This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Agile, Mapletree Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

May 31, 2021

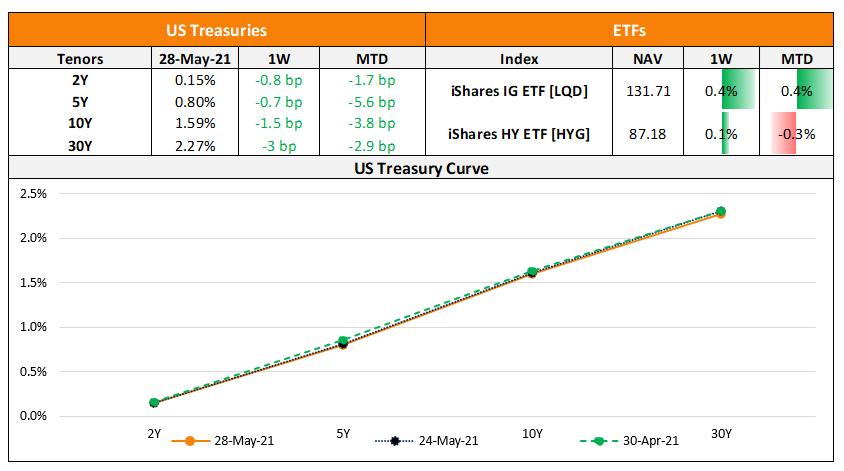

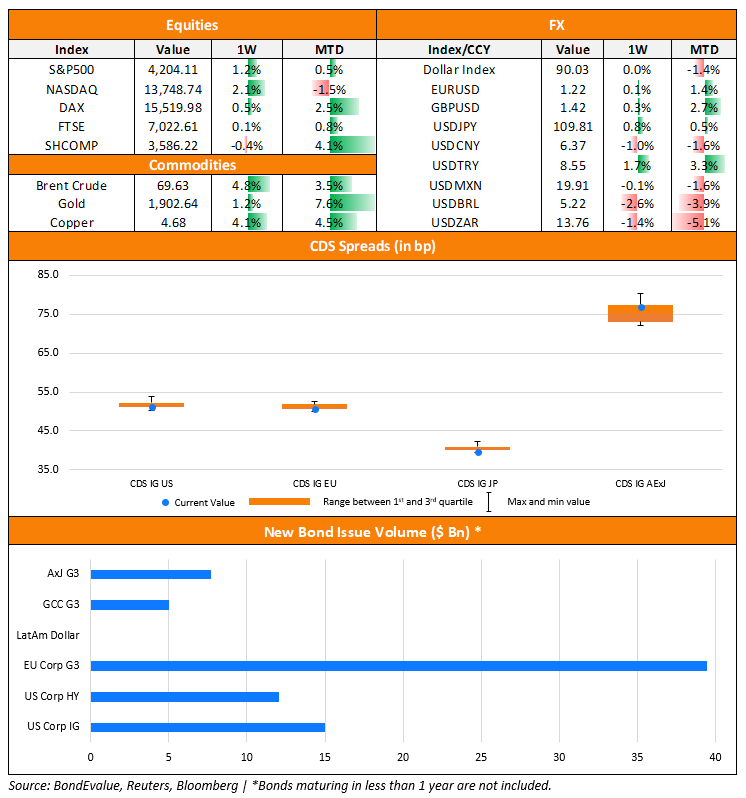

Both S&P and Nasdaq advanced 0.1% to conclude a fourth straight month of gains before the US closed for a long weekend to celebrate Memorial Day. Real Estate and Utilities led the gains while Media, Entertainment and Telecom dragged the indices lower. The markets will be keenly looking out for the May jobs report later this week. US 10Y Treasury yields fell 2bp to 1.59% with a higher month-end extension (Term of the day, explained below) even as inflation rose with Core PCE at 3.1% vs. 2.9% forecasted. European markets ended higher with DAX and CAC up ~0.7% while the FTSE was almost flat. US IG CDS spreads were 0.2bp tighter and HY spreads were 1.4bp tighter. EU main spreads were 0.5bp tighter and crossover spreads tightened 2.9bp. Asian equities are off to a soft start, down ~0.2% with Asia ex-Japan CDS spreads tightening 0.4bp.

3 Days to Go: Exclusive Masterclass on How to Analyze CoCo/AT1 bonds by Experts

Do you invest in CoCo/AT1s? If yes, do attend the upcoming masterclass conducted by debt capital market professionals Pramod Shenoi, Head of Research APAC at CreditSights and Rahul Banerjee, Founder and CEO at BondEvalue. The session will cover understanding the AT1 structure, common features & covenants, and how to pick the right AT1 bond(s) for you. Click on the banner below to register.

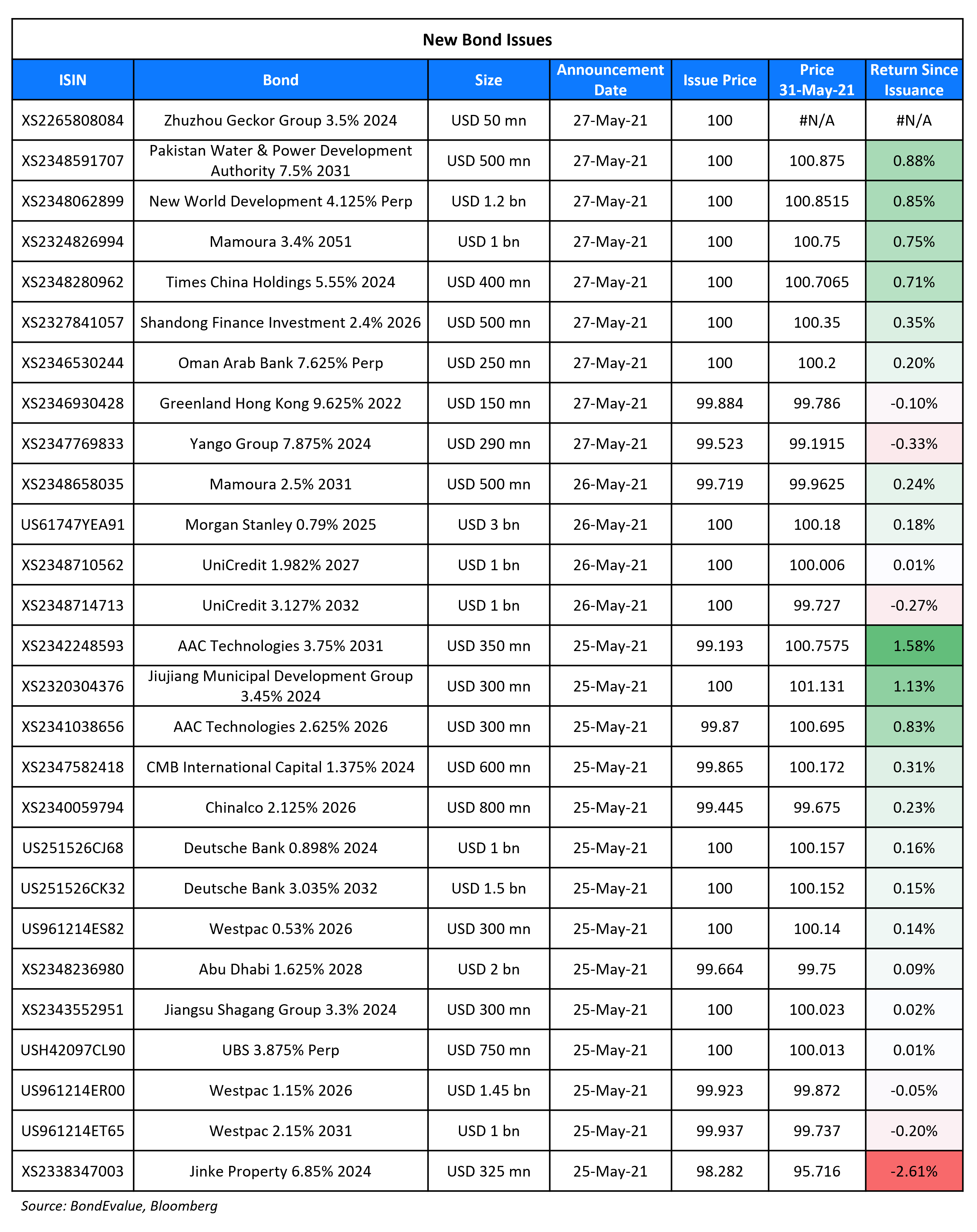

New Bond Issues

- Agile Group Holdings tap of $ 2026s IPG 5.95% area

- Mapletree North Asia S$ PerpNC5 IPG at 3.7% area

- Datang Group Holdings 364-day $ bonds, final at 13%

- Qingdao Jiaozhou Bay Development $ 3Y bond IPG 3.8% area

New Bond Pipeline

- China State Construction International hires banks for $ sub perp

- Gansu Provincial Highway Aviation Tourism Investment Group hires for $ bond

- Shinhan Card hires for $ 5Y senior social Formosa

- Indofood CBP Sukses Makmur hires for $ bond

- Maldives HDC $ sukuk

Rating Changes

- Moody’s upgrades CAR to B3; revises outlook to stable

- Fitch Upgrades China Hongqiao to ‘BB’; Outlook Positive

- Moody’s upgrades Yingde Gases to Ba2; outlook stable

- Moody’s upgrades Core & Main’s CFR to B2; ratings under review for upgrade following IPO announcement

- Moody’s upgrades DTEK Energy to Caa3

- Fitch Downgrades Zhongyuan AMC to ‘BB+’; Outlook Stable

- Bahrain Outlook Revised To Negative By S&P On Persistent Fiscal And External Pressure; ‘B+/B’ Ratings Affirmed

- Fitch Revises Outlook on Zhongliang to Positive; Affirms at ‘B+’

- Fitch Revises Zhenro Properties’ Outlook to Positive, Affirms IDR at ‘B+’

- Fitch Affirms LafargeHolcim Ltd at ‘BBB’; Upgrades Short-Term IDR to ‘F2’

- Moody’s revises Bright Scholar’s outlook to negative; affirms Ba3 ratings

- Algoma Steel Inc. Put On CreditWatch Positive By S&P On Announced Legato Merger Corp. Transaction

The Week That Was

US primary market issuances dipped to $27.4bn, down 18% vs. $33.5bn in the week prior. IG issuances were lower last week at $15bn vs. $20.7bn in the prior week while HY issuances were flat at $12bn. The largest deals in the IG space were led by JPMorgan’s $4.5bn three-trancher and Morgan Stanley’s $3bn deals. In the HY space, DT Midstream’s $2.1bn issuance and Bausch Health’s $1.6bn issuance led the table. In North America, there were a total of 103 upgrades and 18 downgrades combined across the three major rating agencies last week. LatAm saw a second straight week with no new bond deals. EU Corporate G3 issuance saw a sharp rise in issuance last week to $37.4bn vs. $26.3 in the week prior led by AstraZeneca’s $7bn six-trancher, UBS’s $3bn three-trancher and UniCredit’s $2bn dual-trancher. Across the European region, there were 41 upgrades and 11 downgrades across the three major rating agencies. GCC and Sukuk G3 issuances were at $5bn vs. $1.2bn in the week prior – Abu Dhabi’s $2bn deal, Mubadala’s $1.5bn dual-trancher and Oman Arab Bank’s debut $250mn led the issuances. Across the Middle East/Africa region, there were 3 upgrades and 8 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances were higher at $11.3bn vs. $4.7bn in the prior week. Tuesday and Thursday saw a combined 17 new bond deals. The largest deals in the week were Westpac’s $2.75bn three-trancher, NWD’s $1.2bn Perp and Chinalco’s $800mn 5Y deals. In the Asia ex-Japan region, there were 16 upgrades and 5 downgrades combined across the three major rating agencies last week.

Term of the Day

Month-End Extension

Month-end extensions are a rebalancing mechanism at the end of each month by fund managers to make sure that the portfolio tracks the benchmark index. These are sometimes also known as index extensions. Bond portfolios generally track an index and have mandates on the overall portfolio duration. But due to the sheer number and size of investments, the portfolio can have tracking errors. For example, if interest rates go higher, the portfolio’s duration falls. If the duration falls such that the portfolio doesn’t track the benchmark index’s duration, the fund manager would have to buy bonds to increase their portfolio’s duration. These purchases of bonds generally happen towards the end of the month leading to a month-end extension effect. Reuters reports “Barclays estimating its duration index extending out 0.13 years, higher than the long-run average of 0.09 years which means asset managers need to buy Treasuries to hit that index.”

Talking Heads

“Just because you care, doesn’t mean you don’t also have to count.” “I am worried in both the short- and the medium-term about overheating.” “I am concerned,” Summers said. “You do have to manage the macroeconomics right.”

On bond investors watching upcoming payroll report for clues on tapering

Credit Suisse Group AG strategist Jonathan Cohn

“Progress toward achieving the dual mandate should be the biggest factor” driving decisions about policy tightening, said Cohn.

John Briggs, global head of desk strategy at Natwest Markets

“The risks in the market are asymmetric toward higher yields.” “After last month’s payroll figure, economists are being conservative this time, so there’s a chance the actual figure is above consensus. And after that, people will then start to worry about the next consumer price report.”

Matt King, global markets strategist at Citigroup

“The paradox is that the more successful central banks are in driving up valuations of risky assets using stimulus, the harder it becomes for them to exit.” “It is much more likely that rising yields prove destabilising as there is more debt outstanding.”

“The paradox is that the more successful central banks are in driving up valuations of risky assets using stimulus, the harder it becomes for them to exit.” “It is much more likely that rising yields prove destabilising as there is more debt outstanding.”

Steven Blitz, chief US economist at TS Lombard

“The Fed says it has the tools to fight inflation, and it does.” “Is it willing to accept the end of capital market pricing distortions that their policies have created?”

“The Fed says it has the tools to fight inflation, and it does.” “Is it willing to accept the end of capital market pricing distortions that their policies have created?”

Zoltan Pozsar, Global Head of Short-Term Interest Rate Strategy at Credit Suisse

“If the US financial system were a Boeing 747 flying through a fiscal storm, it’s been flying with three engines (JPMorgan, Citibank and Bank of America), and the fourth engine — Wells Fargo — has been offline.”

“If the US financial system were a Boeing 747 flying through a fiscal storm, it’s been flying with three engines (JPMorgan, Citibank and Bank of America), and the fourth engine — Wells Fargo — has been offline.”

Manmohan Singh, senior economist at the International Monetary Fund

The imposition of a Treasury CCP would “cram more of the most important market in the world into already too-big-to-fail institutions ultimately puttable to the taxpayer.” “That would require greater scrutiny by the Fed and maybe the guarantee of further liquidity lines.”

The imposition of a Treasury CCP would “cram more of the most important market in the world into already too-big-to-fail institutions ultimately puttable to the taxpayer.” “That would require greater scrutiny by the Fed and maybe the guarantee of further liquidity lines.”

“Each burst of depreciation risks triggering a fresh lira crisis as it begins to feed back into higher inflation, which the central bank cannot fight off because it is unable to ‘credibly’ hike rates (due to Erdogan’s opposition).” “Because of its inability to hike rates properly, (the central bank) relies on inflation to cool off via external or other factors so that it can enjoy even a short period of stability.”

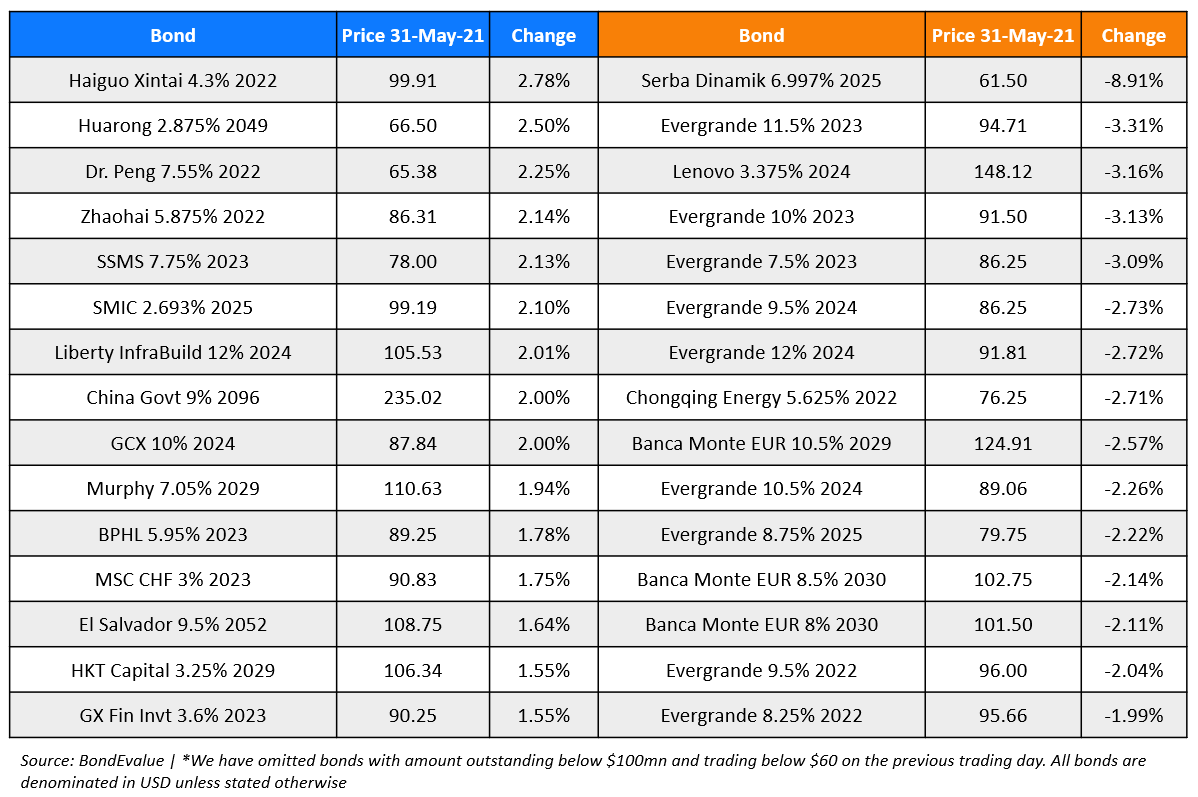

Top Gainers & Losers – 31-May-21*

Go back to Latest bond Market News

Related Posts: