This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

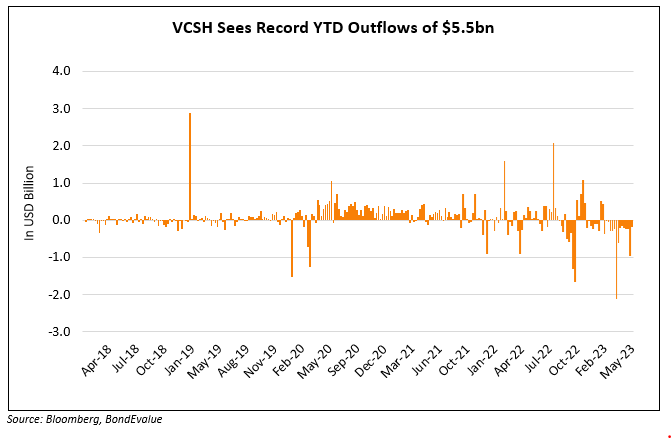

Vanguard’s Short-Term Corporate Bond ETF Sees Highest YTD Outflows Since Inception in 2009

May 11, 2023

The Vanguard Short-Term Corporate Bond ETF (VCSH) has seen about $5.5bn of outflows thus far in 2023. The ETF is on track for 15 consecutive weeks of outflows and this marks the largest outflow in any comparable period since the ETF’s inception in 2009, as per Bloomberg. The ETF tracks investment grade (IG) bonds with a 1-5Y maturity, and is on track for 15 consecutive weeks of outflows. Bloomberg notes that this move coincides with the inflows seen in money market funds (MMF) this year following the Fed’s rate hikes that saw MMF yields rise. Lindsay Rosner, a PM at PGIM said, “If you compare the yield on VCSH and you look at a money market, you can reduce duration, spread duration, and vol coming in the curve and maybe even pick up yield”. She added that concerns of the US debt ceiling breach and about the Fed pausing may slowly see some rotation out of MMFs.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

Agile, KWG, Sino-Ocean’s Dollar Bonds Drop 10-14%

November 9, 2021