This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Three Chinese state-owned Developers to Issue ~$1.3bn in Interbank Market as Rules Ease

November 16, 2021

Three Chinese state-owned developers namely China Merchants Shekou Industrial Zone Holdings, Poly Developments & Holdings and Bright Real Estate Group received approval to sell a combined RMB 8.6bn ($1.3bn) of local bonds on the interbank market this week.

- China Merchants Shekou plans to raise RMB 6bn ($940mn) via a three-trancher this week; this alone would be higher than its total interbank bond sales YTD

- Poly Developments to raise RMB 2bn ($310mn) worth of local bonds this week

- Bright Real Estate plans to raise ~ RMB 580mn ($91mn) in a 3Y note

All three prospective issuances aim to refinance maturing debts. If the issuances are successful, Bloomberg notes that it would be the largest in eight months. “Such a big size of one-time issuance is indeed rare… It sends out an ice-breaking signal that policy makers want to shore up market confidence, and given the better quality of the developers, coupon rates will be low with the support from banks”, said Yang Hao, fixed income analyst at Nanjing Securities Co.

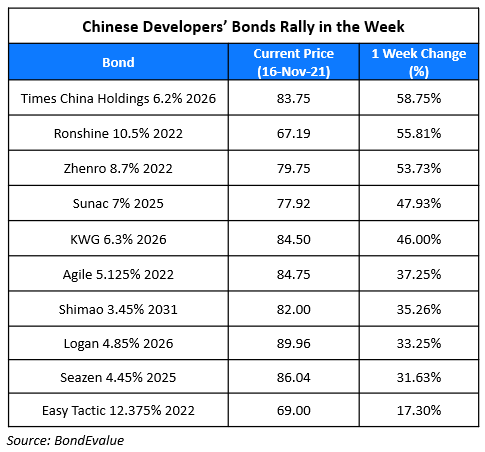

The planned issuances come on the back of news of loosening rules regarding local-currency issuances, leading to a relief rally across Chinese property developers’ bonds. Below is a list of price changes in some of the developers’ bonds.

For the full story, click here

For the full story, click here

Go back to Latest bond Market News

Related Posts: