This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sri Lanka’s Dollar Bonds Drop as Default Fears Rise

April 5, 2022

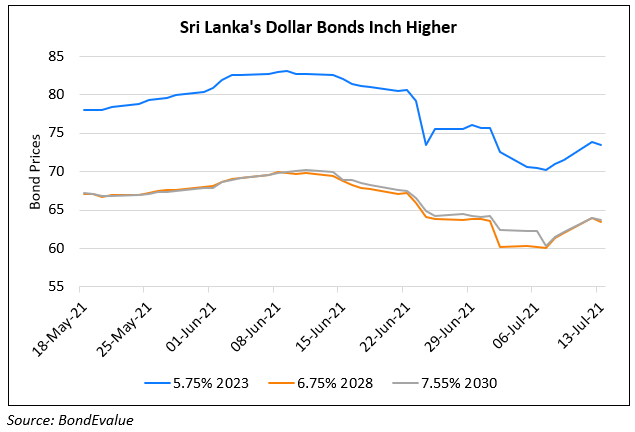

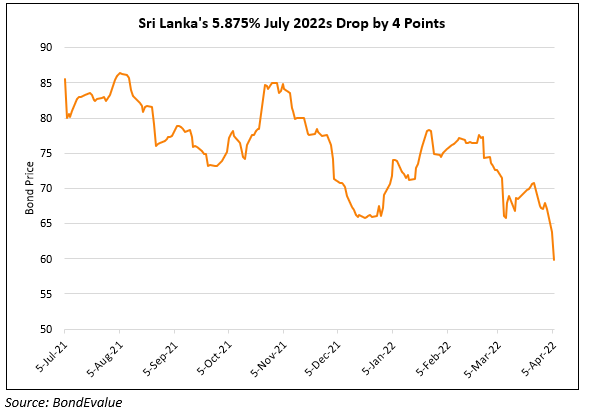

Sri Lanka’s dollar bonds dropped 2-4 points as default fears rose amid the economic crisis that the country is facing. In particular its near term bonds due July 25, 2022 dropped 4 points evidencing the negative sentiment. With 26 cabinet ministers resigning and protests taking place due to inflation, shortages of essentials and declining forex reserves, Bloomberg notes that ‘investors are getting more and more convinced Sri Lanka will have trouble honoring its debt’. This occurs despite Sri Lanka’s expected IMF talks in April and credit facilities from India and talks of one from China in March. President Gotabaya Rajapaksa swore in a new finance minister, Ali Sabry on Monday.

Pat Curran, an economist at Tellimer said, ““Default was inevitable before the political turmoil, but it reduces the likelihood that the government will be able to secure an IMF program and engage with bondholders in the near-term. The prospect of broader political and social unrest also increases downside risks and could lead to higher exit yields and lower recovery values.”

Go back to Latest bond Market News

Related Posts: