This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

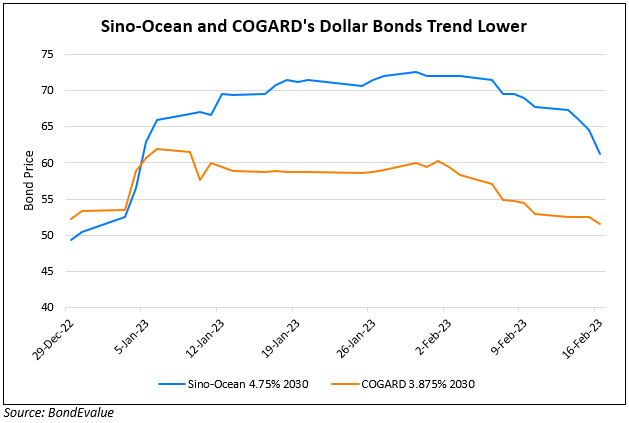

Sino-Ocean, COGARD’s Dollar Bonds Drop

February 16, 2023

Dollar bonds of Chinese property developers Sino-Ocean and Country Garden were down as much as 3 points. While the exact reason for the drop in price is not known, Moody’s said in a report that it expects the nation’s property sales to falling this year. It forecasts that property sales would fall 10-15% by end-2023. Moody’s said that “the sector’s contribution to the economy will remain materially lower over the next few years than in the past decade”. Further a prolonged weakness in the sector could add pressure on local governments’ finances and weaker banks, Moody’s added. However, the latter is unlikely to trigger systematic banking problems. As per SCMP, China’s land sales have accounted for over 40% of the government’s revenue since 2018. However, 2022 land sales fell by 31% YoY to only RMB 4.7tn ($690bn). Also, contracted sales by the China’s top 100 developers stood at RMB 354.3bn ($51.7bn) , a 32.5% YoY drop.

Go back to Latest bond Market News

Related Posts: