This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Turkish Dollar Bond Yields Rise Further Across the Curve on Election Risk

May 18, 2023

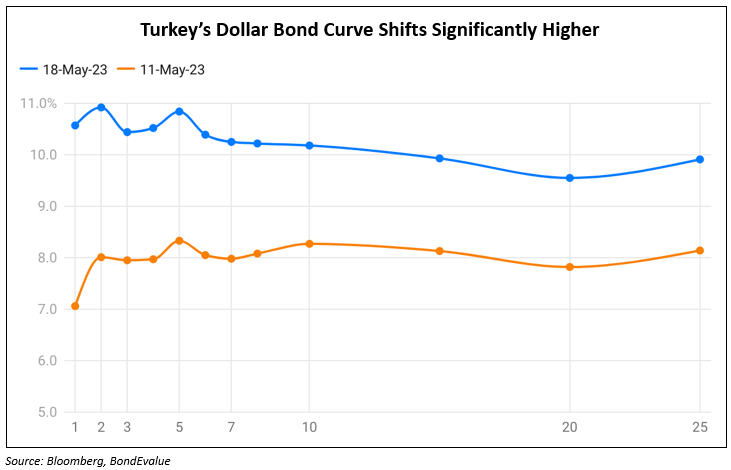

Yields on Turkey’s dollar bonds have risen significantly across the curve on expectations that the President Erdogan will likely hold power following the May 28 run-off election. Markets had not expected Erdogan to garner the number of votes that he actually did. Thus, analysts note that Erdogan has the momentum and thereby, a stronger chance of winning the second round. This comes after neither Erdogan nor his rival, Kemal Kilicdaroglu secured an outright majority in the first round. Erdogan won 49.5% of the votes while Kilicdaroglu got just under 45% support.

In the chart below, we note that Turkey’s dollar bond yields have moved higher by over 250bp front-end of the curve and back-end yields have moved over 170bp higher. Dollar bond yields up to the 10Y segment are now yield over 10%.

Go back to Latest bond Market News

Related Posts: