This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

SMC, CCB, CBA Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 8, 2021

US markets had a mixed opening to start the trading week after the long weekend – S&P was down 0.3% while the tech heavy NASDAQ was up 0.1%. Consumer Discretionary and Communications Services led the upside with gains of ~0.4%. Industrials down ~1.8% dragged the indices lower and most other sectors were down between 0.6% to 1.4%. European markets reversed some of the gains on Monday – DAX, FTSE and CAC were down 0.6%, 0.5% and 0.3% respectively. Saudi’s TASI and UAE’s ADX were up 0.1% and 1.2% respectively. Asian markets had a mixed start – Nikkei and HSI were up 0.8% and 0.1% respectively. Shanghai and Singapore’s STI were down 0.2% and 0.6%. US 10Y Treasury yields climbed another 4bp to 1.36%. US IG CDX and HY CDX spreads widened 0.4bp and 2.8bp respectively. EU Main CDS and Crossover CDS spreads widened by 0.4bp and 3.1bp respectively. Asia ex-Japan CDS spreads tightened 0.2bp.

The ZEW Economic Sentiment for Eurozone for September recorded 31.1 vs. 42.7 last month. The German ZEW Economic Sentiment for September came in at 26.5 vs. 40.4 last month and below the expectations of 30.0. However, the German Industrial Production for July rose to 1% vs. -1% in June and above the expectations of 0.9%.

New Bond Issues

- CCB Financial Leasing $ 5Y bonds at T+140a

-

GF Financial $ 3Y SBLC-backed bond at T+115bp area

-

Zensun $ 2Y final at 12.5%, alongside exchange offer

- SMC Global Power capped $150mn tap of 5.45% PerpNC2026 at T+100bp area

- CBA $ 4.75Y/10Y Yankee at T+60bp/T+85bp areas

- Mizuho Financial $ 10Y SEC-registered Tier-2 notes at T+145/150bp area

- Huzhou Nanxun Tourism Investment $ 35-month @ 1.93% area

.png?width=1400&upscale=true&name=New%20Bond%20Issues%208%20Sep%20(1).png)

ING Groep raised $2bn via a dual-trancher AT1 offering. It raised $1bn via a PerpNC6 AT1 at a yield of 3.875%, 50bp inside the initial guidance of 4.375% area. It also raised $1bn via a PerpNC10 AT1 at a yield of 4.25%, 50bp inside the initial guidance of 4.75% area. Both bonds have expected ratings of Ba1/BBB (Moody’s/Fitch). The PerpNC6 bonds have a first call on May 16, 2027, and if not called, the coupon will reset on November 16, 2027 to the prevailing US 5Y Treasury + 286.2bp, while the PerpNC10 bonds has a first call on May 16, 2031, and if not called, the coupon will reset on November 16, 2031 to the prevailing US 5Y Treasury + 286.2bp. The new PerpNC6s priced 41.5bp over its older 5.75% Perps callable in 2026 that are currently yielding 3.46%.

DBS Group raised $800mn via a 5.5Y bond at a yield of 1.194%, 28bp inside the initial guidance of T+65bp area. The bonds have expected ratings of Aa2/AA– (Moody’s/Fitch) and received orders over $2bn, 2.5x issue size. The new bonds are priced 9bp wider than its older 4.52% bonds due 2028 that are currently yielding 1.1%.

Keppel Corp raised S$400mn via a PerpNC3 bond at a yield of 2.9%, 10bp inside the initial guidance of 3% area, a record low for a Singapore dollar perpetual bond from a non-financial issuer as per IFR. The previous record was by Ascendas REIT’s S$300mn 3% green PerpNC5s issued last year. Keppel’s new bonds are unrated. Proceeds will be used for general corporate and working capital needs, including debt refinancing. The bonds have a call option at the end of 3Y and a coupon reset at the end of the fifth year and every 5Y thereafter to the prevailing SORA OIS plus the initial spread of 209.7bp and a step-up of 100bp. The coupon is deferrable, cumulative and compounding.

China Everbright Bank Luxembourg branch raised $500mn via a 3Y bond at a yield of 0.826%, 40bp inside the initial guidance of T+80bp area. The bonds have expected ratings of BBB+. The new bonds are priced marginally wider to its existing 0.839% 2024s that currently yield 0.81%.

JR East raised raised $1.8bn via a debut issuance. It raised:

- £300mn via a 7Y bond at a yield of 1.162%, 15bp inside the initial guidance of UKT+85bp area. The bonds have expected ratings of A1/A+ (Moody’s and S&P) and received orders over £1.2bn, 4x issue size

- €500mn via a 13Y bond at a yield of 0.773%, 22-27bp inside initial guidance of MS+80-85bp

- €700mn via a 18Y bond at a yield of 1.104%, 20-25bp inside the initial guidance of MS+95-100bp

The euro tranche received combined orders over €2.4bn, 2x issue size. The net proceeds of the issuance will be used for general corporate purposes. East Japan Railway Company or JR East is the largest Japanese passenger railway company.

New Bonds Pipeline

- China Merchants Securities International hires for $ bonds

- Nippon Life hires for $ 30NC10 bond

- China IBK hires for $ sustainability 3Y or 5Y bond

- Oxley Holdings plans for S$ tap of 6.9% 2024s bond

- JSW up to $1bn planned issuance

- ICBC $6bn AT1 Perp

- Denso hires for $ 5Y sustainability notes

- GF Holdings (Hong Kong) Corp hires for $ SBLC-backed bond

- Kuveyt Türk hires for $350m 10.25NC5.25 inaugural sustainability T2 sukuk

Rating Changes

- Moody’s downgrades Evergrande’s and its subsidiaries’ ratings; outlook negative

- Moody’s changes Nabors’ outlook to positive from negative, affirms other ratings

- Fitch Upgrades Jiayuan to ‘B+’; Outlook Stable

- Pampa Outlook Revised To Stable From Negative And Stand-Alone Credit Profile To ‘b-‘ From ‘ccc+’ On Solid Performance

- Carnival Corp. ‘B’ Short-Term Ratings Withdrawn At Company’s Request

Term of the Day

Volcker Moment

Volcker Moment refers to a policy change where the then Federal Reserve Chairman Paul Volcker decided to quickly raise interest rates to 20% to contain inflation in the late 1970s. The sharp move caused a jump in unemployment but also tamed inflation.

With regard to Chinese real estate, Nomura says that the policies tightening the property sector and curbing prices by Beijing may be China’s Volcker Moment as it will cause a significant slowdown in economic growth.

Talking Heads

On government bonds softening as investors bet on taper

Ross Mayfield, US investment strategist at RW Baird

“The timing of this move in Treasuries is strange…[monetary stimulus withdrawal] could put some fire to the heels of the Fed”.

Elisa Belgacem, senior credit strategist at Generali Investments

“There could be a short impact on market sentiment…But the market is already very well prepared for ECB tapering and I do not see any major reactions in bond prices from here.”

On Sri Lanka admitting forex crisis ‘dangerous’

Finance Minster

We are facing a dangerous foreign exchange crisis…We are also facing a shortage of rupee revenues because of lockdowns.”

Ajith Cabraal, Junior Finance Minister

“I want to reassure all those who may have been concerned, as a result of these reports that Sri Lanka would not be able to meet its debt, that we are very much having the ability to do so.”

“We expect the company’s deleveraging path to be bumpy, which could lead to deep price discounts for its property sales and potential asset disposal”.

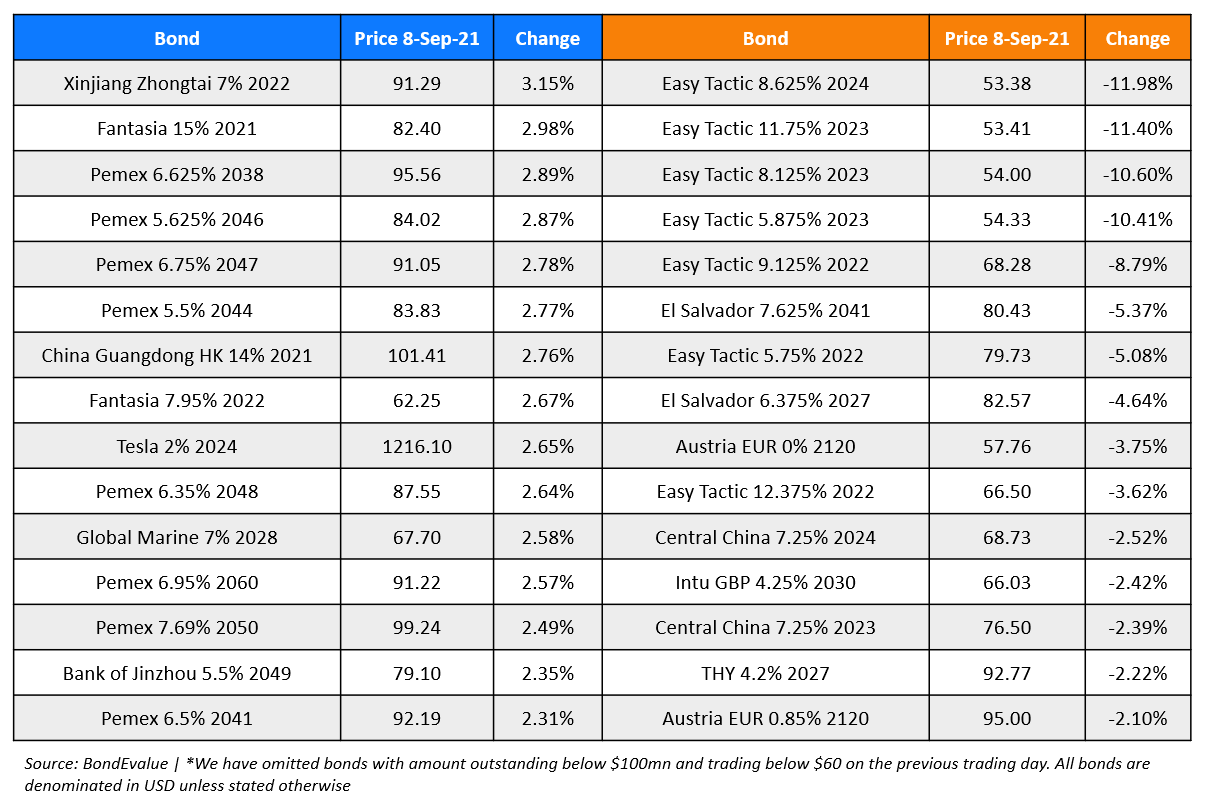

Top Gainers & Losers – 08-Sep-21*

Other Stories

Go back to Latest bond Market News

Related Posts:.png)