This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sri Lanka Scraps $1.5bn Bond Buyback

October 12, 2021

The Sri Lankan central bank on Monday said that it has scrapped plans to buy back $1.5mn of its dollar sovereign bonds given the tepid interest from bondholders at the current discounted prices. The central bank said, “It is clear that the large majority of ISB holders are not ready to part with the bonds unless prices are at par or closer to par. Hence, a buy-back initiative will also not result in any significant price or coupon benefit to the issuer.” Sri Lanka has $1bn of dollar bonds due for redemption in July 2022 and $4.2bn due in all of 2022. Against this, the island nation has foreign exchange reserves of just $2.58bn as at end-September. As per Trisha Peries, head of economic research at Frontier Research, the tepid response to the buy back could be a decision to wait for a possible restructuring that could lead to higher bond prices, as has been the case for sovereign dollar bonds of Argentina and Ecuador post restructuring.

Sri Lanka’s 5.875% 2022s traded over 2 points lower to 75.41, yielding 46.9% currently. Its 5.75% bonds due in January 2022 also trade 2 points lower to 90 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

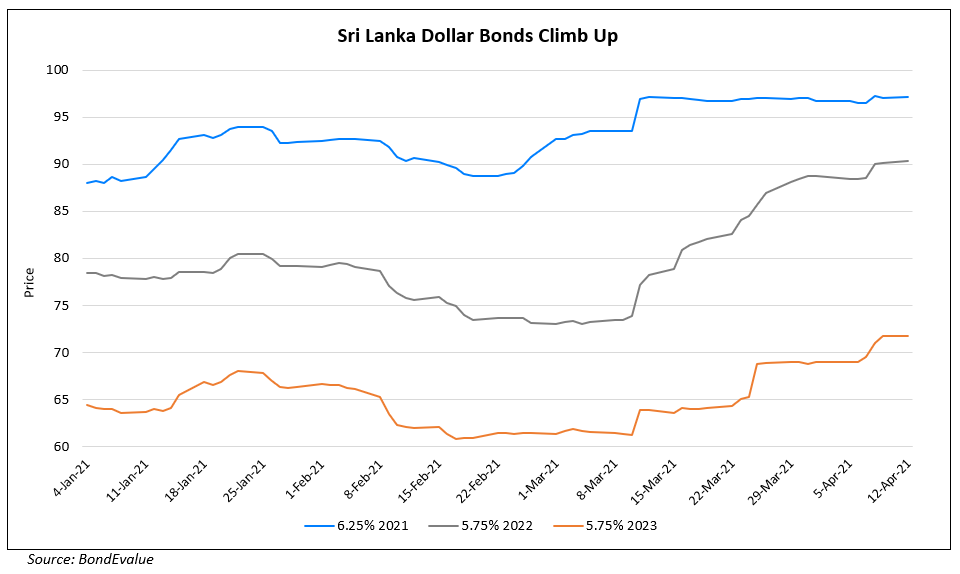

Sri Lanka’s Bonds Trend Higher

April 12, 2021

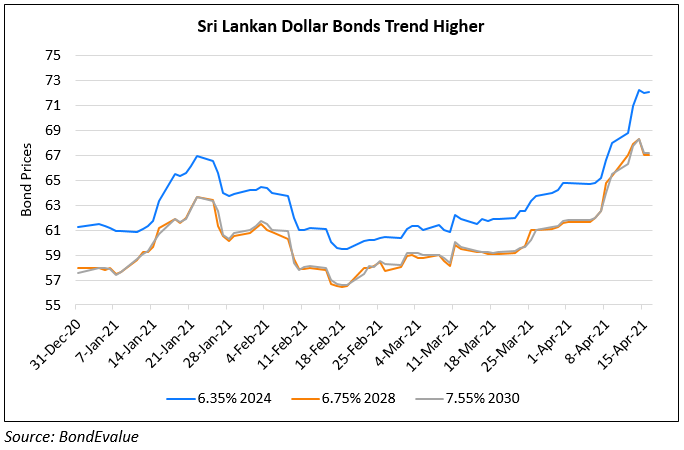

Sri Lanka’s Dollar Bonds Trend Up 10-15% Over a Month

April 16, 2021

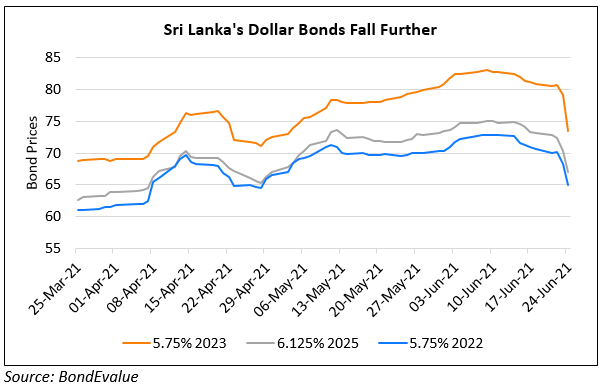

Sri Lanka’s Bonds Dip Further As July Maturity Looms

June 24, 2021