This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sino-Ocean’s IG-Status on Review For Downgrade by Moody’s, akin to COGARD

June 29, 2022

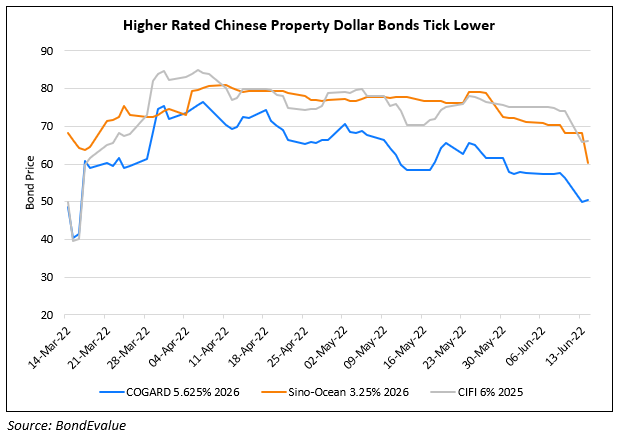

Moody’s has placed Chinese property developer Sino-Ocean and its senior unsecured notes on review for a downgrade from its Baa3 rating. It also placed the developer’s perpetual bonds’ Ba2 rating on review for a downgrade. The rating agency expects operating and credit metrics of Sino-Ocean to weaken over the next 12-18 months. and Moody’s forecasts Sino-Ocean’s contracted sales to decline to ~RMB 110bn ($16.4bn) in 2022, from ~RMB 136bn ($20.3bn) in 2021. Given this backdrop, the company may offer price discounts which would impact margins. Sino-Ocean’s debt leverage (revenue/adjusted debt), is set to weaken to around 60% over the next 12-18 months from 68% in 2021. Its interest coverage will decrease to 2.5-2.7x over the next 12-18 months from 3x in 2021. Moody’s adds that Sino-Ocean’s current Baa3 rating is benefitted from expectations that China Life Insurance Co Ltd will continue to consider Sino-Ocean “as a strategic investment and provide financial support to the company in times of need”. Sino-Ocean is among the very few Chinese developers that are rated in the investment grade category. On May 30, its peer Country Garden was first kept on review for a downgrade by Moody’s post which its dollar bonds fell over 10-15%. Moody’s culminated the review process with a downgrade last week to Ba1.

Sino-Ocean’s dollar bonds are trading lower with its down over 2.6 points to 65 cents on the dollar.

Go back to Latest bond Market News

Related Posts: