This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

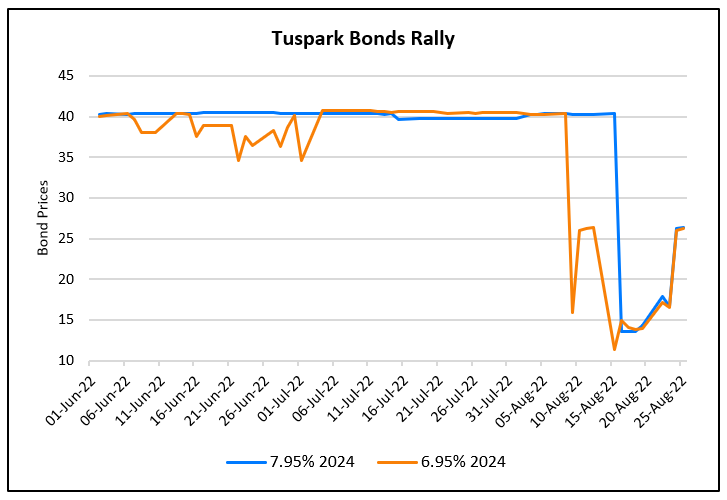

Tuspark Bondholder Group to Reject Bond Extension Proposal

August 26, 2022

A bondholder group in Tuspark Forward’s bonds plans to reject the company’s second payment extension proposal, as per Bloomberg. This week, Tuspark launched a consent solicitation for two of its dollar bonds on which it missed payments in August. The bondholder group members hold more than 25% of both dollar bonds’ principal and are represented by financial adviser Alvarez & Marsal. The proposal requires at least 66% of outstanding amount of bonds to have a consent for a meeting and 75% of votes in favor of proposal. Tuspark had not communicated with bondholders in advance about the consent solicitation terms and the bondholder group’s members said that they wanted transparent negotiations for a debt restructuring plan.

Tus’s dollar bonds 7.95% 2024s were at 26.5 cents on the dollar and its 6.95% 2024s were at 26.75 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Tus-Holdings’ Bondholders Approve Debt Extension Plan

August 17, 2021

Azul plans to Buy 100% of LATAM Airlines

November 3, 2021