This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Reliance May Bid for Future’s Assets under Insolvency and Bankruptcy Code after Scrapping Deal

April 25, 2022

Reliance Retail may participate in the bidding process for Future Group’s assets under the insolvency resolution process of the Insolvency and Bankruptcy Code (IBC). As per executives, Reliance may revise the bid amount lower from the previous $3.4bn to adjust for its receivables and reduction of Future Group’s intangible assets such as brand names. This comes after Reliance Industries informed that the deal to acquire Future Group’s wholesale, retail, and logistics assets cannot be implemented as nearly 70% of Future Retail’s (FRL) secured creditors voted against the scheme.

Executives also pointed out that Reliance wanted to adjust INR 60bn ($782.6mn) that Future Group owed to it over the last 15-16 months for working capital, outstanding payment for rent, and purchase of inventory. As Future Group is likely to go under the IBC resolution process, Reliance will not provide a further line of credit. Promotors’ stake in Future Retail is currently down to 14.3% from 47% in December-2019. The deal rejection adds to the negative news in recent times where Bank Of India already referred Future Retail to NCLT.

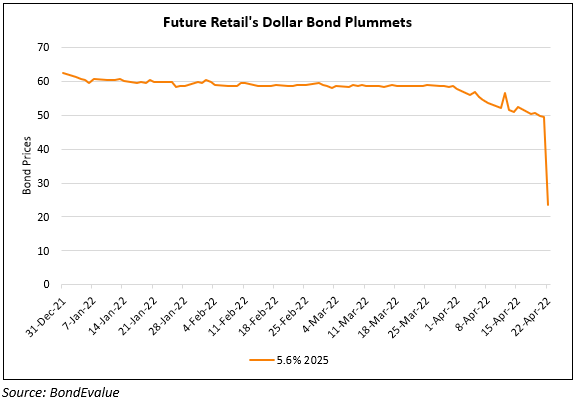

Future Retail’s dollar bond is trading at distressed levels with its 5.6% 2025s at 21 cents on the dollar, after crashing over 50% post the deal’s rejection.

For the full story, click here

Go back to Latest bond Market News

Related Posts: