This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

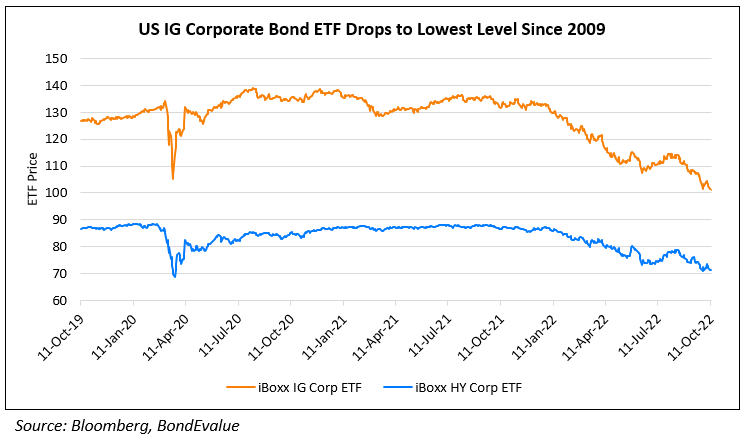

US Corporate Bond ETFs Drop to Multi Year Lows

October 12, 2022

Amid swelling concerns about US Inflation and the sharp sell-off in the UK bond market, US corporate ETFs have plunged, falling to multi-year lows this week. The BlackRock iShares iBoxx Investment Grade (IG) Corporate Bond ETF, which tracks the US IG corporate bond market, fell to $101.05 yesterday, the lowest it has been since 2009. Meanwhile, its High Yield (HY) counterpart dropped to $70.92 on Monday, the lowest it has been since the peak of the pandemic in March 2020. Capital Economics said, “The case could be made that the UK’s fiscal drama has deepened difficulties in a market that was already feeling the strain from a rapid rise in yields to multi-decade highs”. Pointing to the sell-off in the UK seeping its way into US treasuries alongside inflation and the Fed’s hikes, he added, “There appears to be a self-reinforcing trend at work, of higher and more volatile yields prompting liquidity to dry up, prompting yet more volatility. This dynamic also seems at work elsewhere.”

Go back to Latest bond Market News

Related Posts:

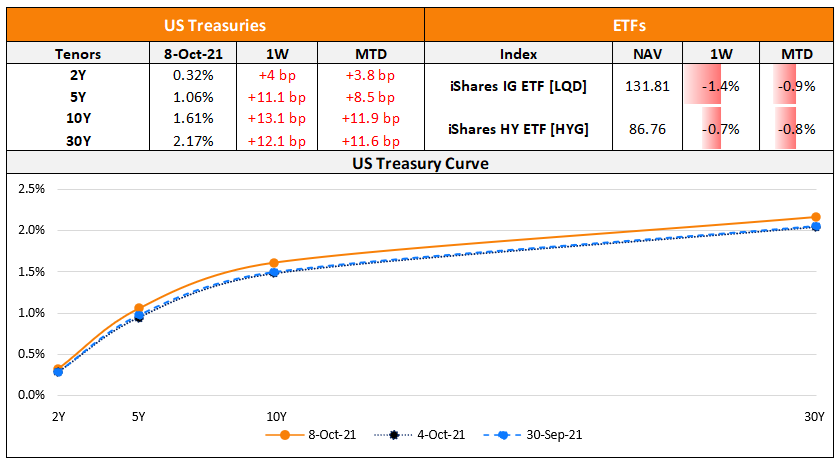

The Week That Was (Oct 4th – 11th)

October 11, 2021

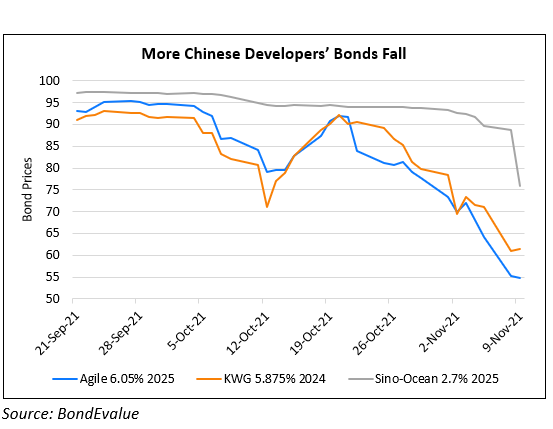

Agile, KWG, Sino-Ocean’s Dollar Bonds Drop 10-14%

November 9, 2021