This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (11 July – 16 July, 2022)

US primary market issuances rose to $6.4bn vs $2.3bn in the previous week. IG issuances stood at $6.4bn vs $1.7bn in the week prior, led by PG&E Wildfire Recovery Funding, which raised $3.9bn through a five-trancher, followed by PepsiCo that raised $2.5bn in a three-tranche deal. There were no HY issuances last week compared to $375mn in the week prior. In North America, there were a total of 26 upgrades and 43 downgrades across the three major rating agencies last week. Following a $5.79bn outflow from US IG funds in the prior week, withdrawals continued with $2.99bn in outflows for the week ended July 15 as per Lipper data, extending the longest losing streak on record to sixteen straight weeks now. HY funds also saw $652mn of outflows, following a $889.2mn inflow in the week prior. LatAm’s primary markets were muted last week vs. $711mn in the week prior. In South America, there were 7 upgrades and 5 downgrades across the major rating agencies. EU Corporate G3 issuance saw a 61.8% decrease to $8.9bn vs $23.3bn in the week prior – BPCE SA raised $1.74bn to lead the table, followed by Deutsche Bank which raised $1.29bn. Across the European region, there were 43 upgrades and 25 downgrades across the three major rating agencies. Issuance from the GCC G3 region was also muted vs. $1.7bn in the week prior. Across the Middle East/Africa region, there were no upgrades or downgrades across the three major rating agencies. APAC ex-Japan G3 region issuances declined to $1.3bn vs $14bn in the week prior – Korea Housing Finance Corp raised €503mn, followed by Fujian Zhanglong Group raising $500mn. In the APAC region, there were no upgrades and 5 downgrades combined across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

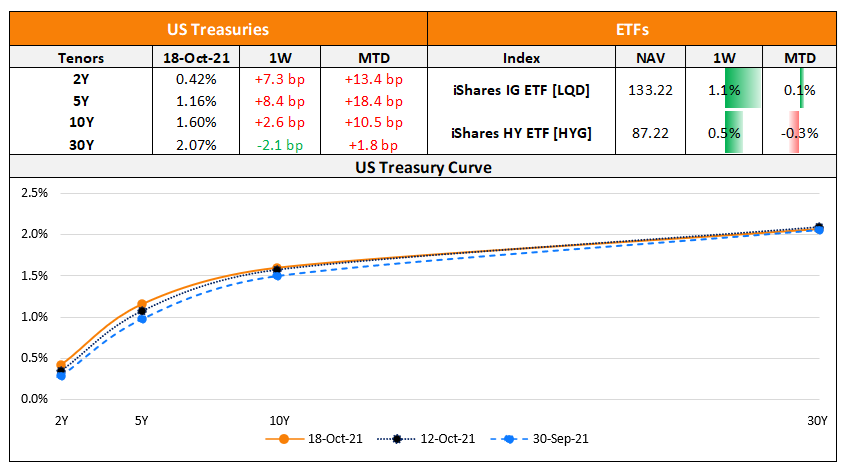

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

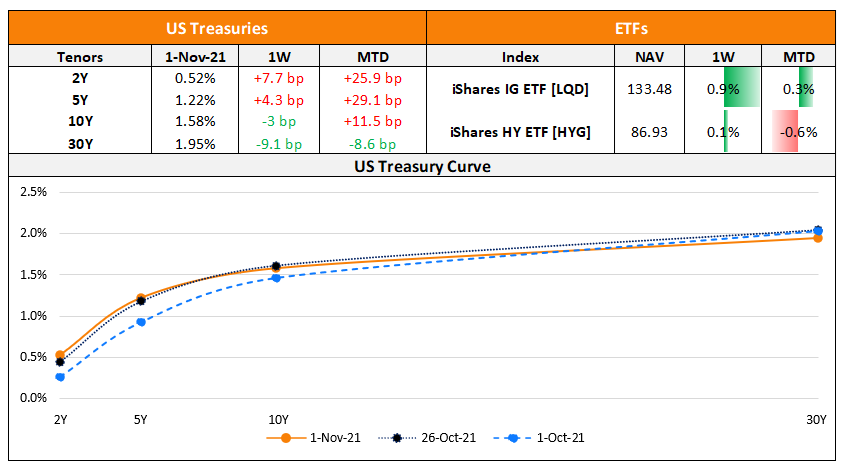

The Week That Was (25 – 31 Oct)

November 1, 2021