This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (30 May – 05 June, 2022)

US primary market issuances last week were at a $16.5bn vs. a mere $881mn in the week prior with Investment grade (IG) corporates issuing $9.8bn of deals and high yield (HY) saw $6.4b in deals. The largest IG deals were led by John Deere raising $1.5bn via a two-trancher and Liberty Financial’s $1bn issuance. HY deals were led by Tenet Healthcare’s $1.8bn deal and Kinetik Holdings’ $1bn deal. In North America, there were a total of 41 upgrades and 27 downgrades combined across the three major rating agencies last week. US bond funds saw their first net weekly inflows in the week ended June 1, after five months of outflows. According to Lipper, investors purchased a net $7.09bn in US bond funds in the week. Majorly, HY bond funds saw $5.61bn in weekly inflows, its biggest since June 2020. LatAm saw no issuances for a second consecutive week. In South America, there was 1 upgrade and 9 downgrades across the major rating agencies. EU Corporate G3 issuance dropped to $23.6bn vs. $40bn in the week prior led by HSBC’s $2.5bn two-trancher and Volkswagen’s $2bn dual-trancher. Across the European region, there were 13 upgrades and 16 downgrades across the three major rating agencies. The GCC G3 region saw just one deal, a $350mn issuance by Arada Development via a debut sukuk. Across the Middle East/Africa region, there was 1 upgrade and 2 downgrades across the three major rating agencies. The APAC ex-Japan G3 region saw $6.9bn in deals vs. $7.9bn in the week prior – NAB raised $2.5bn via a three-trancher, Westpac raised $1.2bn via a 5Y and KB Kookmin Card raised $400mn via a 3Y sustainability bond. In the APAC region, there was 1 upgrade and 9 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

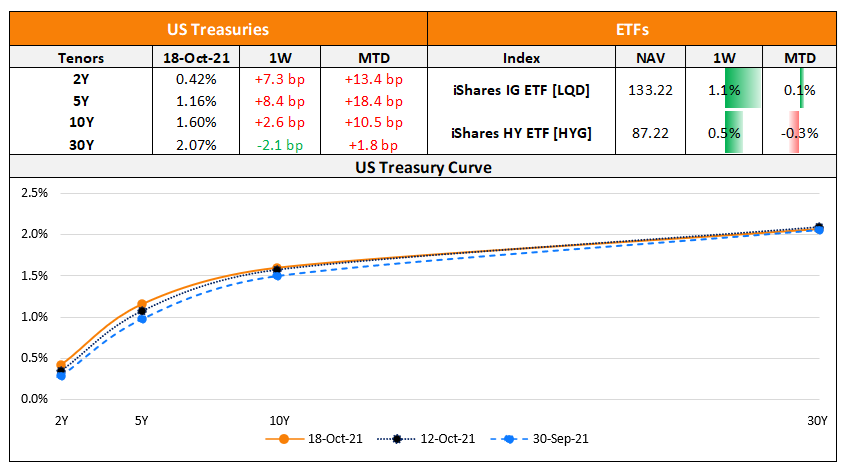

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

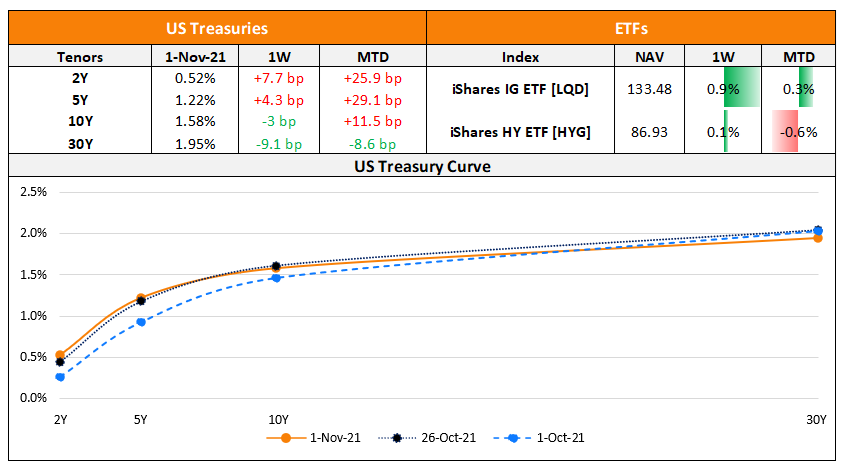

The Week That Was (25 – 31 Oct)

November 1, 2021