This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was – (16th -22nd Aug)

August 23, 2021

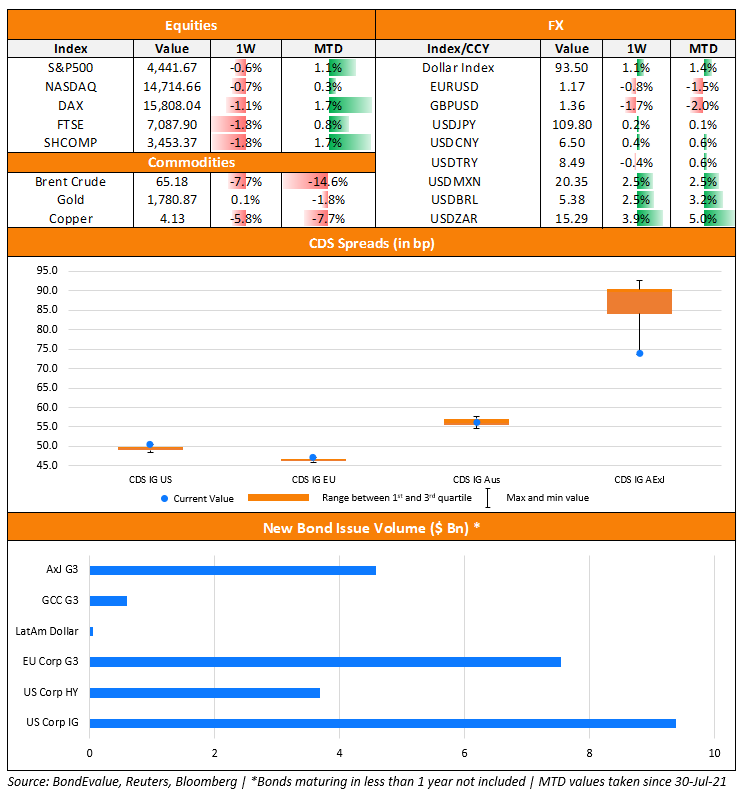

US primary market issuances fell sharply to $13.7bn vs. $46.6bn in the week prior. IG issuances fell to $9.4bn vs. $32.1bn in the prior week while HY issuances were lower at $3.7bn vs. $14.4bn in the prior week. The IG space was led by Athene Global Funding’s $1.25bn three-part deal and Pfizer’s $1bn issuance. In the HY space, Southwestern Energy’s $1.2bn issuance led the table followed by Multiplan raising $1.05bn. According to Bloomberg, US high yield primary market issuance is expected to be quiet until after the Labor Day weekend (September 6). In North America, there were a total of 43 upgrades and 13 downgrades combined across the three major rating agencies last week. LatAm saw just one $50mn deal last week by Scotiabank Chile as compared to no issuances in the prior week. EU Corporate G3 issuances dropped to $7.5bn vs. $8.9bn in the week prior – KfW’s €5bn deal, Swedbank’s $500mn PerpNC8 AT1 and Deutsche PBB’s €500mn deal led the tables. Across the European region, there were 17 upgrades and 10 downgrades across the three major rating agencies. The GCC G3 issuance saw $603mn in deals as compared to just one $200mn deal in the week before that – led by HSBC Bank Middle East’s $475mn two-part deal. Across the Middle East/Africa region, there was 1 upgrade and 2 downgrade across the three major rating agencies. APAC ex-Japan G3 issuances rose to $4.6bn vs. $2.6bn in the prior week – India’s largest private lender HDFC Bank raised $1bn via a debut PerpNC5 at 3.7% and Baidu raised $1bn via a dual-trancher debut sustainability offering, leading the tables. These were followed by Shandong Gold Group’s $600mn deal, China Jianyin Investment’s $500mn deal and Anhui Transportation’s $400mn deal. In the Asia ex-Japan region, there were 8 upgrades and 7 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts: