This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

WeWork’s Bonds Rally On Positive Earnings Surprise

May 11, 2023

WeWork’s bonds were higher by over 4 points after it reported a first quarter negative EPS of $0.34 vs. estimates of a negative EPS of $0.35. It reported a net loss of $299mn, a $205mn improvement YoY. Revenue for the quarter came in at $849mn, in-line with estimates and improving 11% YoY. It reported a negative free cash flow of $343mn, $18mn better than its projection of a negative FCF of $361mn during the quarter. Its physical occupancy in the quarter also improved to 73%, an increase from 67% at the end 1Q 2022. Sandeep Mathrani, the CEO said, “Following our debt restructuring, we now have a strengthened balance sheet and liquidity position that gives us the runway to deliver against our plan… debt restructuring was backed by a large majority of bondholders and investors, demonstrating their conviction in the WeWork business model and our future”.

Go back to Latest bond Market News

Related Posts:

WeWork Burns $3.2bn in 2020; Occupancy Fell to 47%

March 23, 2021

WeWork Downgraded to CCC by Fitch

December 5, 2022

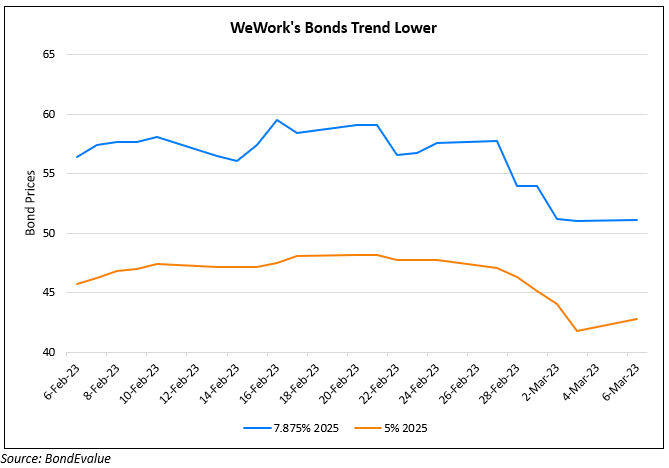

WeWork’s Bonds Trend Lower

March 6, 2023