This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

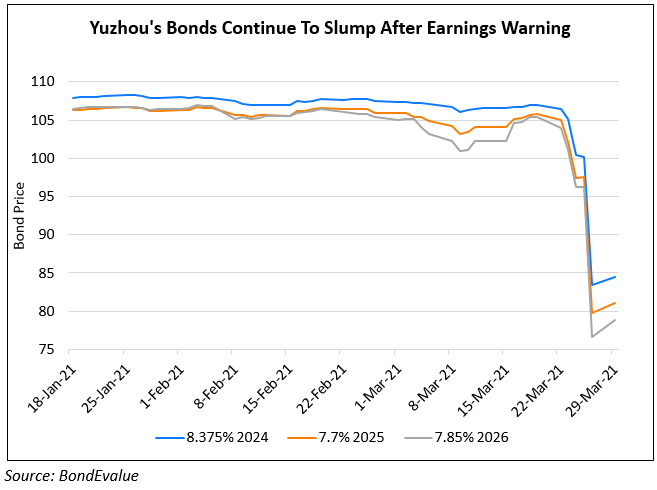

Yuzhou Reports 97% Drop in Profits, Bonds Slump

March 31, 2021

Yuzhou reported net income at CNY 117mn ($18mn) and revenues of CNY 10.4bn ($1.6bn) for 2020, down 97% and 55% YoY in line with the warning by the real estate developer last week. While revenues fell, contracted sales hit a record high in 2020 , up ~40% YoY to CNY 104.9bn ($16bn). Value of non-controlling interests surged 66% last year racking profits of CNY 111.2mn ($17mn) and made up 28% of Yuzhou’s total equity, as per Bloomberg. Net gearing as at 2020-end stood at 85.8%, vs. 70.2% in 2019. Bloomberg cited sources aware of the earnings call during which Yuzhou executives said margins were hit partly by its auditor’s strict standards on consolidating projects onto the firm’s balance sheet. Due to this, the developer also could not consolidate some high margin operations in time for the earnings report. The sources also cited the CFO saying the firm set aside funding to pay-off its 7.9% dollar bonda due in May 2021. Further, the CFO said Yuzhou aims for margins around 20% and that they are aiming to meet the asset/liability ratio target under the government’s “three red lines” this year. Cash and bank balances (including restricted cash) amounted to CNY 34.5bn ($5.2bn). The company proposed a final dividend of HKD 0.215 ($0.028) cents a share taking the total dividend for 2020 to HKD 0.335 ($0.043) cents a share.

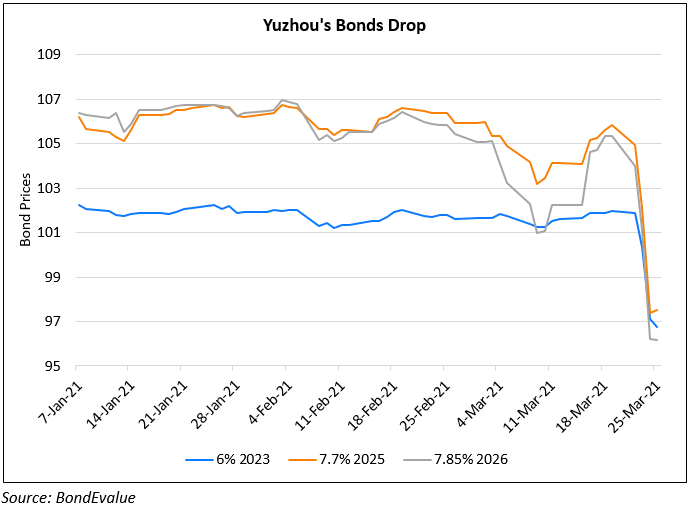

Yuzhou’s 6% 2023s and 7.7% 2025s were down 4.6 and 4.4 cents to 83.7 and 81.9 cents on the dollar respectively.

Go back to Latest bond Market News

Related Posts: