This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

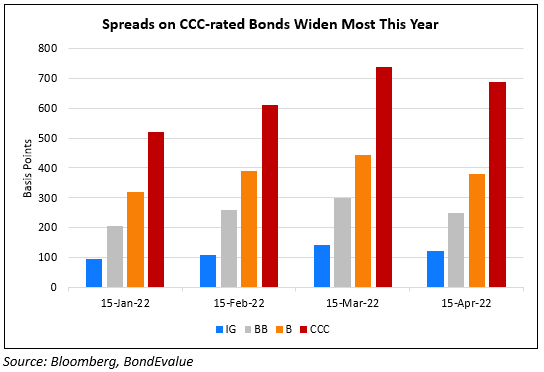

Spreads on Riskiest High Yield Bonds Widen by Most YTD

April 20, 2022

Spreads on US CCC-rated bonds have widened 125bp YTD in 2022 vs. compared to 57bp for BB-rated debt and 69bp on average for all junk bonds, according to Bloomberg data. Whilst a multitude of factors including rising inflation and interest rates, the Russia-Ukraine conflict have been widening spreads this year, the CCC space generally includes companies that have large debt levels as compared to earnings or with low free cash flows. The earnings season has begun and unlike prior quarters, Q1 2022 has seen a soft start by US banks and companies. How this augurs for the riskiest junk-bond category remains to be seen.

Go back to Latest bond Market News

Related Posts: