This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

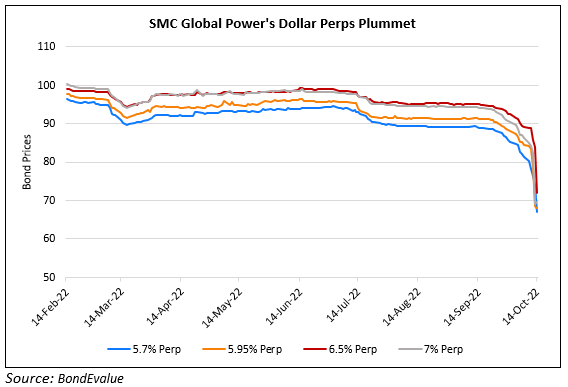

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

SMC Global Power’s perpetual dollar bonds dropped by over 10% yesterday. For instance, its SMC’s 5.7% Perp and 6.5% Perp fell by 10-14% to 66.95 and 71.85 cents on the dollar, yielding 19.96% and 31.12% to call. As per a report by Bloomberg Intelligence, the company “risks a funding shortfall as high as $1 billion by next June”. While this could partly be offset by domestic bonds and bank loans, the report notes that its perps that are callable between 2024 and 2026 have a high non-call risk. If SMC decides to skip the call on its perps, it likely stands to pay higher coupons on most of its perps. For example, the coupon reset on its 6.5% Perp, callable in April 2024, is the 5Y Treasury plus a spread of 660.8bp, which translates to a coupon of ~10.8% based on current levels.

The company is said to be witnessing declining cash flows and high capital investments. Apart from the backdrop of rising rates which would lead to higher costs of funding, the report also notes that the perps’ extension risks are accentuated by ESG risks. Bloomberg Intelligence says that SMC’s coal exposure might make “refinancing on the dollar bond market tougher and more costly, as investors increasingly shun coal-fired power plants”. On the positive side, SMC Global was in compliance with its financial covenants as of June, with net debt-to-equity at 1x vs. a 3.25x covenant limit.

Go back to Latest bond Market News

Related Posts: