This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

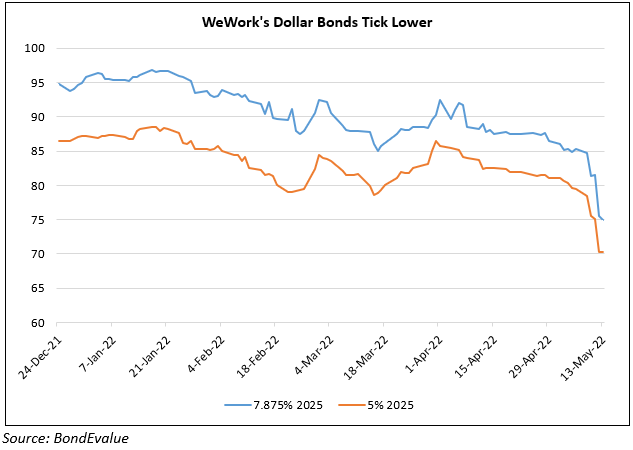

WeWork’s Bonds Drop 5-6 Points after Reporting Results

May 13, 2022

WeWork reported a net loss of $504mn in Q1 2022, a 37% improvement QoQ and narrower than its losses of $2bn in Q1 2021. Revenue rose to $765mn, a 28% YoY growth. Adjusted EBITDA was negative $212mn, improving from a negative EBITDA of $446mn YoY. The company accounted for an impairment of $91mn driven primarily by building exits. As of Q1, WeWork’s systemwide real estate portfolio consisted of 765 locations and 38 countries, supporting 916k workstations and 626k physical memberships. The growth in consolidated physical memberships was 32% YoY. Systemwide gross desk sales were 211k in the Q1, or the equivalent of 12.7mn sqft. sold of which new desk sales were 106k, equating to 6.3mn sqft. sold. In May, WeWork amended its existing letter of credit facility, which was subdivided into a $350mn junior tranche and a $1.25bn senior tranche. Brookfield Asset Management and its affiliates ‘purchased all participations’ under the junior tranche, thereby giving WeWork immediate access to $350mn for general corporate purposes through November 2023. As of Q1, WeWork had $1.6bn in cash and commitments and long-term net debt $665mn. For Q2, its revenue guidance is given at $800-825mn (tightening the previous guidance range of $775- 825mn). Adjusted EBITDA guidance is at negative $125-175mn. Full-year 2022 revenue guidance is at $3.4-3.5bn and adjusted EBITDA guidance to negative $400-475mn

However, despite encouraging results, WeWork’s dollar bonds were trading lower, with its 7.875% 2025s down over 6 points to 75 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

WeWork Explores Fresh Equity Raise

March 7, 2022

WeWork Guides for at least 30% Jump in 2022 Revenues

March 14, 2022

WeWork Burns $3.2bn in 2020; Occupancy Fell to 47%

March 23, 2021