This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Russia-Ukraine Tensions Escalate Further, Weighing on Their Dollar Bonds

February 14, 2022

Tensions between Russia and Ukraine seem to be escalating further with US National Security Advisor Jack Sullivan telling CNN on Sunday that there’s “a distinct possibility that there will be major military action very soon.” He cited US intelligence when he said that a potential attack could come before the Beijing Winter Olympics end on February 20. While Russia has always been denying its plans to invade, the Putin-led nation has deployed over 130,000 troops across the Ukraine border conducting military drills that suggest otherwise. Diplomatic talks between the US and European leaders with Russia have not yielded any results; in the latest effort, German chancellor Olaf Scholz is due to meet with Ukraine President Zelenskiy on Monday and Russian President Putin on Tuesday. While the US and Europe have threatened Russia of economic repercussions in the event of an invasion, there are differences over the extent of the penalties, especially for countries that rely on Russian imports like Germany, which relies on Russian gas. Bloomberg notes that cutting off Russia from the global Swift payment system is unlikely.

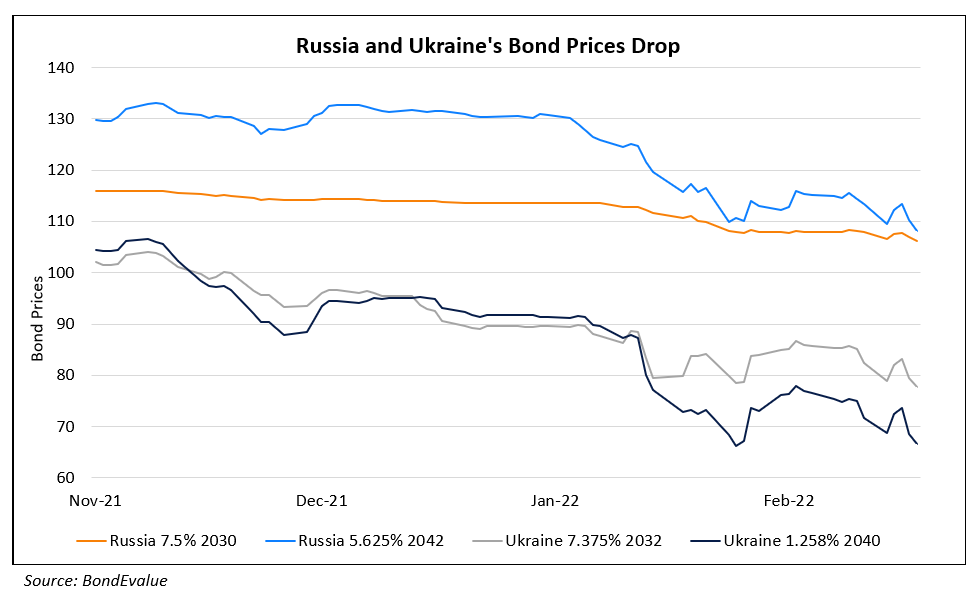

The escalating tensions have weighed on Ukraine and Russia’s dollar bonds – Ukraine’s 7.253% 2033s are trading 3.1 points lower to 81.41 yielding 10.07% while Russia’s longer-dated 5.625% 2042s are trading 1.75 points weaker at 112.81 yielding 4.64%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

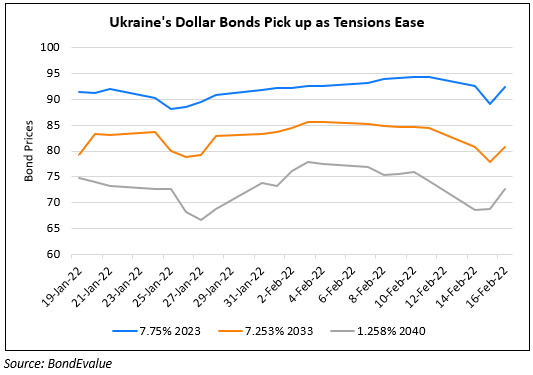

Ukraine Bonds Rally as Russia Says Troops Pulled Back

February 16, 2022

Russia-Ukraine Crisis: Impact on Bonds & CDS Spreads

September 28, 2022