This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

South Africa Downgraded; SOEs Buy Stake in Evergrande from Strategic Inv; China Regulator Promises Zero Tolerance for Bond Market Violations

November 23, 2020

S&P closed lower by 0.7% and Nasdaq down 0.4% with IT, financials and industrials dragging the broader market lower on Friday. US 10Y Treasury yields were almost unchanged on Friday and the 2s10s curve flattened over the week by 5bp. This week sees preliminary durable goods data for October and the FOMC’s November minutes. US IG CDS spreads widened 2.5bp and HY spreads widened 11.9bp. EU main CDS spreads widened 0.9bp while crossover CDS spreads tightened 1.2bp. Asia ex-Japan CDS spreads were wider 1.7bp and Asian equities have opened the week higher ~0.7% today.

Bond Traders’ Masterclass – Two Days To Go

Sign up for the upcoming sessions on Bond Valuation & Risk on Wednesday, November 25 and Bond Portfolio Optimization & Risk in Perpetual Bonds on Thursday, November 26. These are part of the Bond Traders’ Masterclass across five sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

Register today to avail a 25% discount on the Masterclass package

New Bond Issues

Carnival Corp raised $1.45bn via a 5.25Y non-call 3.25Y (5.25NC3.25) bond at a yield of 7.625%, inside initial guidance in the mid-high 8%s. They also raised €500mn ($594mn) via a 5.25Y non-call 3.25Y (5.25NC3.25) bond at a yield of 7.625% %, inside initial guidance in the mid-high 8%s. The bonds are rated B2/B (Moody’s/S&P). Unlike its earlier issuances this year that were backed by its fleet of ships as collateral, the new issuance is unsecured. However, Bloomberg reported that the new bonds carry a guarantee and thus rank higher than its other unsecured debt but below its secured debt.

New Bonds Pipeline

- HDB 15Y up to S$900mn

- CALG $70mn 5.9% 5Y privately placed bonds

- IIX 4Y Women’s Livelihood bond

Rating Changes

- Fitch Downgrades South Africa to ‘BB-‘; Outlook Negative

- Moody’s downgrades South Africa’s ratings to Ba2, maintains negative outlook

- Spanish Telecom Operator Telefonica Downgraded To ‘BBB-/A-3’ By S&P On Weaker Leverage Prospects; Outlook Stable

- Moody’s downgrades Crown Resorts’ rating to Baa3 from Baa2, rating remains on review for downgrade

- Termocandelaria Power Ltd Outlook Revised To Negative By S&P On Expected Weaker EBITDA, ‘BB’ Ratings Affirmed

- Sotheby’s Outlook Revised To Stable From Negative By S&P, Ratings Affirmed On Consistent Anticipated Performance

- Moody’s changes Sotheby’s outlook to negative; rates add-on notes B1

- Guatemala ‘BB-‘ Long-Term Foreign Currency Rating Placed On CreditWatch Negative By S&P Following Dispute On Bond Payment

- Fitch Affirms Tata Motors at ‘B’; Outlook Negative; Withdraws Rating

The Week That Was

US primary market issuances rose 15% last week to $63bn with IG contributing $48bn and HY $15bn. Across North America, there were 49 upgrades and 62 downgrades across the three major rating agencies. EU G3 issuances were also higher by 24% at $34bn as compared to the week before. LatAm saw $13.9bn of deals priced, a sharp rise with Mexico raising $3.63bn in a dual-trancher. Gulf issuance rose significantly to $9.4bn dominated by Aramco’s $8bn five-trancher. The major highlight last week in Asian markets was China’s €4bn ($4.75bn) triple-trancher issuance which received orders 4.4x issue size, with the 5Y tranche being their first negative yielding sovereign bond. Barring China’s issuance, Asian issuances were muted, down 27% to $6.23bn compared to the week before. Asia ex-Japan dollar bond issuances were only at $1.19bn last week. Across the major rating agencies, there were 6 upgrades and 4 downgrades in total across Asia ex-Japan.

South Africa Downgraded By Moody’s and Fitch Further Into Junk; Affirmed by S&P

South Africa (SA) suffered a twin blow as both Moody’s and Fitch downgraded the sovereign’s rating by one notch each to push it further into junk while maintaining a negative outlook. While Moody’s downgraded SA’s rating to Ba2 from Ba1, pushing it two notches into junk, Fitch downgraded it to BB- from BB, pushing it three notches into junk. S&P also reported a rating action on the country in which it affirmed its ratings at BB- (three notches into junk). This was the second downgrade by both Moody’s and Fitch this year. Moody’s had lowered the nation’s rating to Ba1 from Baa3 in March and Fitch had lowered the rating to BB from BB+ in April. According to Moody’s, the pandemic shock could lead to a higher debt burden and a lower debt affordability for the nation. It said, “The key driver behind the rating downgrade to Ba2 is the further expected weakening in South Africa’s fiscal strength over the medium term.” Fitch echoed the sentiment and sighted rising government debt amid the ongoing pandemic as the trigger for the downgrade. According to Fitch, “The pandemic has severely hit South Africa’s economic growth performance, and GDP is expected to remain below 2019 levels even in 2022.”

S&P affirmed the sovereign’s rating based on the fact that the nation’s economy had begun to rebound in Q3 after suffering the sharpest economic decline in Q2 which led to widening of the fiscal deficit and rising government debt. S&P had also downgraded the nation to BB- from BB in April this year. The economy had shrunk 17% YoY in 2Q2020. Unlike the other two rating agencies, S&P maintained a stable outlook on the country as it felt that the country had a stable central bank and acknowledged the flexible exchange rate, actively traded currency, and deep capital markets which had the potential to counterbalance low economic growth.

The key metrics as predicted by the three rating agencies are as follows.

South Africa’s 8.25% 2032‘s were up by 0.02, trading at 89.4 cents on the dollar. Its 6.3% 2048‘s were up 0.27 and were trading at 102.9. The rating actions came after the markets closed on Friday and the bond prices would be exposed to the market sentiment today.

For the rating action by Moody’s, click here, for the rating action by Fitch, click here and for the rating action by S&P, click here

China Regulators Promise Zero Tolerance For Bond Market Violations

After the onset of defaults from YongCheng Coal, Brilliance Auto and Tsinghua Unigroup, China’s financial regulators pledged to take a “zero tolerance” approach to violations in the bond market. Particularly in the case of Yongcheng Coal, regulators have been investigating securities firms and banks for any wrongdoing and misbehaviour in connection with Yongcheng Coal’s default. “The recent increase in default cases is the result of a combination of cyclical, institutional and behavioural factors… We must investigate and deal with fraudulent issuance, false information disclosure, malicious transfer of assets, misappropriation of issued funds and other illegal activities, and severely punish all kinds of debt evasion to protect the legitimate rights and interests of investors” according to a meeting summary of the State Council’s financial stability committee as per Bloomberg. Emphasis was placed on investigating hidden risks, maintaining ample liquidity and protecting the bottom line to prevent systemic risks. The committees’ meeting also focused on deepening reforms of SOEs to improve operational quality and efficiency.

For the full story, click here

Evergrande Gets $4.6 Billion Help from State Firms Say Sources; Services Arm Launches IPO

Firms owned by the local governments of Shenzhen and Guangzhou will buy equity worth CNY 30bn ($4.6 billion) from existing investors in Hengda Real Estate according to sources as the information is not public yet. Hengda is a unit of Evergrande that holds the developer’s main property assets in China. The sources say that the buyers of equity are Shenzhen Talents Housing Group Co. and Guangzhou City Investment Company Ltd., while the sellers include a consortium led by Shandong Hi-Speed Group Co., Hengda’s largest strategic investor. The news comes after Evergrande scrapped its Shenzhen listing plan earlier this month after a majority of the strategic investors agreed not to ask for repayment of debts. Hengda’s 11.5% bonds due 2022 are up 0.07 to 86.26 cents on the dollar on the secondary markets.

In related news, Evergrande Property Services, the property management services arm of Evergrande is launching a HK$15.8bn ($2.04bn) IPO – 1.62 billion shares at an indicative price range of HK$8.5 – HK$9.75 ($1.10 – $1.26), equally splitting them between existing and newly issued shares, it said in an online media briefing. The IPO also comes with a greenshoe option which if exercised, could raise as much as HK$18.17bn ($2.35bn). The IPO can help the parent company Evergrande pare back its debt pile of ~$122bn. The IPO along with the sale of a 28% stake in the property management company to 14 investors in August, could raise almost HK$40bn ($5.16bn) for Evergrande, according to SCMP. Evergrande’s dollar bonds are slightly higher in trade today – its 8.9% 2021s are up 0.1 points to 95.6 and its 10.5% 2024s are up 0.2 points to 79.88 cents on the dollar.

CCI Approves Reliance-Future Retail Deal

The Competition Commission of India (CCI) approved the Reliance Retail–Future Retail deal. The statement read “CCI approves acquisition by Reliance Retail Ventures Limited (“RRVL”), Reliance Retail and Fashion Lifestyle Limited (“RRVL WOS”) of the retail and wholesale undertaking and the logistics and warehousing undertaking of the Future Group under Section 31(1) of the Competition Act, 2002”. The deal will see six companies being merged with Future Enterprises, including Future Consumer Limited, Future Lifestyle Fashions Limited, Future Retail Limited, Future Market Networks Limited, Future Supply Chain Solutions Limited, and Futurebazaar India Limited (FIL) and its subsidiaries. These entities aka transferor companies will then be transferred to Reliance Retail. The approval by the CCI comes after Amazon had requested the CCI and SEBI, the regulator of the securities market in India, to consider Singapore International Arbitration Centre’s order and block the deal. Future Retail’s 5.6% dollar bond due 2025 rose 3.5 points to 75.25, yielding 13.6%

For the full story, click here

L Brands Swings to Profits in 3Q

L Brands, the parent of Victoria’s Secret reported quarterly earnings with net income at $330.5mn as compared to a $251.9mn loss in the same quarter last year. This translated into an EPS of $1.17/share as compared to a loss per share of $0.91 in the same quarter last year. Revenue rose to $3.06bn, from $2.68bn a year ago with same-store sales up 28% in the quarter. “L Brands reported a record third quarter, driven by exceptional results and continued strength at Bath & Body Works, and a significant improvement in performance at Victoria’s Secret,” the CEO said. L Brands’ 6.875% bonds due 2035 are up 4% over the last three days to 108.13 and its 5.25% bonds due 2028 are up 2% over the same period to 102.64.

For the full story, click here

Abu Dhabi Unveils 22 Billion Barrel Discovery & $122 Billion Capex for 2021-2025

The Supreme Petrol Council (SPC) announced on Sunday the discovery of recoverable unconventional onshore oil resources, estimated at 22bn stock tank barrels (STBs) and a 2bn STB increase in conventional oil reserves in the Emirate of Abu Dhabi. The SPC also approved Abu Dhabi National Oil Company (ADNOC)’s capital expenditure plans of AED 448bn ($122bn) for 2021-2025. As per the plan, ADNOC plans to drive back AED 160bn ($43.6bn) into the United Arab Emirates’ economy, enabled by its In-Country Value (ICV) program “which is aimed at nurturing new local and international partnerships and business opportunities for the private sector, fostering socio-economic growth and creating job opportunities for Emiratis” as per the press release. At the same meeting, the SPC gave approval for ADNOC to award exploration blocks in Abu Dhabi’s second competitive block bid round which was launched in 2019. Abu Dhabi’s 3.125% bonds due 2030 traded up by ~0.1 point to 113.45 while its 2.7% bonds due 2070 traded lower by 0.7 points to 96.83 on the secondary markets.

For the full story, click here

Malaysia Airlines’ Looks for Support from Sovereign Wealth Fund

Malaysia Airlines is seeking support from the country’s sovereign wealth fund Khazanah to tide over its financial difficulties. “Malaysia Aviation Group has requested financial support from our shareholder Khazanah Nasional although the company isn’t in a position to comment on amount at this point in time,” according to the company.

The company, which has been forced to seek a restructure after the pandemic shock left the entire airline industry without business is struggling with its restructure plans as some of its creditors have rejected a proposal to restructure its MYR16 bn ($3.85 bn). The company had warned in October that it faced a cash crunch unless funded by Khazanah and was unlikely to be able to make payments that are due after November. Shortly afterwards, the Malaysian finance minister said that the government would not provide relief to the national airline if the rescue talks with the lessor failed. The company has taken many steps to reduce costs including pay cuts for management and pilots, sending staff on unpaid furloughs, etc. but its financial woes continue. Khazanah had taken over a 69% stake in Malaysia Airlines in 2001 after the Asian financial crisis and completed a full takeover in 2014 after the disappearance of flight MH370 and shooting down of MH17 over Ukraine. Khazana’s 3.035% bonds maturing in 2021 were trading at 100.4 on the secondary market.

For the full story, click here

Term of the Day

Petroyuan

Petroyuan are Yuan denominated oil futures contracts. These are listed in the Shanghai International Energy Exchange. China, seeking to promote international use of the yuan, has made cultivating the “petroyuan” a central part of its currency strategy, according to Nikkei. With the petroyuan market growing, Saudi Aramco is planning to float Yuan denominated bonds as compared to its current dollar bond issuances, according to a recent prospectus filing. As oil transactions are usually settled in dollars, many oil-producing nations have pegged their own currencies to the dollar. An issuance of Yuan bonds by Aramco would give the currency’s stature a substantial boost, as well as diversify funding sources for Aramco.

Talking Heads

Jack McIntyre, fund manager at Brandywine Global Investment Management

“There’s a big war going on in bonds,” said McIntyre. “With the vaccine news bonds should be selling off, but that hasn’t held. The market’s expectations for Fed action is what is keeping bonds from selling off.”

Elaine Kan, a portfolio manager at Loomis Sayles & Co

“People are nervous about the virus with a lot of states imposing partial lockdowns and school closings,” said Kan. “So yields are probably going to be rangy and the more we have negative headline news, the flatter the curve will be.”

Xu Lin, former official at the National Development and Reform Commission

“This is just the beginning, and the problem will continue to spread.” “We have invested in too many projects through debt financing, and many projects can’t generate enough economic returns to repay the debt. It’s only a matter of time for defaults to emerge.”

Julian Evans-Pritchard, senior China economist at Capital Economics

“The fact that Yongcheng Coal, the biggest firm to default this month, had a AAA rating highlights the extent to which the pricing of credit risk remains heavily distorted by the assumption of state support,” he wrote.

On vaccine hopes clearing path for riskier groups to tap capital markets

James Durance, European high yield portfolio manager at Fidelity International

“The bond market is definitely quite hot now and has taken the vaccine headlines from Pfizer and Moderna very positively at least in thinking about credit risk,” said Durance, adding that it had become easier for low-rated issuers to come to market.

Dominic Ashcroft, co-head of EMEA leveraged finance at Goldman Sachs

Prior to the vaccine announcements, deals for companies including Boparan “would have been more challenging to get done or wouldn’t get to the pricing levels that we’ve seen . . . This week they got a better level than they would have got two weeks ago.”

Sergey Goncharov, a fund manager at Vontobel Asset Management

“Before the second wave of Covid, markets were open for EM borrowers, but not en masse,” said Goncharov. The vaccine developments have made investors “way more comfortable buying into these riskier names,” he added. “Portfolio managers have accumulated so much cash, and they are looking for places to put it to work.”

On UK to unveil record 400 billion-pound borrowing plan next week – in a note by Citi economists

“Events next week might… prove an important prelude for a pivot to a tighter fiscal approach in the spring budget,” Citi economists wrote.

On emerging markets looking to 2021 as Goldman adds to bullish calls

In a report by Andrew Tilton, Kamakshya Trivedi and team, Goldman Sachs analysts

Investors should “move into pro-cyclical positions heading into year-end instead of waiting for economic data to turn more meaningfully,” the analysts wrote. The market is likely to “defer difficult questions around vaccine production and distribution for later.”

Paul Greer, money manager at Fidelity International

“EM debt still offers attractive risk premium for bond investors that cannot be ignored in an increasingly income-hungry, low inflation and low interest-rate world,” Greer said. “The story into 2021, however, remains clouded and much will depend on the evolution of the virus-versus-vaccine trajectory.”

On the possibility of the worsening pandemic in the US halting the vaccine rally – according to analysts at Oxford Economics.

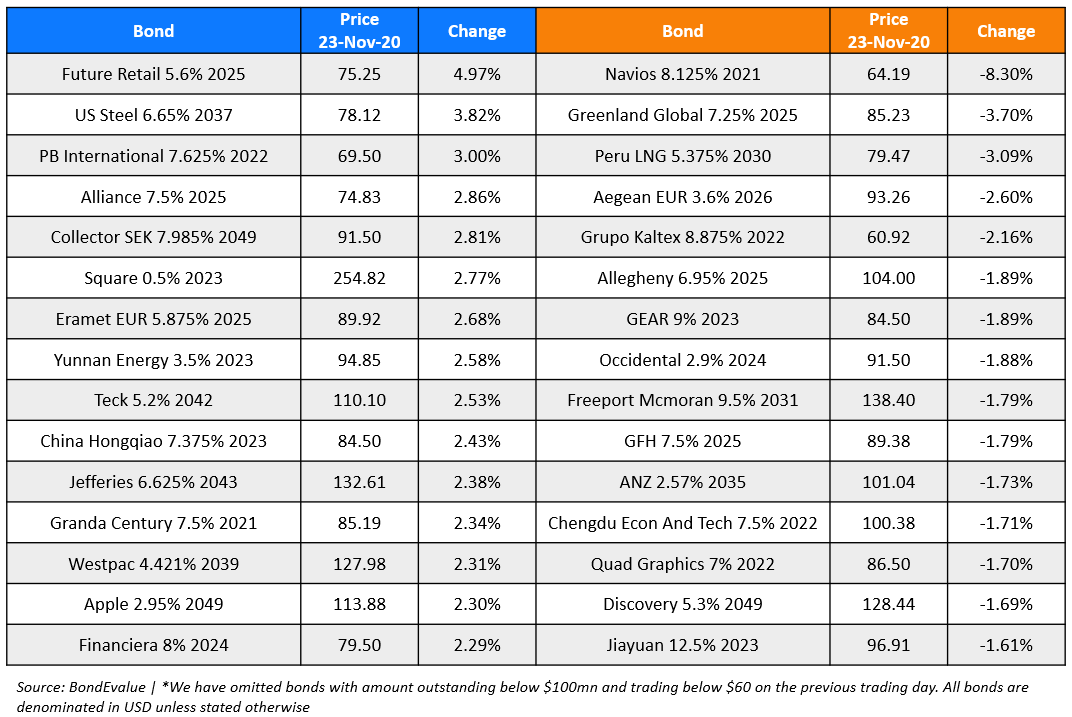

Top Gainers & Losers – 23-Nov-20*

Other Stories:

Go back to Latest bond Market News

Related Posts: