This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

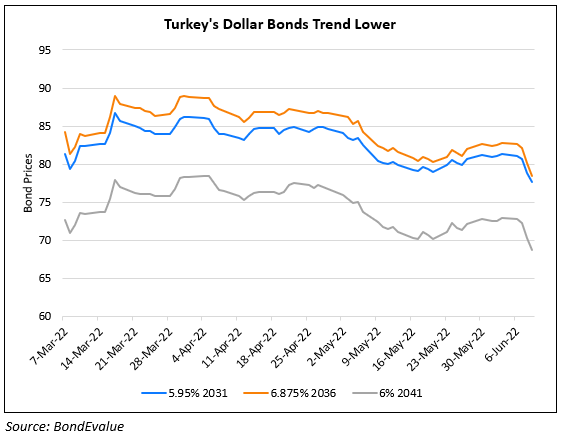

Turkey Cut to B3 by Moody’s

August 15, 2022

Moody’s has downgraded Turkey from B2 to B3, with a stable outlook as the pressure on Turkey’s balance of payments has risen due to higher energy prices. Moody’s expects Turkey’s current account deficit (CAD) at ~6% of GDP for the current year, over 3x higher than expected prior to the Russia-Ukraine war in February, and even higher than last year’s deficit of 1.7% of GDP. The rating agency also sees pressure on the exchange rate and forex reserves. For 2022, external financing needs are high at around $250bn or 34% of GDP. Moody’s estimated that refinancing needs stand at around $128bn or 17% of GDP, mainly owed by the private sector. Inflation is also extremely high at 79.6% in July. The rating agency expects inflation to stay at elevated levels of ~70% through 2022. The Turkish lira (TRY) has depreciated ~30% against the dollar this year, and 45% over the last two months of 2021, triggered by several interest rate cuts. The rating agency sees an economic slowdown in 2H and in 2023 with expected real GDP growth of 4.5% and 2% for 2022 and 2023 respectively; further, a risk of a sharper slowdown is material. Turkey’s public finances are also expected to be weakened this year as high inflation will add ~1.2% of GDP in interest payments vs. last year. Moody’s believes debt affordability is deteriorating, with the ratio of interest payments to revenue expected to rise to 10.2% this year, the highest level since 2010.

Turkey’s 5.75% dollar bonds due in 2047 are trading lower at 66.79, down by 0.61 points to yield 9.16%.

Go back to Latest bond Market News

Related Posts: