1.25bn via a 11NC10 tier 2 bond at a yield of 3.742%, 25bp inside initial guidance of T+235bp area. The bonds are unrated. Proceeds will be used for general corporate purposes.

Credit Agricole raised $2.25bn via a dual-trancher. It raised:

-

$1bn via a PerpNC7 AT1 at a yield of 4.75%, 29bp inside initial guidance of 5.125% area. The bonds have expected ratings of BBB-/BBB (S&P/Fitch). The coupon will reset at the end of year seven to the prevailing constant maturity Treasury rate plus the initial credit spread of 323.7bp. A capital ratio event will be deemed to have occurred if Credit Agricole SA Group’s CET1 capital ratio falls or remains below 5.125% or if the Credit Agricole Group’s CET1 capital ratio falls or remains below 7%.

-

$1.25bn via a 5Y bond at a yield of 2.015%, 15bp inside initial guidance of T+80bp area. The bonds have expected ratings of Aa3/A+/AA- (Moody’s/S&P/Fitch).

BNP Paribas raised €1.5bn via a 8.5NC7.5 bond at a yield of 0.998%, 17bp inside initial guidance of MS+100bp area. The bonds have expected ratings of Baa1/A-/A+, and received orders over €3.25bn, 2.2x issue size. The bond has a first call date on 11 July 2029, and if not called, the coupon will reset quarterly to the prevailing 3-month Euribor + 83bps.

Royal Caribbean raised $1bn via a 5.5Y bond at a yield of 5.375%, 12.5bp inside initial guidance of 5.5% area. The bonds have expected ratings of B (S&P). Proceeds will be used to repay principal payments on its bond due November 2022. Pending such uses, Royal Caribbean may temporarily apply the proceeds to repay borrowings under its revolving credit facilities or other borrowings. The new bonds offer a juicy new issue premium of 100.5bp vs. its existing ‘B’ rated 7.5% 2027s (issued in 1997) that currently yield 4.37%. The new bonds also priced 23.5bp wider than its 5.5% 2028s issued in March 2021 that yield 5.14% despite its shorter tenor.

Nomura raised $4.75bn via a three-tranche deal. It raised:

- $1.25bn via a 2Y bond at a yield of 2.329%, 23bp inside initial guidance of T+120bp area

- $500mn via a 6Y bond at a yield of 2.71%, 25bp inside initial guidance of T+140bp area

- $750mn via a 11Y bond at a yield of 2.999%, 15bp inside initial guidance of T+160bp area

The bonds have expected ratings of Baa1/BBB+ (Moody’s/S&P). The issuer plans to use proceeds for loans to its subsidiaries, including Nomura Securities, which will use such funds for their general corporate purposes.

UBS raised $3bn via a 2-tranche deal. It raised $1.5bn via a 11NC10 bond at a yield of 2.746%, 20bp inside the initial guidance of T+130bp, and $1.5bn via a 21NC20 bond at a yield of 3.179%, 20bp inside the initial guidance of T+130bp. The bonds have expected ratings of A-/A+ (S&P/Fitch).

National Australia Bank raised $4.75bn via a five-tranche deal. Details are given in the table below:

-png.png)

The 15NC10s are Tier 2 bonds that have expected ratings of Baa1/BBB+/A–.

New Bonds Pipeline

- KNOC hires for $ 3.25/5.25/10.25Y bond

- ReNew Power hires for $ 5.25Y green bond

- China Oilfield Services Limited hires for $ bond

Rating Changes

- AXA Bank Belgium Downgraded To ‘BBB+’ From ‘A-‘, Off Watch On Acquisition By Crelan; Crelan ‘BBB+/A-2’ Ratings Affirmed

- ION Geophysical Corp. Downgraded To ‘D’ On Missed Interest And Principal Payments

Term of the Day

Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls. Garuda is offering investors a haircut of 81 cents on the dollar.

Talking Heads

“We have the highest two-year yield of the past year. We have the highest three-year yield. We have basically a high on the five-year yield. And so what’s happening is the yield curve is sending a bonafide recessionary signal. You have interest rates going up at the short end and going down at the long end.”

“I think the bond market is already showing enough of a recession indicator that by 2023 it’s seems pretty likely. And I, like I said earlier, I don’t think a lot of Fed officials, economists and investors appreciate the fact the economy keeps buckling at lower and lower interest rates. So I think the Fed only has to raise rates four times and you’re going to start seeing really a plethora of recessionary signals. I think it’s certainly a non-zero probability that you get a recession in the latter part of 2022. That’s going to be dependent again on how aggressive the Fed is. One thing that we did notice in 2018 is the Fed stopped QE, they started quantitative tightening — letting the bonds roll off. And then they started raising interest rates and we got an instantaneous bear market.”

“With the consensus view being higher equities and higher long-term bond yields, the market is now pricing that.” “TLT (the iShares 20+ Year Treasury Bond ETF) is unlikely to perform well unless or until risk appetite turns sour.” “When the outlook for equities is more balanced, then the relative income in equities compared to bonds will matter a lot more,” Chatwell said. “At that point, TLT will have upside — but before then, it will be tough to generate a positive return.”

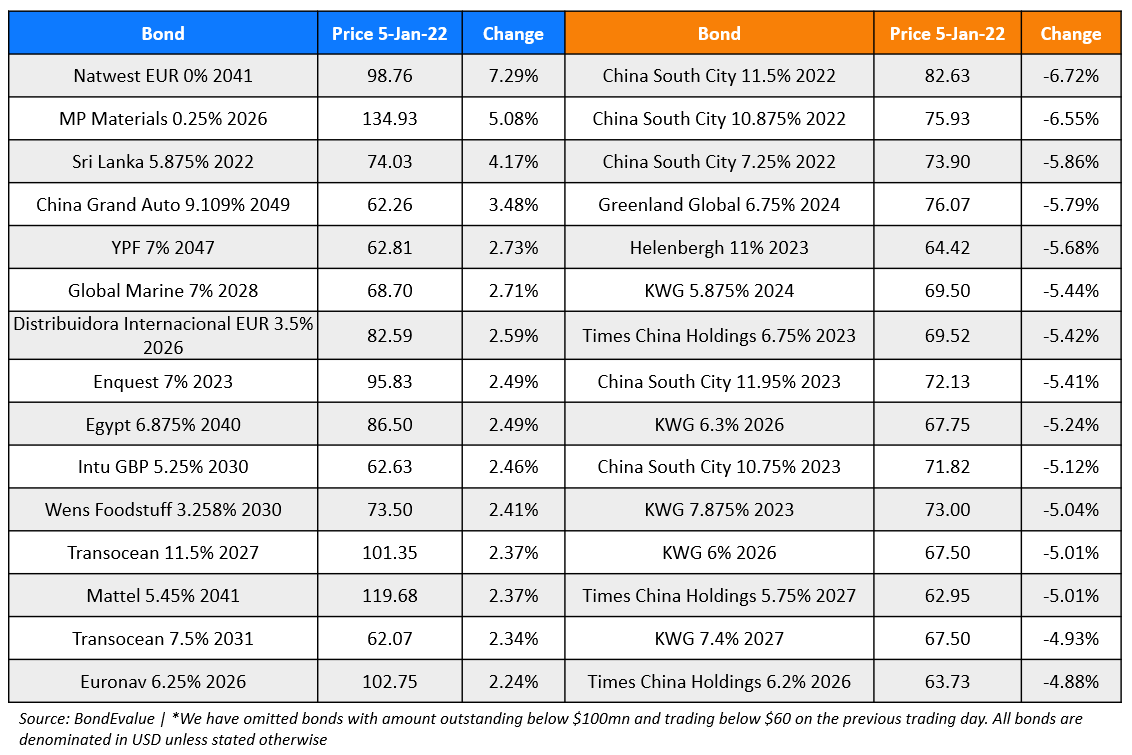

Top Gainers & Losers – 05-Jan-22*

Other Stories:

Go back to Latest bond Market News

Related Posts: