This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

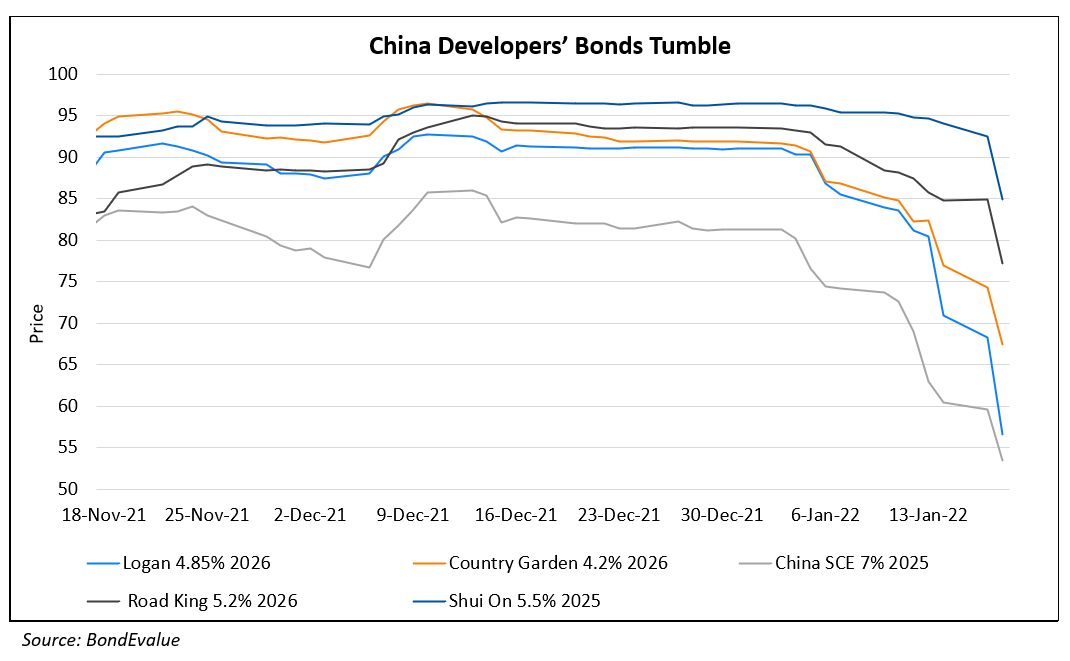

Undisclosed Debt at Logan Group Sparks Another Selloff In Developers’ Bonds

January 18, 2022

Chinese property developers’ bonds took another beating on Monday led by Logan Group, whose bonds fell ~15 points after Debtwire reported that the developer could have $812mn worth of hidden guarantees on outstanding debt obligations through 2023. While Logan denied the Debtwire report and speculation that it had privately sold debt, most of its dollar bonds fell to ~55-60 levels from ~90 levels in early January. The selloff was driven by investor concerns over transparency at China’s higher-rated developers (Logan BB/Ba2/BB, Country Garden BB+/Baa3/BBB-) with heightened risks over hidden liabilities receiving preferential treatment in repayment over offshore bonds. Country Garden, China SCE, Road King and Shui On led the losers with their dollar bonds falling 8-10 points since the start of the week.

For the full story, click here

Go back to Latest bond Market News

Related Posts: