This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

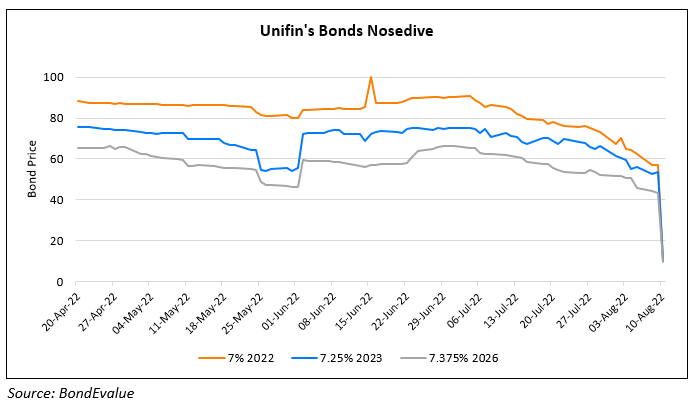

Unifin Downgraded to RD by Fitch

August 19, 2022

Unifin Financiera was downgraded to RD from C by Fitch due to its uncured payment defaults on some of its credit facilities. As Unifin has not filed for bankruptcy or entered liquidation or any other formal winding-up process, the RD rating was considered appropriate by Fitch. Some of Unifin’s bank credit facilities have a shorter grace period than the typical 30-day horizon for local and global bonds. This adds to further negative pressure on the company regarding the ability to pay its dues. Unifin has not initiated an official debt restructuring process. However, if a debt restructuring process is in place, Unifin may be further downgraded by Fitch considering it a Distressed Debt Exchange (DDE) post evaluating Unifin’s financials after the restructuring process. If Unifin does not reveal sufficient information to Fitch and the market, Fitch said that it could potentially withdraw its ratings on the company. On the other hand, there will be a positive rating action/ upgrade if there is sufficient disclosure of Unifin’s financials and plans after the completion of the debt restricting process.

Unifin’s dollar bonds were trading weaker with its 7% 2025s down 0.9 points to 15.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Unifin Downgraded to B+ by S&P

March 17, 2022

Bed Bath Downgraded to Caa2 by Moody’s

July 21, 2022