This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

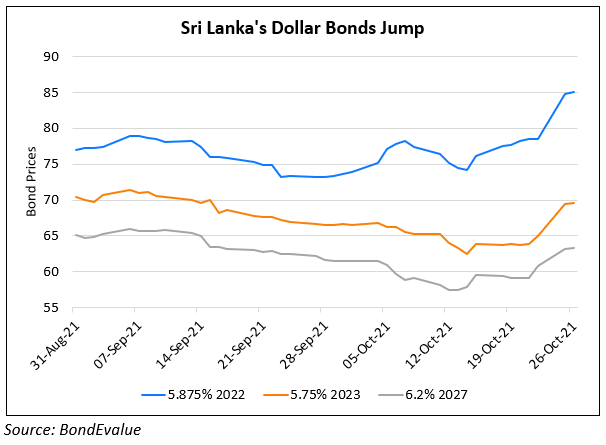

Sri Lanka Allocates $500mn for January Bond Payment

January 6, 2022

Sri Lanka’s central bank said it has allocated $500mn to repay its 5.75% dollar bond maturing on January 18, 2022. Sri Lanka repayments of ~$4.5bn in 2022 and has forex reserves worth $1.6bn at end-November. Media company CNA said that the low levels of forex reserves forced the central bank to draw on a $1.5bn yuan swap from China, to lift its reserves to $3.1bn at the end-December. Central bank Governor Ajith Nivard Cabraal said in a tweet, “CBSL has allocated the required #Forex for the USD 500 million #ISB that is maturing on 18 Jan 22. It’s a shame that some #investors lost out becoz of organized negative stories spread by certain vested interests.”

Sri Lanka’s dollar bonds were slightly lower with its 7.55% 2030s down 0.57 points to 51.31.

For the full story, click here

Go back to Latest bond Market News

Related Posts: