This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

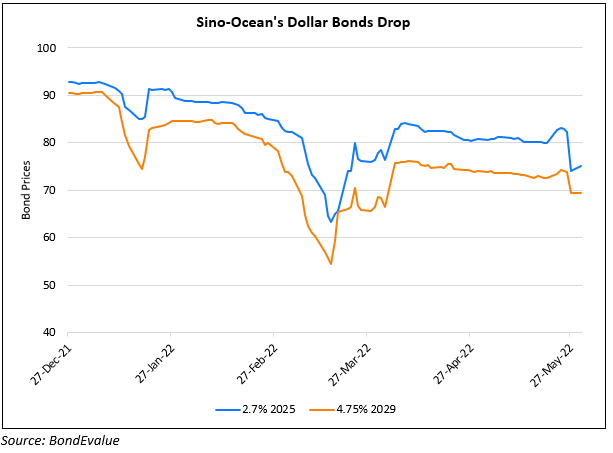

Sino-Ocean’s Dollar Bonds Drop ~10%; Clarifies it is Not Under Refinancing Pressure

May 30, 2022

Dollar bonds of Chinese property developer Sino-Ocean dropped as much as 10% on Friday. The move comes just days after property sector peer Greenland’s dollar bonds fell over 20% on liquidity fears. Sino-Ocean in response to the fall in its bonds, said that it does not face any liquidity issues and there has been no negative changes in the company’s fundamentals. Sino-Ocean is among the few investment grade rated developers at Baa3/BBB- (Moody’s/Fitch).

Separately, Yango Group’s onshore bondholders approved proposals to demand accelerated repayments on three RMB-denominated bonds – its 7% August 2024s, 7.3% April 2025s and 7.3% July 2025s.

Go back to Latest bond Market News

Related Posts:

Alibaba Fined Record $2.8bn by Chinese Regulators

April 12, 2021

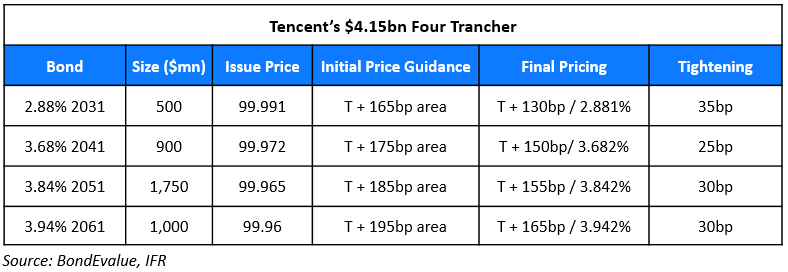

Tencent Raises $4.15bn via Four Trancher

April 16, 2021