This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Yuzhou Buys Back Bonds and Shares In an Attempt to Restore Investor Confidence

April 1, 2021

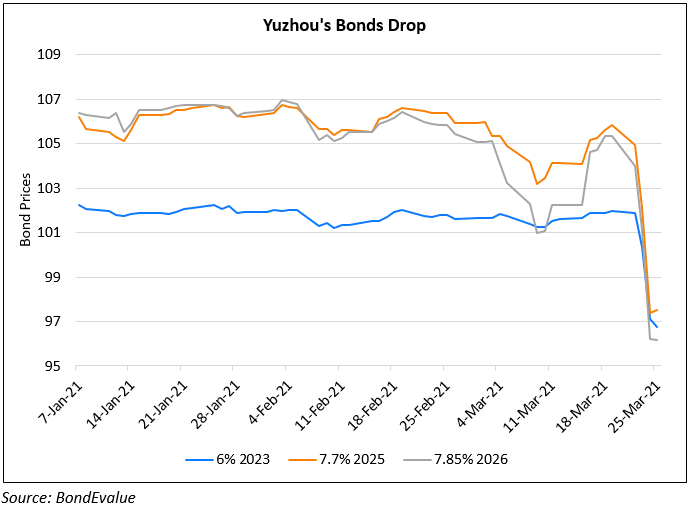

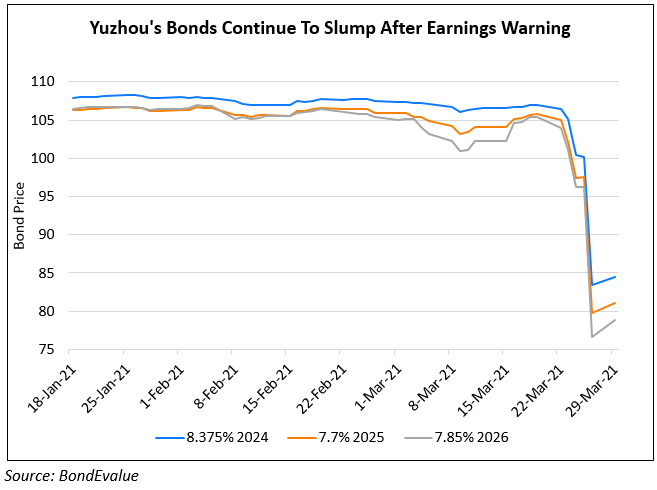

Chinese real estate developer Yuzhou Group Holdings announced that it has bought back some of its bonds and shares from the open market in a bid to instill some confidence in investors. This comes after its stock and bonds took a beating post a profit warning and subsequent downgrade. Yuzhou bought back $16mn worth of bonds across its 8.3% 2025s, 7.375% 2026s, 7.85% 2026s and 6.35% 2027s. Further, it bought back 1mn shares at an average price of HK$2.315 per share for its share award scheme. As at March 31, including the latest purchase, a total of 8.08mn shares have been bought under the scheme, as per IFR. Its chairman and controlling shareholder, Lam Lung-On also bought 1.3mn of shares on Wednesday for ~HK$3.25mn. BOCI International said in a note, “Its earnings recovery should support the bond performance in the medium term” adding that its bonds due January 2022, February 2023 and April 2023 are in “sweet spots”, given their relatively attractive yields vs the longer tenor bonds.

Yuzhou’s 8.5% 2023s traded slightly higher at 95.65 yielding 11.18% while its 7.375% bonds due 2026 traded at 85.5 yielding 11.39%.

Go back to Latest bond Market News

Related Posts: