This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sino-Ocean Downgraded to B- by Fitch

April 12, 2023

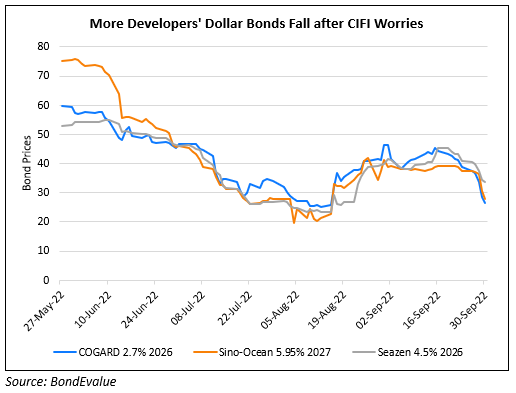

Sino-Ocean was downgraded to B- from B+ by Fitch due to increasing uncertainty over its financial flexibility after it missed an amortization payment on its syndicated loans on 31 March 2023. While the payment is voluntary and does not constitute a default, it does cast doubts over its liquidity position. Sino-Ocean’s cash balances dropped sharply to RMB 4.6bn ($670mn) by end-2022 from RMB 14.6bn ($2.1bn) at 1H 2022 as sales dropped and the company repaid debt. Fitch believes that its cash balances cannot sufficiently cover capital-market debt due over the next 12 months. Importantly, Fitch also notes China Life and its related entities’ support to the developer. The insurer had subscribed to its onshore and offshore bonds and helped contribute to asset acquisitions and making secured loans. China Life’s management has also publicly confirmed its willingness to support in its recent annual results. However, following the recent string of negative incidents, Fitch said it is assessing China Life’s actual support to Sino-Ocean. Any weakening in China Life’s need or ability to support the developer may lead to the removal of one-notch support. This is its second downgrade by Fitch in as many weeks.

Its dollar bonds were trading stable at 31-35 cents on the dollar.

Go back to Latest bond Market News

Related Posts: