This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (3rd – 9th Jan)

January 10, 2022

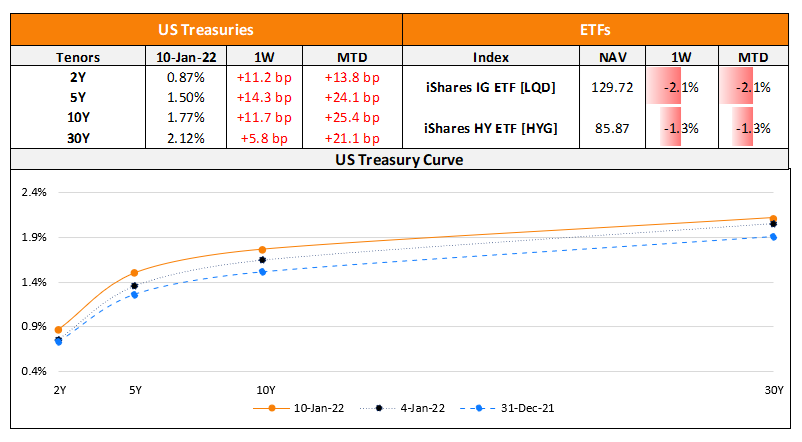

US Treasury yields saw a massive jump to start the year with the 10Y yield up 25bp. The curve has steepened with the 2s10s up 11bp to 90bp. The moves come alongside the FOMC’s minutes that showed that the Fed may need to raise interest rates “sooner or at a faster pace” than officials had initially anticipated. US primary markets issuances total $29bn in the prior week. IG issuances were at $22.8bn in the prior week and HY issuances were at $4.1bn in the prior week. The IG space was led General Motors that raised $2.55bn via a three-trancher followed by John Deere’s $1.8bn two-trancher to lead the gainers list. In the HY space, Ford Motors raised $2bn via a dual-trancher and Royal Caribbean raised $1bn to lead the gainers. In North America, there were a total of 14 upgrades and 12 downgrades combined across the three major rating agencies last week. LatAm saw $5bn in issuances in the week prior led with Mexico raising $4.1bn via a two-trancher and Banco do Brasil’s $500mn deal. In South America, there were no upgrades or downgrades across the major rating agencies. EU Corporate G3 issuances were at $40bn led by KfW’s $5bn issuance, Deutsche Bank’s and UBS’s $3bn two-trancher. The week also included two AT1s issued – UBS’s $1.5bp PerpNC5 priced at 4.875% and Credit Agricole’s $1bn PerpNC7 priced at 4.75%. Across the European region, there were 2 upgrades and 4 downgrades across the three major rating agencies. GCC G3 issuances were at $420mn last week with Abu Dhabi Commercial Bank and QNB raising $270mn and $150mn. Across the Middle East/Africa region, there were no upgrades or downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $17.8bn despite no Chinese property issuances. NAB and Nomura raised $4.75bn via a five-part and three-part deal followed by Reliance and AAHK raising $4bn via a three-part and four-part deal respectively. In the Asia ex-Japan region, there were 2 upgrades and 1 downgrades combined across the three major rating agencies last week.

.png)

Go back to Latest bond Market News

Related Posts:

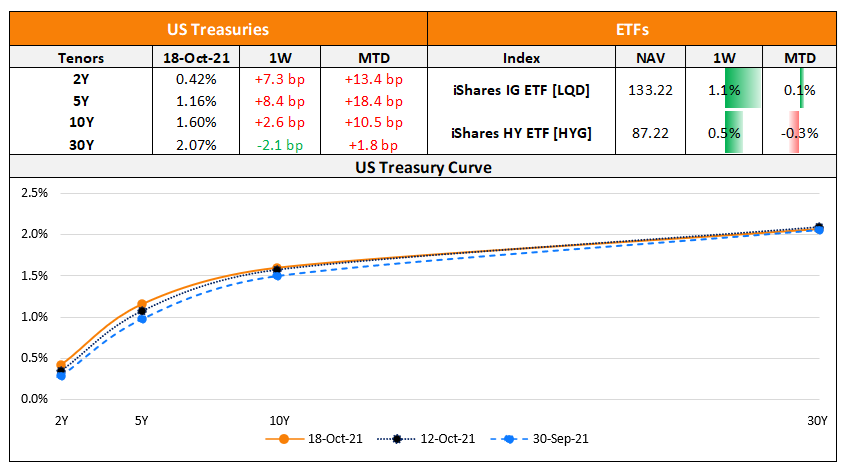

The Week That Was (Oct 4th – 11th)

October 11, 2021

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

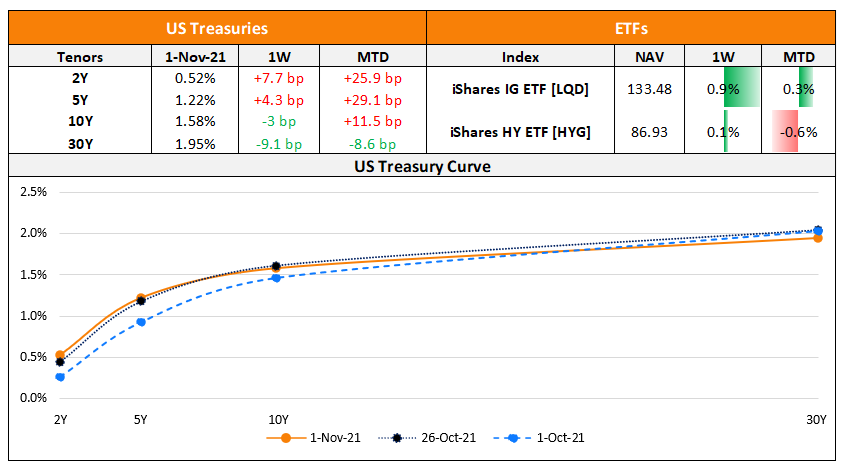

The Week That Was (25 – 31 Oct)

November 1, 2021